Annual report 2005 - Xeikon

Annual report 2005 - Xeikon

Annual report 2005 - Xeikon

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

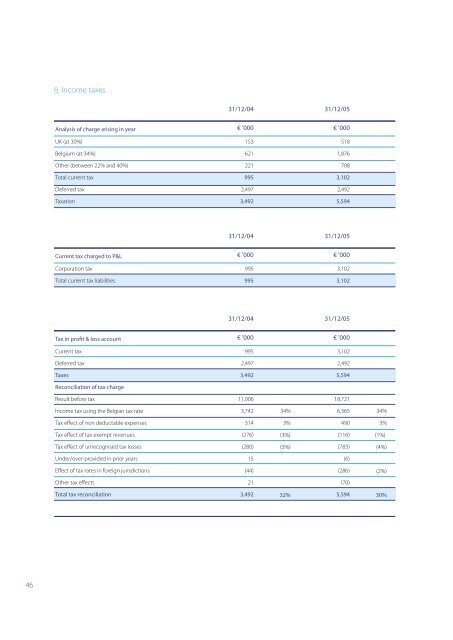

6. Income taxes<br />

31/12/04<br />

Analysis of charge arising in year € '000<br />

31/12/05<br />

€ '000<br />

UK (at 30%)<br />

Belgium (at 34%)<br />

Other (between 22% and 40%)<br />

Total current tax<br />

Deferred tax<br />

Taxation<br />

153<br />

621<br />

221<br />

995<br />

2,497<br />

3,492<br />

518<br />

1,876<br />

708<br />

3,102<br />

2,492<br />

5,594<br />

31/12/04<br />

31/12/05<br />

Current tax charged to P&L € '000<br />

€ '000<br />

Corporation tax<br />

Total current tax liabilities<br />

995<br />

995<br />

3,102<br />

3,102<br />

31/12/04<br />

31/12/05<br />

Tax in profit & loss account € '000<br />

€ '000<br />

Current tax<br />

995<br />

3,102<br />

Deferred tax<br />

2,497<br />

2,492<br />

Taxes<br />

3,492<br />

5,594<br />

Reconciliation of tax charge<br />

Result before tax<br />

11,006<br />

18,721<br />

Income tax using the Belgian tax rate<br />

3,742<br />

34%<br />

6,365<br />

34%<br />

Tax effect of non deductable expenses<br />

314<br />

3%<br />

490<br />

3%<br />

Tax effect of tax exempt revenues<br />

(276)<br />

(3%)<br />

(116)<br />

(1%)<br />

Tax effect of unrecognised tax losses<br />

(280)<br />

(3%)<br />

(783)<br />

(4%)<br />

Under/over-provided in prior years<br />

15<br />

(6)<br />

Effect of tax rates in foreign jurisdictions<br />

(44)<br />

(286)<br />

(2%)<br />

Other tax effects<br />

21<br />

(70)<br />

Total tax reconciliation<br />

3,492<br />

32%<br />

5,594<br />

30%<br />

46