Capital Opportunities for Small Businesses - sbtdc

Capital Opportunities for Small Businesses - sbtdc

Capital Opportunities for Small Businesses - sbtdc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

C A P I T A L O P P O R T U N I T I E S F O R SMA L L B U S I N E S S E S<br />

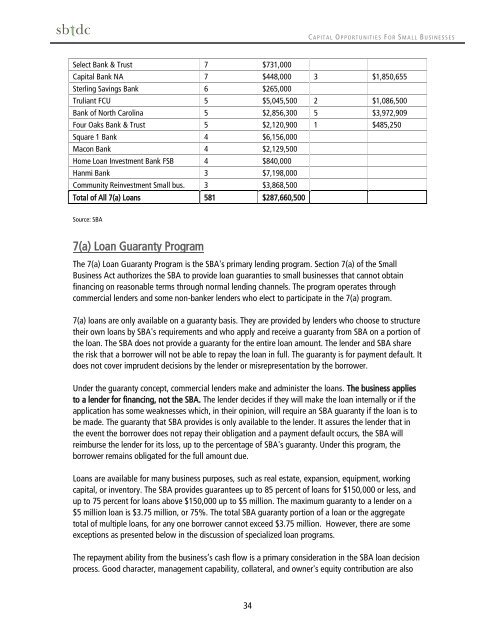

Select Bank & Trust 7 $731,000<br />

<strong>Capital</strong> Bank NA 7 $448,000 3 $1,850,655<br />

Sterling Savings Bank 6 $265,000<br />

Truliant FCU 5 $5,045,500 2 $1,086,500<br />

Bank of North Carolina 5 $2,856,300 5 $3,972,909<br />

Four Oaks Bank & Trust 5 $2,120,900 1 $485,250<br />

Square 1 Bank 4 $6,156,000<br />

Macon Bank 4 $2,129,500<br />

Home Loan Investment Bank FSB 4 $840,000<br />

Hanmi Bank 3 $7,198,000<br />

Community Reinvestment <strong>Small</strong> bus. 3 $3,868,500<br />

Total of All 7(a) Loans 581 $287,660,500<br />

Source: SBA<br />

7(a) Loan Guaranty Program<br />

The 7(a) Loan Guaranty Program is the SBA's primary lending program. Section 7(a) of the <strong>Small</strong><br />

Business Act authorizes the SBA to provide loan guaranties to small businesses that cannot obtain<br />

financing on reasonable terms through normal lending channels. The program operates through<br />

commercial lenders and some non-banker lenders who elect to participate in the 7(a) program.<br />

7(a) loans are only available on a guaranty basis. They are provided by lenders who choose to structure<br />

their own loans by SBA's requirements and who apply and receive a guaranty from SBA on a portion of<br />

the loan. The SBA does not provide a guaranty <strong>for</strong> the entire loan amount. The lender and SBA share<br />

the risk that a borrower will not be able to repay the loan in full. The guaranty is <strong>for</strong> payment default. It<br />

does not cover imprudent decisions by the lender or misrepresentation by the borrower.<br />

Under the guaranty concept, commercial lenders make and administer the loans. The business applies<br />

to a lender <strong>for</strong> financing, not the SBA. The lender decides if they will make the loan internally or if the<br />

application has some weaknesses which, in their opinion, will require an SBA guaranty if the loan is to<br />

be made. The guaranty that SBA provides is only available to the lender. It assures the lender that in<br />

the event the borrower does not repay their obligation and a payment default occurs, the SBA will<br />

reimburse the lender <strong>for</strong> its loss, up to the percentage of SBA's guaranty. Under this program, the<br />

borrower remains obligated <strong>for</strong> the full amount due.<br />

Loans are available <strong>for</strong> many business purposes, such as real estate, expansion, equipment, working<br />

capital, or inventory. The SBA provides guarantees up to 85 percent of loans <strong>for</strong> $150,000 or less, and<br />

up to 75 percent <strong>for</strong> loans above $150,000 up to $5 million. The maximum guaranty to a lender on a<br />

$5 million loan is $3.75 million, or 75%. The total SBA guaranty portion of a loan or the aggregate<br />

total of multiple loans, <strong>for</strong> any one borrower cannot exceed $3.75 million. However, there are some<br />

exceptions as presented below in the discussion of specialized loan programs.<br />

The repayment ability from the business’s cash flow is a primary consideration in the SBA loan decision<br />

process. Good character, management capability, collateral, and owner's equity contribution are also<br />

34