Capital Opportunities for Small Businesses - sbtdc

Capital Opportunities for Small Businesses - sbtdc

Capital Opportunities for Small Businesses - sbtdc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

C A P I T A L O P P O R T U N I T I E S F O R SMA L L B U S I N E S S E S<br />

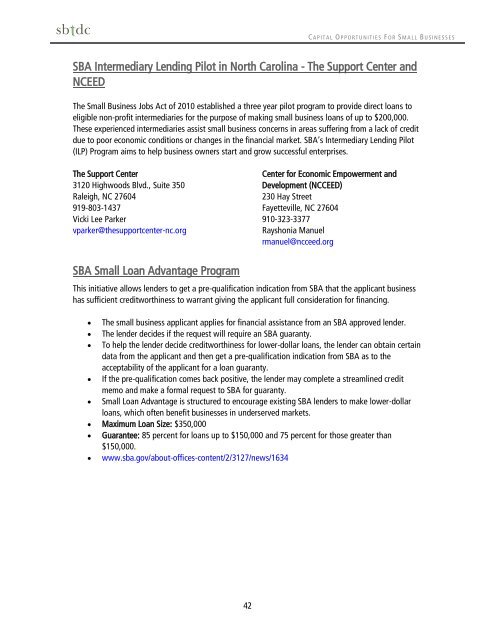

SBA Intermediary Lending Pilot in North Carolina - The Support Center and<br />

NCEED<br />

The <strong>Small</strong> Business Jobs Act of 2010 established a three year pilot program to provide direct loans to<br />

eligible non-profit intermediaries <strong>for</strong> the purpose of making small business loans of up to $200,000.<br />

These experienced intermediaries assist small business concerns in areas suffering from a lack of credit<br />

due to poor economic conditions or changes in the financial market. SBA’s Intermediary Lending Pilot<br />

(ILP) Program aims to help business owners start and grow successful enterprises.<br />

The Support Center<br />

3120 Highwoods Blvd., Suite 350<br />

Raleigh, NC 27604<br />

919-803-1437<br />

Vicki Lee Parker<br />

vparker@thesupportcenter-nc.org<br />

Center <strong>for</strong> Economic Empowerment and<br />

Development (NCCEED)<br />

230 Hay Street<br />

Fayetteville, NC 27604<br />

910-323-3377<br />

Rayshonia Manuel<br />

rmanuel@ncceed.org<br />

SBA <strong>Small</strong> Loan Advantage Program<br />

This initiative allows lenders to get a pre-qualification indication from SBA that the applicant business<br />

has sufficient creditworthiness to warrant giving the applicant full consideration <strong>for</strong> financing.<br />

The small business applicant applies <strong>for</strong> financial assistance from an SBA approved lender.<br />

The lender decides if the request will require an SBA guaranty.<br />

To help the lender decide creditworthiness <strong>for</strong> lower-dollar loans, the lender can obtain certain<br />

data from the applicant and then get a pre-qualification indication from SBA as to the<br />

acceptability of the applicant <strong>for</strong> a loan guaranty.<br />

If the pre-qualification comes back positive, the lender may complete a streamlined credit<br />

memo and make a <strong>for</strong>mal request to SBA <strong>for</strong> guaranty.<br />

<strong>Small</strong> Loan Advantage is structured to encourage existing SBA lenders to make lower-dollar<br />

loans, which often benefit businesses in underserved markets.<br />

Maximum Loan Size: $350,000<br />

Guarantee: 85 percent <strong>for</strong> loans up to $150,000 and 75 percent <strong>for</strong> those greater than<br />

$150,000.<br />

www.sba.gov/about-offices-content/2/3127/news/1634<br />

42