Download PDF (619 ko )FSST and CSST Financial Statements 2007

Download PDF (619 ko )FSST and CSST Financial Statements 2007

Download PDF (619 ko )FSST and CSST Financial Statements 2007

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

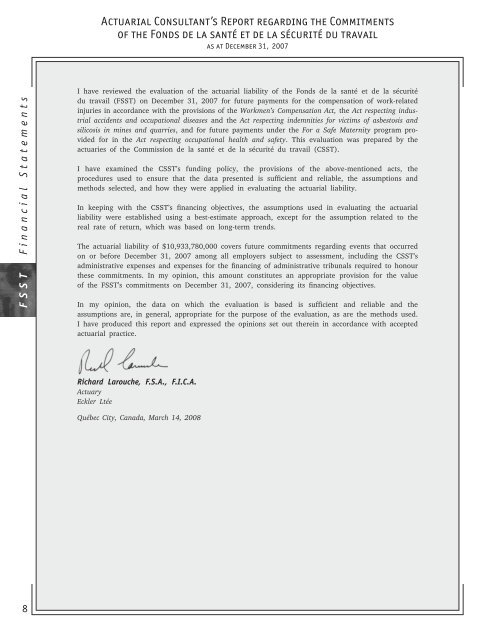

Actuarial Consultant’s Report regarding the Commitments<br />

of the Fonds de la santé et de la sécurité du travail<br />

as at December 31, <strong>2007</strong><br />

<strong>FSST</strong> <strong>Financial</strong> <strong>Statements</strong><br />

I have reviewed the evaluation of the actuarial liability of the Fonds de la santé et de la sécurité<br />

du travail (<strong>FSST</strong>) on December 31, <strong>2007</strong> for future payments for the compensation of work-related<br />

injuries in accordance with the provisions of the Workmen’s Compensation Act, the Act respecting industrial<br />

accidents <strong>and</strong> occupational diseases <strong>and</strong> the Act respecting indemnities for victims of asbestosis <strong>and</strong><br />

silicosis in mines <strong>and</strong> quarries, <strong>and</strong> for future payments under the For a Safe Maternity program provided<br />

for in the Act respecting occupational health <strong>and</strong> safety. This evaluation was prepared by the<br />

actuaries of the Commission de la santé et de la sécurité du travail (<strong>CSST</strong>).<br />

I have examined the <strong>CSST</strong>’s funding policy, the provisions of the above-mentioned acts, the<br />

procedures used to ensure that the data presented is sufficient <strong>and</strong> reliable, the assumptions <strong>and</strong><br />

methods selected, <strong>and</strong> how they were applied in evaluating the actuarial liability.<br />

In keeping with the <strong>CSST</strong>’s financing objectives, the assumptions used in evaluating the actuarial<br />

liability were established using a best-estimate approach, except for the assumption related to the<br />

real rate of return, which was based on long-term trends.<br />

The actuarial liability of $10,933,780,000 covers future commitments regarding events that occurred<br />

on or before December 31, <strong>2007</strong> among all employers subject to assessment, including the <strong>CSST</strong>’s<br />

administrative expenses <strong>and</strong> expenses for the financing of administrative tribunals required to honour<br />

these commitments. In my opinion, this amount constitutes an appropriate provision for the value<br />

of the <strong>FSST</strong>’s commitments on December 31, <strong>2007</strong>, considering its financing objectives.<br />

In my opinion, the data on which the evaluation is based is sufficient <strong>and</strong> reliable <strong>and</strong> the<br />

assumptions are, in general, appropriate for the purpose of the evaluation, as are the methods used.<br />

I have produced this report <strong>and</strong> expressed the opinions set out therein in accordance with accepted<br />

actuarial practice.<br />

Richard Larouche, F.S.A., F.I.C.A.<br />

Actuary<br />

Eckler Ltée<br />

Québec City, Canada, March 14, 2008<br />

8