M&A International Inc. Alternative Energy M&A - Western Reserve ...

M&A International Inc. Alternative Energy M&A - Western Reserve ...

M&A International Inc. Alternative Energy M&A - Western Reserve ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

12 <strong>Alternative</strong> <strong>Energy</strong> M&A<br />

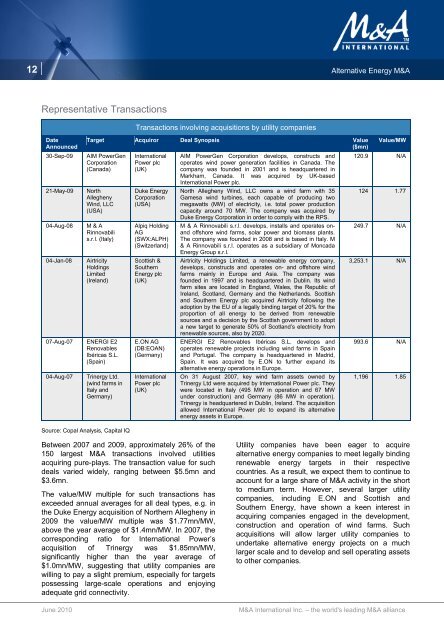

Representative Transactions<br />

Transactions involving acquisitions by utility companies<br />

Date<br />

Announced<br />

30-Sep-09<br />

21-May-09<br />

04-Aug-08<br />

04-Jan-08<br />

07-Aug-07<br />

04-Aug-07<br />

Target Acquiror Deal Synopsis Value<br />

($mn)<br />

AIM PowerGen<br />

Corporation<br />

(Canada)<br />

North<br />

Allegheny<br />

Wind, LLC<br />

(USA)<br />

M & A<br />

Rinnovabili<br />

s.r.l. (Italy)<br />

Airtricity<br />

Holdings<br />

Limited<br />

(Ireland)<br />

ENERGI E2<br />

Renovables<br />

Ibéricas S.L.<br />

(Spain)<br />

Trinergy Ltd.<br />

(wind farms in<br />

Italy and<br />

Germany)<br />

<strong>International</strong><br />

Power plc<br />

(UK)<br />

Duke <strong>Energy</strong><br />

Corporation<br />

(USA)<br />

Alpiq Holding<br />

AG<br />

(SWX:ALPH)<br />

(Switzerland)<br />

Scottish &<br />

Southern<br />

<strong>Energy</strong> plc<br />

(UK)<br />

E.ON AG<br />

(DB:EOAN)<br />

(Germany)<br />

<strong>International</strong><br />

Power plc<br />

(UK)<br />

AIM PowerGen Corporation develops, constructs and<br />

operates wind power generation facilities in Canada. The<br />

company was founded in 2001 and is headquartered in<br />

Markham, Canada. It was acquired by UK-based<br />

<strong>International</strong> Power plc.<br />

North Allegheny Wind, LLC owns a wind farm with 35<br />

Gamesa wind turbines, each capable of producing two<br />

megawatts (MW) of electricity, i.e. total power production<br />

capacity around 70 MW. The company was acquired by<br />

Duke <strong>Energy</strong> Corporation in order to comply with the RPS.<br />

M & A Rinnovabili s.r.l. develops, installs and operates onand<br />

offshore wind farms, solar power and biomass plants.<br />

The company was founded in 2008 and is based in Italy. M<br />

& A Rinnovabili s.r.l. operates as a subsidiary of Moncada<br />

<strong>Energy</strong> Group s.r.l.<br />

Airtricity Holdings Limited, a renewable energy company,<br />

develops, constructs and operates on- and offshore wind<br />

farms mainly in Europe and Asia. The company was<br />

founded in 1997 and is headquartered in Dublin. Its wind<br />

farm sites are located in England, Wales, the Republic of<br />

Ireland, Scotland, Germany and the Netherlands. Scottish<br />

and Southern <strong>Energy</strong> plc acquired Airtricity following the<br />

adoption by the EU of a legally binding target of 20% for the<br />

proportion of all energy to be derived from renewable<br />

sources and a decision by the Scottish government to adopt<br />

a new target to generate 50% of Scotland’s electricity from<br />

renewable sources, also by 2020.<br />

ENERGI E2 Renovables Ibéricas S.L. develops and<br />

operates renewable projects including wind farms in Spain<br />

and Portugal. The company is headquartered in Madrid,<br />

Spain. It was acquired by E.ON to further expand its<br />

alternative energy operations in Europe.<br />

On 31 August 2007, key wind farm assets owned by<br />

Trinergy Ltd were acquired by <strong>International</strong> Power plc. They<br />

were located in Italy (495 MW in operation and 67 MW<br />

under construction) and Germany (86 MW in operation).<br />

Trinergy is headquartered in Dublin, Ireland. The acquisition<br />

allowed <strong>International</strong> Power plc to expand its alternative<br />

energy assets in Europe.<br />

Value/MW<br />

120.9 N/A<br />

124 1.77<br />

249.7 N/A<br />

3,253.1 N/A<br />

993.6 N/A<br />

1,196 1.85<br />

Source: Copal Analysis, Capital IQ<br />

Between 2007 and 2009, approximately 26% of the<br />

150 largest M&A transactions involved utilities<br />

acquiring pure-plays. The transaction value for such<br />

deals varied widely, ranging between $5.5mn and<br />

$3.6mn.<br />

The value/MW multiple for such transactions has<br />

exceeded annual averages for all deal types, e.g. in<br />

the Duke <strong>Energy</strong> acquisition of Northern Allegheny in<br />

2009 the value/MW multiple was $1.77mn/MW,<br />

above the year average of $1.4mn/MW. In 2007, the<br />

corresponding ratio for <strong>International</strong> Power’s<br />

acquisition of Trinergy was $1.85mn/MW,<br />

significantly higher than the year average of<br />

$1.0mn/MW, suggesting that utility companies are<br />

willing to pay a slight premium, especially for targets<br />

possessing large-scale operations and enjoying<br />

adequate grid connectivity.<br />

June 2010<br />

Utility companies have been eager to acquire<br />

alternative energy companies to meet legally binding<br />

renewable energy targets in their respective<br />

countries. As a result, we expect them to continue to<br />

account for a large share of M&A activity in the short<br />

to medium term. However, several larger utility<br />

companies, including E.ON and Scottish and<br />

Southern <strong>Energy</strong>, have shown a keen interest in<br />

acquiring companies engaged in the development,<br />

construction and operation of wind farms. Such<br />

acquisitions will allow larger utility companies to<br />

undertake alternative energy projects on a much<br />

larger scale and to develop and sell operating assets<br />

to other companies.<br />

M&A <strong>International</strong> <strong>Inc</strong>. – the world's leading M&A alliance