Annual Report 2010 - Ophir Energy

Annual Report 2010 - Ophir Energy

Annual Report 2010 - Ophir Energy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the<br />

Financial Statements<br />

25 Borrowing facilities<br />

The Company and the Group had no borrowing facilities as at 31 December <strong>2010</strong> (2009: Nil).<br />

26 Financial risk management and financial instruments<br />

Strategy and objectives<br />

The Group’s principal financial assets and liabilities comprise cash and short-term deposits and various items, such<br />

as receivables and trade and other payables, which arise directly from its operations. The main purpose of these<br />

financial instruments is to manage short-term cash flow and provide finance for the Group’s operations.<br />

The Group’s senior management oversees the management of financial instrument risk and the Board of Directors<br />

has established an Audit Committee to assist in the identification and evaluation of significant financial risks. Where<br />

appropriate, consultation is sought with an external advisor to determine the appropriate response to identified risks.<br />

The Group does not trade in derivatives for speculative purposes.<br />

67<br />

<strong>Ophir</strong> energy plc | <strong>2010</strong> ANNUAL REPORT<br />

Group accounts | notes to the financial statements<br />

The main risks that could adversely affect the Group’s financial assets, liabilities or future cash flows are foreign<br />

currency, interest rate and credit risks.<br />

(a) Significant accounting policies<br />

Details of significant accounting policies and methods adopted in respect of each class of financial assets, financial<br />

liability and equity instrument are disclosed in note 2 to the Financial Statements.<br />

(b) Credit risk<br />

Credit risk refers to the risk that a third party will default on its contractual obligations resulting in financial loss to the<br />

Company or Group. The Company and Group’s maximum exposure to credit risk of third parties is the aggregate of<br />

the carrying value of its security deposits, cash and short-term deposits, and trade and other receivables.<br />

The Group trades only with recognised, creditworthy third parties, and as such collateral is not requested nor is it the<br />

Group’s policy to securitise its trade and other receivables<br />

In addition, receivable balances are monitored on an ongoing basis with the result that the Group’s experience of bad<br />

debts has not been significant.<br />

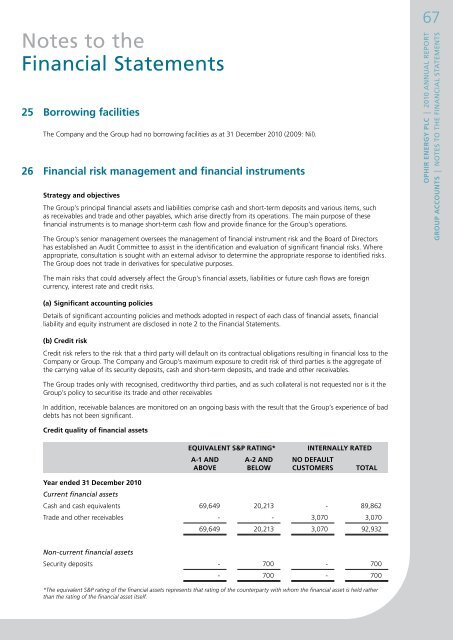

Credit quality of financial assets<br />

EQUIVALENT S&P RATING*<br />

A-1 AND<br />

ABOVE<br />

A-2 AND<br />

BELOW<br />

INTERNALLY RATED<br />

NO DEFAULT<br />

CUSTOMERS TOTAL<br />

Year ended 31 December <strong>2010</strong><br />

Current financial assets<br />

Cash and cash equivalents 69,649 20,213 - 89,862<br />

Trade and other receivables - - 3,070 3,070<br />

69,649 20,213 3,070 92,932<br />

Non-current financial assets<br />

Security deposits - 700 - 700<br />

- 700 - 700<br />

*The equivalent S&P rating of the financial assets represents that rating of the counterparty with whom the financial asset is held rather<br />

than the rating of the financial asset itself.