cotton - Greenmount Press

cotton - Greenmount Press

cotton - Greenmount Press

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

World CoMModity Watch<br />

India<br />

Indian mills have been a major benefactor of<br />

the increase in Chinese demand for imported<br />

yarn. To feed this demand Indian spinners have<br />

predominately sourced local <strong>cotton</strong> with limited<br />

demand for imported Extra Long Staple. A<br />

recent announcement by the Minister for Indian<br />

Textiles confirmed there would be no ban on<br />

Indian <strong>cotton</strong> exports this marketing year due to<br />

the Indian Cotton Advisory Board predicting an<br />

exportable surplus of 5.5 million bales. This is<br />

currently a full two million bales more than the<br />

3.5 million estimated by the USDA. Nationwide<br />

daily seed <strong>cotton</strong> arrivals are relatively steady<br />

as farmers opt to hold onto it as the Indian<br />

domestic price softened.<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

China<br />

China’s CNCRC is currently holding in reserve one whole years’ worth of consumption<br />

in warehouses. What they propose to do with it is arguably the main focus point<br />

of traders worldwide. Current figures put the Reserve procurement for the year at<br />

over 3.6 million tonnes (16 million bales) and there appears no sign of the Reserve<br />

slowing down in this regard. The high price of Chinese domestic <strong>cotton</strong> and an ever<br />

dwindling import quota of cheaper overseas <strong>cotton</strong> has seen Chinese demand for<br />

imported yarn increase rapidly at the expense of its local mills. India and Bangladesh<br />

have been the main beneficiaries of this increased demand for yarn. Harvest of<br />

the Chinese crop is almost complete and classing is two thirds through, which is<br />

advanced progress from this time last year. Looking ahead at their next crop (to be<br />

planted April/May 2013) Chinese growers are still predicted to continue to produce<br />

<strong>cotton</strong> given it is still provides a better financial option over other crops, however we<br />

await the announcement of the new minimum support price in March.<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Australia<br />

Planting got off to a fine start with many<br />

growers very pleased with the progress of<br />

their crops to date. After a few cold snaps,<br />

summer has finally arrived, with dryland<br />

crops in significant need of rainfall, and<br />

irrigated crops are consuming more<br />

water than usual for this time of year. A<br />

few growers in SW Qld and the Border<br />

Rivers region are keeping a close eye on<br />

their water supply, as concerns for supply<br />

for their final irrigation are starting to<br />

surface. The rivers will need to run before<br />

we can begin to speculate on 2014 crop<br />

<strong>cotton</strong> acreage. Back to the season at<br />

hand, recent reports suggest our crop to<br />

be 3.9–4 million bales, down from initial<br />

estimates due to reduced dryland planting<br />

and ongoing dry conditions. Marketing for<br />

2013 season is off to a slow start with the<br />

crop historically undersold for this stage<br />

of the season.<br />

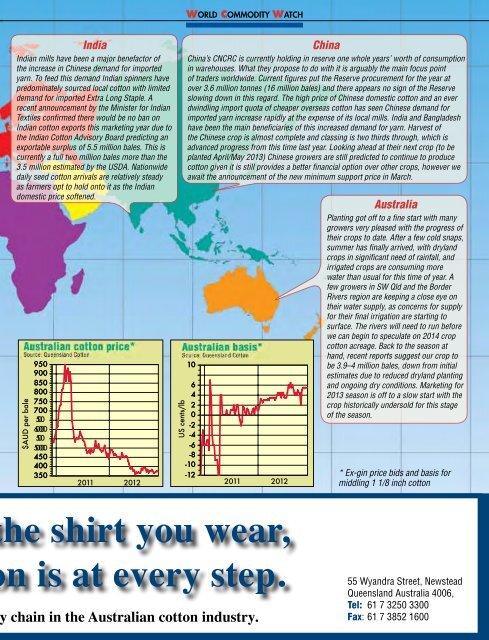

* Ex-gin price bids and basis for<br />

middling 1 1/8 inch <strong>cotton</strong><br />

he shirt you wear,<br />

n is at every step.<br />

chain in the Australian <strong>cotton</strong> industry.<br />

55 Wyandra Street, Newstead<br />

Queensland Australia 4006,<br />

Tel: 61 7 3250 3300<br />

Fax: 61 7 3852 1600