Annual Report 2010 - Ophir Energy

Annual Report 2010 - Ophir Energy

Annual Report 2010 - Ophir Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

58<br />

<strong>Ophir</strong> energy plc | <strong>2010</strong> ANNUAL REPORT<br />

grOUp AccOUnTs | NOTEs TO THE fiNANCiAL sTATEmENTs<br />

Notes to the<br />

financial statements<br />

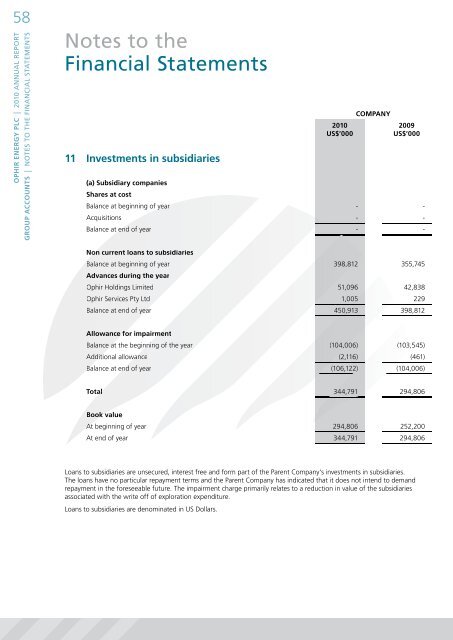

11 investments in subsidiaries<br />

<strong>2010</strong><br />

Us$’000<br />

cOMpAny<br />

2009<br />

Us$’000<br />

(a) subsidiary companies<br />

shares at cost<br />

Balance at beginning of year<br />

- -<br />

Acquisitions - -<br />

Balance at end of year<br />

- -<br />

non current loans to subsidiaries<br />

Balance at beginning of year<br />

398,812<br />

355,745<br />

Advances during the year<br />

<strong>Ophir</strong> Holdings Limited<br />

51,096 42,838<br />

<strong>Ophir</strong> Services Pty Ltd<br />

1,005<br />

229<br />

Balance at end of year<br />

450,913<br />

398,812<br />

Allowance for impairment<br />

Balance at the beginning of the year<br />

(104,006) (103,545)<br />

Additional allowance<br />

(2,116) (461)<br />

Balance at end of year<br />

(106,122)<br />

(104,006)<br />

Total<br />

344,791<br />

294,806<br />

Book value<br />

At beginning of year<br />

294,806 252,200<br />

At end of year 344,791 294,806<br />

Loans to subsidiaries are unsecured, interest free and form part of the Parent Company’s investments in subsidiaries.<br />

The loans have no particular repayment terms and the Parent Company has indicated that it does not intend to demand<br />

repayment in the foreseeable future. The impairment charge primarily relates to a reduction in value of the subsidiaries<br />

associated with the write off of exploration expenditure.<br />

Loans to subsidiaries are denominated in US Dollars.