M&A International Inc. Alternative Energy M&A - Western Reserve ...

M&A International Inc. Alternative Energy M&A - Western Reserve ...

M&A International Inc. Alternative Energy M&A - Western Reserve ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4 <strong>Alternative</strong> <strong>Energy</strong> M&A<br />

costs may fall due to technological innovation and<br />

economies of scale. Technological advancements<br />

continue to cause the marginal cost of renewables to<br />

decline, while non-renewables continue to see<br />

marginal cost inflation.<br />

M&A Overview & Analysis<br />

Rising M&A deal volumes highlight buyer interest in<br />

the sector with volumes growing at a CAGR of 19%<br />

over the past three years. At the same time, total<br />

deal value fell steadily at a CAGR of 25%, implying a<br />

gradual correction in valuations following the recent<br />

credit crisis.<br />

$bn<br />

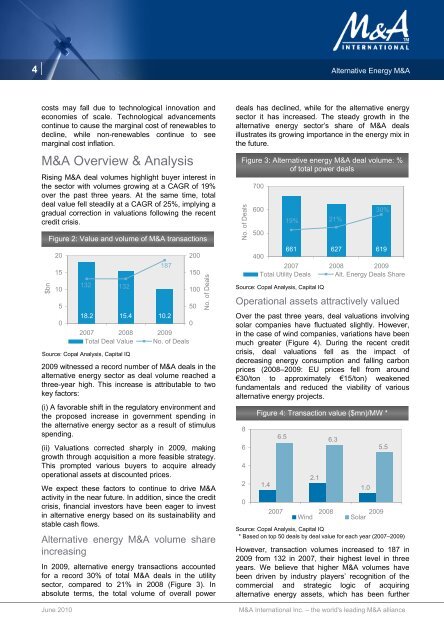

Figure 2: Value and volume of M&A transactions<br />

20<br />

15<br />

10<br />

5<br />

0<br />

June 2010<br />

132<br />

132<br />

187<br />

200<br />

150<br />

100<br />

50<br />

18.2 15.4 10.2<br />

0<br />

2007 2008 2009<br />

Total Deal Value No. of Deals<br />

Source: Copal Analysis, Capital IQ<br />

No. of Deals<br />

2009 witnessed a record number of M&A deals in the<br />

alternative energy sector as deal volume reached a<br />

three-year high. This increase is attributable to two<br />

key factors:<br />

(i) A favorable shift in the regulatory environment and<br />

the proposed increase in government spending in<br />

the alternative energy sector as a result of stimulus<br />

spending.<br />

(ii) Valuations corrected sharply in 2009, making<br />

growth through acquisition a more feasible strategy.<br />

This prompted various buyers to acquire already<br />

operational assets at discounted prices.<br />

We expect these factors to continue to drive M&A<br />

activity in the near future. In addition, since the credit<br />

crisis, financial investors have been eager to invest<br />

in alternative energy based on its sustainability and<br />

stable cash flows.<br />

<strong>Alternative</strong> energy M&A volume share<br />

increasing<br />

In 2009, alternative energy transactions accounted<br />

for a record 30% of total M&A deals in the utility<br />

sector, compared to 21% in 2008 (Figure 3). In<br />

absolute terms, the total volume of overall power<br />

deals has declined, while for the alternative energy<br />

sector it has increased. The steady growth in the<br />

alternative energy sector’s share of M&A deals<br />

illustrates its growing importance in the energy mix in<br />

the future.<br />

Figure 3: <strong>Alternative</strong> energy M&A deal volume: %<br />

of total power deals<br />

No. of Deals<br />

700<br />

600<br />

500<br />

19% 21%<br />

30%<br />

661 627 619<br />

400<br />

2007 2008 2009<br />

Total Utility Deals Alt. <strong>Energy</strong> Deals Share<br />

Source: Copal Analysis, Capital IQ<br />

Operational assets attractively valued<br />

Over the past three years, deal valuations involving<br />

solar companies have fluctuated slightly. However,<br />

in the case of wind companies, variations have been<br />

much greater (Figure 4). During the recent credit<br />

crisis, deal valuations fell as the impact of<br />

decreasing energy consumption and falling carbon<br />

prices (2008–2009: EU prices fell from around<br />

€30/ton to approximately €15/ton) weakened<br />

fundamentals and reduced the viability of various<br />

alternative energy projects.<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Figure 4: Transaction value ($mn)/MW *<br />

1.4<br />

6.5<br />

2.1<br />

6.3<br />

1.0<br />

2007 2008 2009<br />

Wind<br />

Solar<br />

5.5<br />

Source: Copal Analysis, Capital IQ<br />

* Based on top 50 deals by deal value for each year (2007–2009)<br />

However, transaction volumes increased to 187 in<br />

2009 from 132 in 2007, their highest level in three<br />

years. We believe that higher M&A volumes have<br />

been driven by industry players’ recognition of the<br />

commercial and strategic logic of acquiring<br />

alternative energy assets, which has been further<br />

M&A <strong>International</strong> <strong>Inc</strong>. – the world's leading M&A alliance