Annual report 2005 - Xeikon

Annual report 2005 - Xeikon

Annual report 2005 - Xeikon

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

36<br />

Significant accounting policies<br />

Basis of preparation<br />

These financial statements have been prepared in<br />

accordance with International Financial Reporting<br />

Standards (IFRS and IFRIC interpretations) issued by<br />

the International Accounting Standards Board (IASB)<br />

as adopted by the EU and with those parts of the<br />

Companies Act 1985 applicable to companies preparing<br />

their accounts under IFRS.<br />

These are the first financial statements presented by the<br />

group. The transition date for IFRS 1 has been taken as<br />

January 1, 2004. The only exemption taken under IFRS 1<br />

is the transition date for IAS39 and IAS32 which has been<br />

taken as January 1, <strong>2005</strong>.<br />

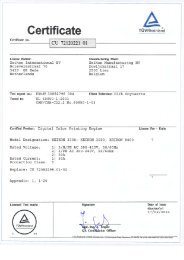

The company was incorporated in the United Kingdom<br />

as Punch Graphix Limited on March 24, <strong>2005</strong> and<br />

re-registered as a public limited company with the<br />

name Punch Graphix plc on April 29, <strong>2005</strong>. On April 20,<br />

<strong>2005</strong> the company acquired <strong>Xeikon</strong> International nv<br />

(‘<strong>Xeikon</strong>’), Strobbe Graphics nv (‘Strobbe’), basysPrint<br />

GmbH (‘basysPrint’), and certain other companies, in<br />

which Punch International nv (‘Punch International’)<br />

had an investment immediately prior to April 20, <strong>2005</strong>.<br />

Following the company’s Admission onto AIM on May<br />

26, <strong>2005</strong>, its issued share capital was £10,282,922 divided<br />

into 102,829,220 fully paid ordinary shares. This is the first<br />

period that the company has presented consolidated<br />

financial statements.<br />

The company’s controlling interest in its directly held<br />

subsidiaries was acquired through a transaction under<br />

common control, as defined in IFRS 3 Business<br />

Combinations. The directors note that transactions<br />

under common control are outside the scope of IFRS 3<br />

and that there is no guidance elsewhere in IFRS covering<br />

such transactions.<br />

IFRS contain specific guidance to be followed where a<br />

transaction falls outside the scope of IFRS. This guidance<br />

is included at paragraphs 10 to 12 pf IAS 8 Accounting<br />

Policies, Changes in Accounting Estimates and Errors.<br />

This requires, inter alia, that where IFRS does not include<br />

guidance for a particular issue, the directors should also<br />

consider the most recent pronouncements of other<br />

standard setting bodies that use a similar conceptual<br />

framework to develop accounting standards. In this<br />

regard, it is noted that the United States Financial<br />

Accounting Standards Board (FASB) has issued an<br />

accounting standard covering business combinations<br />

(FAS 141) that is similar in a number of respects to IFRS<br />

3. Further, there is currently a major project being run<br />

jointly by the IASB and FASB to converge IFRS and<br />

US GAAP.<br />

In contrast to IFRS 3, FAS 141 does include, as an<br />

Appendix, limited accounting guidance for transactions<br />

under common control which, as with IFRS 3, are outside<br />

the scope of that accounting standard. The guidance<br />

contained in FAS 141 indicates that a form of accounting<br />

that is similar to pooling of interests accounting, which<br />

was previously set out in Accounting Principles Board<br />

(APB) Opinion 16, may be used when accounting for<br />

transactions under common control.<br />

Having considered the requirements of IAS 8, and the<br />

guidance included within FAS 141, it is considered<br />

appropriate to use a form of accounting which is<br />

similar to pooling of interests when dealing with<br />

the transaction in which the company acquired its<br />

controlling interest in its subsidiaries.<br />

In consequence, the Financial Information for Punch<br />

Graphix plc <strong>report</strong>s the result of operations for the<br />

period as though the acquisition of its controlling<br />

interest through a transaction under common control<br />

had occurred on January 1, 2004. The effects of<br />

intercompany transactions have been eliminated in<br />

determining the results of operations for the period<br />

prior to the acquisition of the controlling interest,<br />

meaning that those results are on substantially the same<br />

basis as the results of operations for the period after the<br />

acquisition of the controlling interest.<br />

Similarly, the consolidated balance sheets and other<br />

financial information have been presented as though<br />

the assets and liabilities of the combining entities had<br />

been transferred on January 1, 2004.<br />

A summary of the more important accounting policies<br />

is set out below. The accounting principles have been<br />

applied consistently for all years presented.<br />

Basis of consolidation<br />

Where the company has the power, either directly or<br />

indirectly, to govern the financial and operating policies<br />

of another entity or business so as to obtain benefits<br />

from its activities, it is classified as a subsidiary. The<br />

consolidated financial statements present the results<br />

of the company and its subsidiaries (“the group”) as if<br />

they formed a single entity. Intercompany transactions<br />

and balances between group companies are therefore<br />

eliminated in full.<br />

Business combinations<br />

The consolidated financial statements incorporate the<br />

results of business combinations using the purchase<br />

method. In the consolidated balance sheet, the<br />

acquiree’s identifiable assets, liabilities and contingent<br />

liabilities are initially recognised at their fair values<br />

at the acquisition date. The results of acquired<br />

operations are included in the consolidated income<br />

statement from the date on which control is obtained.