M&A International Inc. Alternative Energy M&A - Western Reserve ...

M&A International Inc. Alternative Energy M&A - Western Reserve ...

M&A International Inc. Alternative Energy M&A - Western Reserve ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

10 <strong>Alternative</strong> <strong>Energy</strong> M&A<br />

$mn<br />

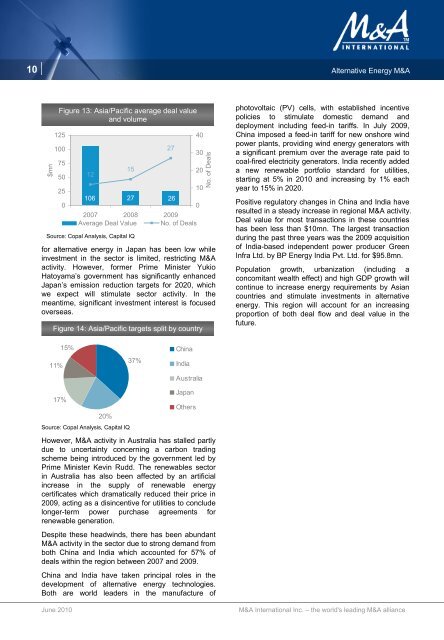

Figure 13: Asia/Pacific average deal value<br />

and volume<br />

125<br />

100<br />

75<br />

50<br />

25<br />

0<br />

12<br />

15<br />

27<br />

40<br />

30<br />

20<br />

10<br />

106 27 26<br />

0<br />

2007 2008 2009<br />

Average Deal Value No. of Deals<br />

Source: Copal Analysis, Capital IQ<br />

No. of Deals<br />

for alternative energy in Japan has been low while<br />

investment in the sector is limited, restricting M&A<br />

activity. However, former Prime Minister Yukio<br />

Hatoyama’s government has significantly enhanced<br />

Japan’s emission reduction targets for 2020, which<br />

we expect will stimulate sector activity. In the<br />

meantime, significant investment interest is focused<br />

overseas.<br />

Figure 14: Asia/Pacific targets split by country<br />

photovoltaic (PV) cells, with established incentive<br />

policies to stimulate domestic demand and<br />

deployment including feed-in tariffs. In July 2009,<br />

China imposed a feed-in tariff for new onshore wind<br />

power plants, providing wind energy generators with<br />

a significant premium over the average rate paid to<br />

coal-fired electricity generators. India recently added<br />

a new renewable portfolio standard for utilities,<br />

starting at 5% in 2010 and increasing by 1% each<br />

year to 15% in 2020.<br />

Positive regulatory changes in China and India have<br />

resulted in a steady increase in regional M&A activity.<br />

Deal value for most transactions in these countries<br />

has been less than $10mn. The largest transaction<br />

during the past three years was the 2009 acquisition<br />

of India-based independent power producer Green<br />

Infra Ltd. by BP <strong>Energy</strong> India Pvt. Ltd. for $95.8mn.<br />

Population growth, urbanization (including a<br />

concomitant wealth effect) and high GDP growth will<br />

continue to increase energy requirements by Asian<br />

countries and stimulate investments in alternative<br />

energy. This region will account for an increasing<br />

proportion of both deal flow and deal value in the<br />

future.<br />

15% China<br />

11%<br />

37%<br />

India<br />

Australia<br />

17%<br />

20%<br />

Source: Copal Analysis, Capital IQ<br />

Japan<br />

Others<br />

However, M&A activity in Australia has stalled partly<br />

due to uncertainty concerning a carbon trading<br />

scheme being introduced by the government led by<br />

Prime Minister Kevin Rudd. The renewables sector<br />

in Australia has also been affected by an artificial<br />

increase in the supply of renewable energy<br />

certificates which dramatically reduced their price in<br />

2009, acting as a disincentive for utilities to conclude<br />

longer-term power purchase agreements for<br />

renewable generation.<br />

Despite these headwinds, there has been abundant<br />

M&A activity in the sector due to strong demand from<br />

both China and India which accounted for 57% of<br />

deals within the region between 2007 and 2009.<br />

China and India have taken principal roles in the<br />

development of alternative energy technologies.<br />

Both are world leaders in the manufacture of<br />

June 2010<br />

M&A <strong>International</strong> <strong>Inc</strong>. – the world's leading M&A alliance