Annual Report 2010 - Ophir Energy

Annual Report 2010 - Ophir Energy

Annual Report 2010 - Ophir Energy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

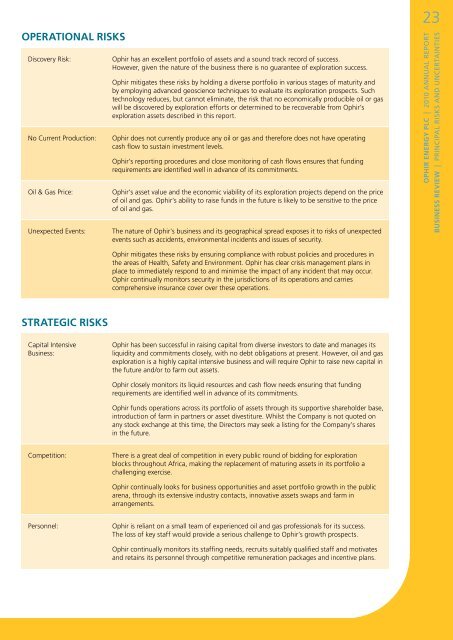

OPERATIONAL RISKS<br />

Discovery Risk:<br />

No Current Production:<br />

Oil & Gas Price:<br />

Unexpected Events:<br />

<strong>Ophir</strong> has an excellent portfolio of assets and a sound track record of success.<br />

However, given the nature of the business there is no guarantee of exploration success.<br />

<strong>Ophir</strong> mitigates these risks by holding a diverse portfolio in various stages of maturity and<br />

by employing advanced geoscience techniques to evaluate its exploration prospects. Such<br />

technology reduces, but cannot eliminate, the risk that no economically producible oil or gas<br />

will be discovered by exploration efforts or determined to be recoverable from <strong>Ophir</strong>’s<br />

exploration assets described in this report.<br />

<strong>Ophir</strong> does not currently produce any oil or gas and therefore does not have operating<br />

cash flow to sustain investment levels.<br />

<strong>Ophir</strong>’s reporting procedures and close monitoring of cash flows ensures that funding<br />

requirements are identified well in advance of its commitments.<br />

<strong>Ophir</strong>’s asset value and the economic viability of its exploration projects depend on the price<br />

of oil and gas. <strong>Ophir</strong>’s ability to raise funds in the future is likely to be sensitive to the price<br />

of oil and gas.<br />

The nature of <strong>Ophir</strong>’s business and its geographical spread exposes it to risks of unexpected<br />

events such as accidents, environmental incidents and issues of security.<br />

23<br />

<strong>Ophir</strong> energy plc | <strong>2010</strong> ANNUAL REPORT<br />

Business review | Principal Risks and Uncertainties<br />

<strong>Ophir</strong> mitigates these risks by ensuring compliance with robust policies and procedures in<br />

the areas of Health, Safety and Environment. <strong>Ophir</strong> has clear crisis management plans in<br />

place to immediately respond to and minimise the impact of any incident that may occur.<br />

<strong>Ophir</strong> continually monitors security in the jurisdictions of its operations and carries<br />

comprehensive insurance cover over these operations.<br />

STRATEGIC RISKS<br />

Capital Intensive<br />

Business:<br />

<strong>Ophir</strong> has been successful in raising capital from diverse investors to date and manages its<br />

liquidity and commitments closely, with no debt obligations at present. However, oil and gas<br />

exploration is a highly capital intensive business and will require <strong>Ophir</strong> to raise new capital in<br />

the future and/or to farm out assets.<br />

<strong>Ophir</strong> closely monitors its liquid resources and cash flow needs ensuring that funding<br />

requirements are identified well in advance of its commitments.<br />

<strong>Ophir</strong> funds operations across its portfolio of assets through its supportive shareholder base,<br />

introduction of farm in partners or asset divestiture. Whilst the Company is not quoted on<br />

any stock exchange at this time, the Directors may seek a listing for the Company’s shares<br />

in the future.<br />

Competition:<br />

There is a great deal of competition in every public round of bidding for exploration<br />

blocks throughout Africa, making the replacement of maturing assets in its portfolio a<br />

challenging exercise.<br />

<strong>Ophir</strong> continually looks for business opportunities and asset portfolio growth in the public<br />

arena, through its extensive industry contacts, innovative assets swaps and farm in<br />

arrangements.<br />

Personnel:<br />

<strong>Ophir</strong> is reliant on a small team of experienced oil and gas professionals for its success.<br />

The loss of key staff would provide a serious challenge to <strong>Ophir</strong>’s growth prospects.<br />

<strong>Ophir</strong> continually monitors its staffing needs, recruits suitably qualified staff and motivates<br />

and retains its personnel through competitive remuneration packages and incentive plans.