M&A International Inc. Alternative Energy M&A - Western Reserve ...

M&A International Inc. Alternative Energy M&A - Western Reserve ...

M&A International Inc. Alternative Energy M&A - Western Reserve ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6 <strong>Alternative</strong> <strong>Energy</strong> M&A<br />

20%<br />

% Share by Deal<br />

Volume<br />

Operational<br />

Technology<br />

80%<br />

23%<br />

% Share by Deal<br />

Value<br />

Operational<br />

Technology<br />

77%<br />

Source: Copal Analysis, Capital IQ<br />

* Based on top 50 deals by deal value for each year (2007–2009)<br />

M&A Deal Makers<br />

While utilities have accounted for the largest share of<br />

deal value, deal volume is currently driven by pureplay<br />

companies.<br />

18%<br />

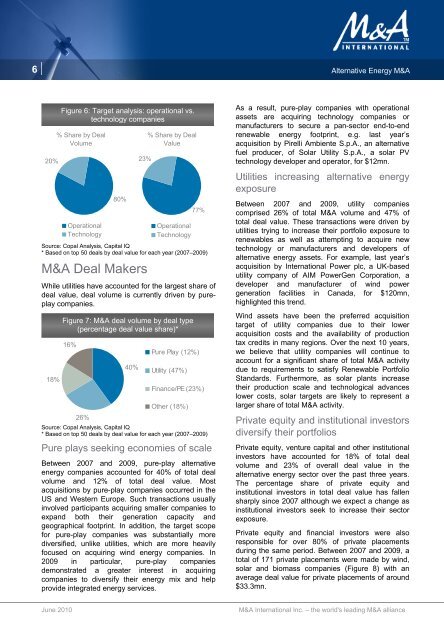

Figure 6: Target analysis: operational vs.<br />

technology companies<br />

Figure 7: M&A deal volume by deal type<br />

(percentage deal value share)*<br />

16%<br />

40%<br />

Pure Play (12%)<br />

Utility (47%)<br />

Finance/PE (23%)<br />

Other (18%)<br />

26%<br />

Source: Copal Analysis, Capital IQ<br />

* Based on top 50 deals by deal value for each year (2007–2009)<br />

Pure plays seeking economies of scale<br />

Between 2007 and 2009, pure-play alternative<br />

energy companies accounted for 40% of total deal<br />

volume and 12% of total deal value. Most<br />

acquisitions by pure-play companies occurred in the<br />

US and <strong>Western</strong> Europe. Such transactions usually<br />

involved participants acquiring smaller companies to<br />

expand both their generation capacity and<br />

geographical footprint. In addition, the target scope<br />

for pure-play companies was substantially more<br />

diversified, unlike utilities, which are more heavily<br />

focused on acquiring wind energy companies. In<br />

2009 in particular, pure-play companies<br />

demonstrated a greater interest in acquiring<br />

companies to diversify their energy mix and help<br />

provide integrated energy services.<br />

As a result, pure-play companies with operational<br />

assets are acquiring technology companies or<br />

manufacturers to secure a pan-sector end-to-end<br />

renewable energy footprint, e.g. last year’s<br />

acquisition by Pirelli Ambiente S.p.A., an alternative<br />

fuel producer, of Solar Utility S.p.A., a solar PV<br />

technology developer and operator, for $12mn.<br />

Utilities increasing alternative energy<br />

exposure<br />

Between 2007 and 2009, utility companies<br />

comprised 26% of total M&A volume and 47% of<br />

total deal value. These transactions were driven by<br />

utilities trying to increase their portfolio exposure to<br />

renewables as well as attempting to acquire new<br />

technology or manufacturers and developers of<br />

alternative energy assets. For example, last year’s<br />

acquisition by <strong>International</strong> Power plc, a UK-based<br />

utility company of AIM PowerGen Corporation, a<br />

developer and manufacturer of wind power<br />

generation facilities in Canada, for $120mn,<br />

highlighted this trend.<br />

Wind assets have been the preferred acquisition<br />

target of utility companies due to their lower<br />

acquisition costs and the availability of production<br />

tax credits in many regions. Over the next 10 years,<br />

we believe that utility companies will continue to<br />

account for a significant share of total M&A activity<br />

due to requirements to satisfy Renewable Portfolio<br />

Standards. Furthermore, as solar plants increase<br />

their production scale and technological advances<br />

lower costs, solar targets are likely to represent a<br />

larger share of total M&A activity.<br />

Private equity and institutional investors<br />

diversify their portfolios<br />

Private equity, venture capital and other institutional<br />

investors have accounted for 18% of total deal<br />

volume and 23% of overall deal value in the<br />

alternative energy sector over the past three years.<br />

The percentage share of private equity and<br />

institutional investors in total deal value has fallen<br />

sharply since 2007 although we expect a change as<br />

institutional investors seek to increase their sector<br />

exposure.<br />

Private equity and financial investors were also<br />

responsible for over 80% of private placements<br />

during the same period. Between 2007 and 2009, a<br />

total of 171 private placements were made by wind,<br />

solar and biomass companies (Figure 8) with an<br />

average deal value for private placements of around<br />

$33.3mn.<br />

June 2010<br />

M&A <strong>International</strong> <strong>Inc</strong>. – the world's leading M&A alliance