Annual Report 2010 - Ophir Energy

Annual Report 2010 - Ophir Energy

Annual Report 2010 - Ophir Energy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

46<br />

<strong>Ophir</strong> energy plc | <strong>2010</strong> ANNUAL REPORT<br />

grOUp AccOUnTs | NOTEs TO THE fiNANCiAL sTATEmENTs<br />

Notes to the<br />

financial statements<br />

IFRS 3 (revised) introduces significant changes in the<br />

accounting for business combinations occurring after this<br />

date. Changes affect the valuation of non-controlling<br />

interests (previously “minority interests”), the accounting<br />

for transaction costs, the initial recognition and subsequent<br />

measurement of contingent consideration and business<br />

combinations achieved in stages. These changes will impact<br />

the amount of goodwill recognised, the reported results<br />

in the period when an acquisition occurs and future<br />

reported results.<br />

IAS 27 (revised) requires that a change in the ownership<br />

interest of a subsidiary (without a change in control) is to be<br />

accounted for as a transaction with owners in their capacity<br />

as owners. The revised Standard changes the accounting for<br />

losses incurred by a partially owned subsidiary as well as the<br />

loss of control of a subsidiary.<br />

The changes in IFRS 3 (revised) and IAS 27 (revised)<br />

will affect future acquisitions, changes in, and loss of<br />

control of, subsidiaries and transactions with noncontrolling<br />

interests.<br />

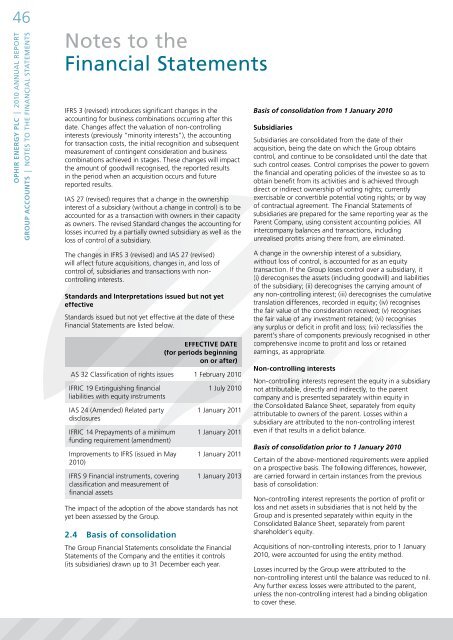

standards and interpretations issued but not yet<br />

effective<br />

Standards issued but not yet effective at the date of these<br />

Financial Statements are listed below.<br />

eFFecTive DATe<br />

(for periods beginning<br />

on or after)<br />

IAS 32 Classification of rights issues<br />

1 February <strong>2010</strong><br />

IFRIC 19 Extinguishing financial<br />

liabilities with equity instruments<br />

IAS 24 (Amended) Related party<br />

disclosures<br />

IFRIC 14 Prepayments of a minimum<br />

funding requirement (amendment)<br />

Improvements to IFRS (issued in May<br />

<strong>2010</strong>)<br />

IFRS 9 Financial instruments, covering<br />

classification and measurement of<br />

financial assets<br />

1 July <strong>2010</strong><br />

1 January 2011<br />

1 January 2011<br />

1 January 2011<br />

1 January 2013<br />

The impact of the adoption of the above standards has not<br />

yet been assessed by the Group.<br />

2.4 Basis of consolidation<br />

The Group Financial Statements consolidate the Financial<br />

Statements of the Company and the entities it controls<br />

(its subsidiaries) drawn up to 31 December each year.<br />

Basis of consolidation from 1 January <strong>2010</strong><br />

subsidiaries<br />

Subsidiaries are consolidated from the date of their<br />

acquisition, being the date on which the Group obtains<br />

control, and continue to be consolidated until the date that<br />

such control ceases. Control comprises the power to govern<br />

the financial and operating policies of the investee so as to<br />

obtain benefit from its activities and is achieved through<br />

direct or indirect ownership of voting rights; currently<br />

exercisable or convertible potential voting rights; or by way<br />

of contractual agreement. The Financial Statements of<br />

subsidiaries are prepared for the same reporting year as the<br />

Parent Company, using consistent accounting policies. All<br />

intercompany balances and transactions, including<br />

unrealised profits arising there from, are eliminated.<br />

A change in the ownership interest of a subsidiary,<br />

without loss of control, is accounted for as an equity<br />

transaction. If the Group loses control over a subsidiary, it<br />

(i) derecognises the assets (including goodwill) and liabilities<br />

of the subsidiary; (ii) derecognises the carrying amount of<br />

any non-controlling interest; (iii) derecognises the cumulative<br />

translation differences, recorded in equity; (iv) recognises<br />

the fair value of the consideration received; (v) recognises<br />

the fair value of any investment retained; (vi) recognises<br />

any surplus or deficit in profit and loss; (vii) reclassifies the<br />

parent’s share of components previously recognised in other<br />

comprehensive income to profit and loss or retained<br />

earnings, as appropriate.<br />

non-controlling interests<br />

Non-controlling interests represent the equity in a subsidiary<br />

not attributable, directly and indirectly, to the parent<br />

company and is presented separately within equity in<br />

the Consolidated Balance Sheet, separately from equity<br />

attributable to owners of the parent. Losses within a<br />

subsidiary are attributed to the non-controlling interest<br />

even if that results in a deficit balance.<br />

Basis of consolidation prior to 1 January <strong>2010</strong><br />

Certain of the above-mentioned requirements were applied<br />

on a prospective basis. The following differences, however,<br />

are carried forward in certain instances from the previous<br />

basis of consolidation:<br />

Non-controlling interest represents the portion of profit or<br />

loss and net assets in subsidiaries that is not held by the<br />

Group and is presented separately within equity in the<br />

Consolidated Balance Sheet, separately from parent<br />

shareholder’s equity.<br />

Acquisitions of non-controlling interests, prior to 1 January<br />

<strong>2010</strong>, were accounted for using the entity method.<br />

Losses incurred by the Group were attributed to the<br />

non-controlling interest until the balance was reduced to nil.<br />

Any further excess losses were attributed to the parent,<br />

unless the non-controlling interest had a binding obligation<br />

to cover these.