Annual Report 2010 - Ophir Energy

Annual Report 2010 - Ophir Energy

Annual Report 2010 - Ophir Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the<br />

financial statements<br />

<strong>2010</strong><br />

Us$’000<br />

grOUp<br />

2009<br />

Us$’000<br />

<strong>2010</strong><br />

Us$’000<br />

cOMpAny<br />

2009<br />

Us$’000<br />

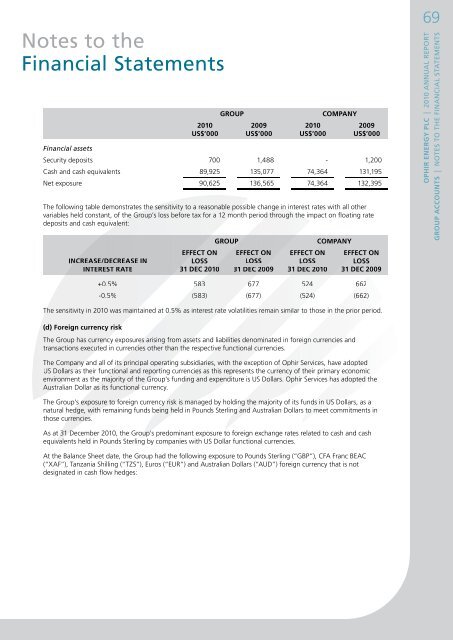

Financial assets<br />

Security deposits 700 1,488 - 1,200<br />

Cash and cash equivalents 89,925 135,077 74,364 131,195<br />

Net exposure 90,625 136,565 74,364 132,395<br />

The following table demonstrates the sensitivity to a reasonable possible change in interest rates with all other<br />

variables held constant, of the Group’s loss before tax for a 12 month period through the impact on floating rate<br />

deposits and cash equivalent:<br />

increAse/DecreAse in<br />

inTeresT rATe<br />

grOUp<br />

eFFecT On<br />

eFFecT On<br />

lOss<br />

lOss<br />

31 Dec <strong>2010</strong><br />

31 Dec 2009<br />

cOMpAny<br />

eFFecT On<br />

eFFecT On<br />

lOss<br />

lOss<br />

31 Dec <strong>2010</strong><br />

31 Dec 2009<br />

69<br />

<strong>Ophir</strong> energy plc | <strong>2010</strong> ANNUAL REPORT<br />

grOUp AccOUnTs | NOTEs TO THE fiNANCiAL sTATEmENTs<br />

+0.5%<br />

583 677<br />

524<br />

662<br />

-0.5%<br />

(583)<br />

(677) (524)<br />

(662)<br />

The sensitivity in <strong>2010</strong> was maintained at 0.5% as interest rate volatilities remain similar to those in the prior period.<br />

(d) Foreign currency risk<br />

The Group has currency exposures arising from assets and liabilities denominated in foreign currencies and<br />

transactions executed in currencies other than the respective functional currencies.<br />

The Company and all of its principal operating subsidiaries, with the exception of <strong>Ophir</strong> Services, have adopted<br />

US Dollars as their functional and reporting currencies as this represents the currency of their primary economic<br />

environment as the majority of the Group’s funding and expenditure is US Dollars. <strong>Ophir</strong> Services has adopted the<br />

Australian Dollar as its functional currency.<br />

The Group’s exposure to foreign currency risk is managed by holding the majority of its funds in US Dollars, as a<br />

natural hedge, with remaining funds being held in Pounds Sterling and Australian Dollars to meet commitments in<br />

those currencies.<br />

As at 31 December <strong>2010</strong>, the Group’s predominant exposure to foreign exchange rates related to cash and cash<br />

equivalents held in Pounds Sterling by companies with US Dollar functional currencies.<br />

At the Balance Sheet date, the Group had the following exposure to Pounds Sterling (“GBP”), CFA Franc BEAC<br />

(“XAF”), Tanzania Shilling (“TZS”), Euros (“EUR”) and Australian Dollars (“AUD”) foreign currency that is not<br />

designated in cash flow hedges: