Annual Report 2010 - Ophir Energy

Annual Report 2010 - Ophir Energy

Annual Report 2010 - Ophir Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the<br />

Financial Statements<br />

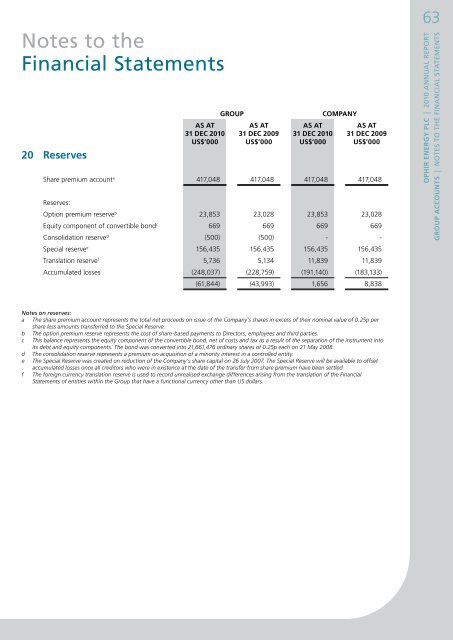

20 Reserves<br />

AS AT<br />

31 DEC <strong>2010</strong><br />

US$’000<br />

GROUP<br />

AS AT<br />

31 DEC 2009<br />

US$’000<br />

AS AT<br />

31 DEC <strong>2010</strong><br />

US$’000<br />

COMPANY<br />

AS AT<br />

31 DEC 2009<br />

US$’000<br />

Share premium account a 417,048 417,048 417,048 417,048<br />

Reserves:<br />

Option premium reserve b 23,853 23,028 23,853 23,028<br />

Equity component of convertible bond c 669 669 669 669<br />

Consolidation reserve d (500) (500) - -<br />

Special reserve e 156,435 156,435 156,435 156,435<br />

Translation reserve f 5,736 5,134 11,839 11,839<br />

Accumulated losses (248,037) (228,759) (191,140) (183,133)<br />

(61,844) (43,993) 1,656 8,838<br />

63<br />

<strong>Ophir</strong> energy plc | <strong>2010</strong> ANNUAL REPORT<br />

Group accounts | notes to the financial statements<br />

Notes on reserves:<br />

a The share premium account represents the total net proceeds on issue of the Company’s shares in excess of their nominal value of 0.25p per<br />

share less amounts transferred to the Special Reserve.<br />

b The option premium reserve represents the cost of share-based payments to Directors, employees and third parties.<br />

c This balance represents the equity component of the convertible bond, net of costs and tax as a result of the separation of the instrument into<br />

its debt and equity components. The bond was converted into 21,661,476 ordinary shares of 0.25p each on 21 May 2008.<br />

d The consolidation reserve represents a premium on acquisition of a minority interest in a controlled entity.<br />

e The Special Reserve was created on reduction of the Company’s share capital on 26 July 2007. The Special Reserve will be available to offset<br />

accumulated losses once all creditors who were in existence at the date of the transfer from share premium have been settled.<br />

f The foreign currency translation reserve is used to record unrealised exchange differences arising from the translation of the Financial<br />

Statements of entities within the Group that have a functional currency other than US dollars.