SDOT2 Product Disclosure Statement - Stockland

SDOT2 Product Disclosure Statement - Stockland

SDOT2 Product Disclosure Statement - Stockland

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

08<br />

1.<br />

Key Investment<br />

Features (cont.)<br />

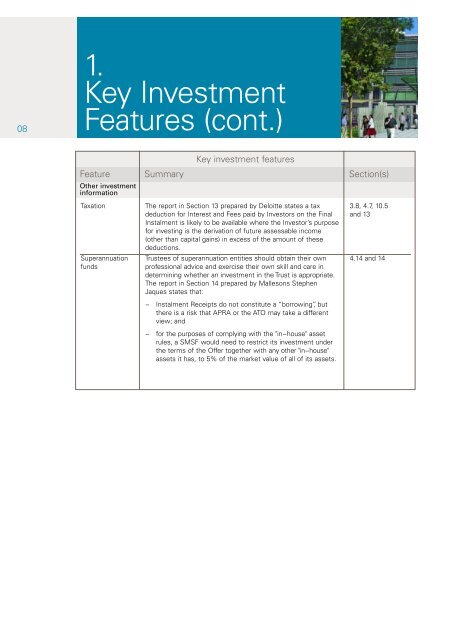

Key investment features<br />

Feature Summary Section(s)<br />

Other investment<br />

information<br />

Taxation<br />

Superannuation<br />

funds<br />

The report in Section 13 prepared by Deloitte states a tax<br />

deduction for Interest and Fees paid by Investors on the Final<br />

Instalment is likely to be available where the Investor’s purpose<br />

for investing is the derivation of future assessable income<br />

(other than capital gains) in excess of the amount of these<br />

deductions.<br />

Trustees of superannuation entities should obtain their own<br />

professional advice and exercise their own skill and care in<br />

determining whether an investment in the Trust is appropriate.<br />

The report in Section 14 prepared by Mallesons Stephen<br />

Jaques states that:<br />

- Instalment Receipts do not constitute a “borrowing”, but<br />

there is a risk that APRA or the ATO may take a different<br />

view; and<br />

- for the purposes of complying with the "in-house" asset<br />

rules, a SMSF would need to restrict its investment under<br />

the terms of the Offer together with any other "in-house"<br />

assets it has, to 5% of the market value of all of its assets.<br />

3.8, 4.7, 10.5<br />

and 13<br />

4.14 and 14