Capital Opportunities for Small Businesses - sbtdc

Capital Opportunities for Small Businesses - sbtdc

Capital Opportunities for Small Businesses - sbtdc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

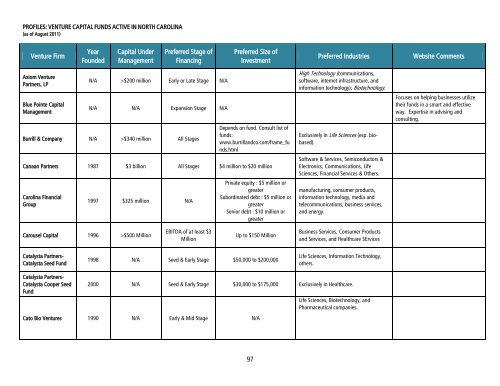

PROFILES: VENTURE CAPITAL FUNDS ACTIVE IN NORTH CAROLINA<br />

(as of August 2011)<br />

Venture Firm<br />

Year<br />

Founded<br />

<strong>Capital</strong> Under<br />

Management<br />

Preferred Stage of<br />

Financing<br />

Preferred Size of<br />

Investment<br />

Preferred Industries<br />

Website Comments<br />

Axiom Venture<br />

Partners, LP<br />

Blue Pointe <strong>Capital</strong><br />

Management<br />

N/A >$200 million Early or Late Stage N/A<br />

N/A N/A Expansion Stage N/A<br />

Burrill & Company N/A >$340 million All Stages<br />

Depends on fund. Consult list of<br />

funds:<br />

www.burrillandco.com/frame_fu<br />

nds.html<br />

Canaan Partners 1987 $3 billion All Stages $4 million to $20 million<br />

Carolina Financial<br />

Group<br />

1997 $325 million N/A<br />

Private equity : $5 million or<br />

greater<br />

Subordinated debt : $5 million or<br />

greater<br />

Senior debt : $10 million or<br />

greater<br />

High Technology (communications,<br />

software, internet infrastructure, and<br />

in<strong>for</strong>mation technology); Biotechnology.<br />

Exclusively in Life Sciences (esp. biobased).<br />

Software & Services, Semiconductors &<br />

Electronics, Communications, Life<br />

Sciences, Financial Services & Others.<br />

manufacturing, consumer products,<br />

in<strong>for</strong>mation technology, media and<br />

telecommunications, business services,<br />

and energy.<br />

Focuses on helping businesses utilize<br />

their funds in a smart and effective<br />

way. Expertise in advising and<br />

consulting.<br />

Carousel <strong>Capital</strong> 1996 >$500 Million<br />

EBITDA of at least $3<br />

Million<br />

Up to $150 Million<br />

Business Services, Consumer Products<br />

and Services, and Healthcare SErvices<br />

Catalysta Partners-<br />

Catalysta Seed Fund<br />

1998 N/A Seed & Early Stage $50,000 to $200,000<br />

Life Sciences, In<strong>for</strong>mation Technology,<br />

others.<br />

Catalysta Partners-<br />

Catalysta Cooper Seed<br />

Fund<br />

2000 N/A Seed & Early Stage $30,000 to $175,000 Exclusively in Healthcare.<br />

Cato Bio Ventures 1990 N/A Early & Mid Stage N/A<br />

Life Sciences, Biotechnology, and<br />

Pharmaceutical companies.<br />

97