Capital Opportunities for Small Businesses - sbtdc

Capital Opportunities for Small Businesses - sbtdc

Capital Opportunities for Small Businesses - sbtdc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

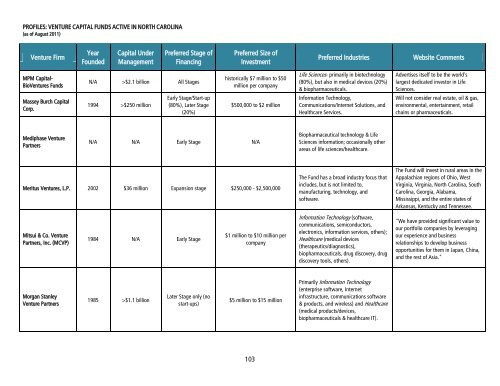

PROFILES: VENTURE CAPITAL FUNDS ACTIVE IN NORTH CAROLINA<br />

(as of August 2011)<br />

Venture Firm<br />

Year<br />

Founded<br />

<strong>Capital</strong> Under<br />

Management<br />

Preferred Stage of<br />

Financing<br />

Preferred Size of<br />

Investment<br />

Preferred Industries<br />

Website Comments<br />

MPM <strong>Capital</strong>-<br />

BioVentures Funds<br />

Massey Burch <strong>Capital</strong><br />

Corp.<br />

N/A >$2.1 billion All Stages<br />

1994 >$250 million<br />

Early Stage/Start-up<br />

(80%), Later Stage<br />

(20%)<br />

historically $7 million to $50<br />

million per company<br />

$500,000 to $2 million<br />

Life Sciences- primarily in biotechnology<br />

(80%), but also in medical devices (20%)<br />

& biopharmaceuticals.<br />

In<strong>for</strong>mation Technology,<br />

Communications/Internet Solutions, and<br />

Healthcare Services.<br />

Advertises itself to be the world's<br />

largest dedicated investor in Life<br />

Sciences.<br />

Will not consider real estate, oil & gas,<br />

environmental, entertainment, retail<br />

chains or pharmaceuticals.<br />

Mediphase Venture<br />

Partners<br />

N/A N/A Early Stage N/A<br />

Biopharmaceutical technology & Life<br />

Sciences in<strong>for</strong>mation; occasionally other<br />

areas of life sciences/healthcare.<br />

Meritus Ventures, L.P. 2002 $36 million Expansion stage $250,000 - $2,500,000<br />

The Fund has a broad industry focus that<br />

includes, but is not limited to,<br />

manufacturing, technology, and<br />

software.<br />

The Fund will invest in rural areas in the<br />

Appalachian regions of Ohio, West<br />

Virginia, Virginia, North Carolina, South<br />

Carolina, Georgia, Alabama,<br />

Mississippi, and the entire states of<br />

Arkansas, Kentucky and Tennessee.<br />

Mitsui & Co. Venture<br />

Partners, Inc. (MCVP)<br />

1984 N/A Early Stage<br />

$1 million to $10 million per<br />

company<br />

In<strong>for</strong>mation Technology (software,<br />

communications, semiconductors,<br />

electronics, in<strong>for</strong>mation services, others);<br />

Healthcare (medical devices<br />

(therapeutics/diagnostics),<br />

biopharmaceuticals, drug discovery, drug<br />

discovery tools, others).<br />

"We have provided significant value to<br />

our portfolio companies by leveraging<br />

our experience and business<br />

relationships to develop business<br />

opportunities <strong>for</strong> them in Japan, China,<br />

and the rest of Asia."<br />

Morgan Stanley<br />

Venture Partners<br />

1985 >$1.1 billion<br />

Later Stage only (no<br />

start-ups)<br />

$5 million to $15 million<br />

Primarily In<strong>for</strong>mation Technology<br />

(enterprise software, Internet<br />

infrastructure, communications software<br />

& products, and wireless) and Healthcare<br />

(medical products/devices,<br />

biopharmaceuticals & healthcare IT).<br />

103