annual report - Kendrion

annual report - Kendrion

annual report - Kendrion

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

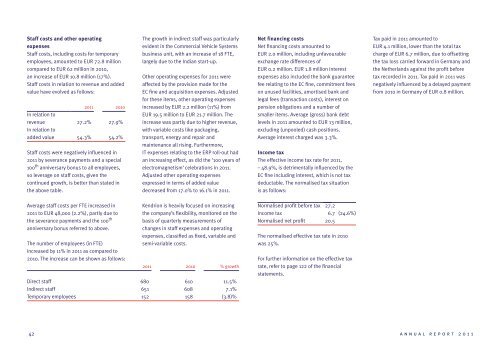

Staff costs and other operating<br />

expenses<br />

Staff costs, including costs for temporary<br />

employees, amounted to EUR 72.8 million<br />

compared to EUR 62 million in 2010,<br />

an increase of EUR 10.8 million (17%).<br />

Staff costs in relation to revenue and added<br />

value have evolved as follows:<br />

2011 2010<br />

In relation to<br />

revenue 27.2% 27.9%<br />

In relation to<br />

added value 54.3% 54.2%<br />

Staff costs were negatively influenced in<br />

2011 by severance payments and a special<br />

100 th anniversary bonus to all employees,<br />

so leverage on staff costs, given the<br />

continued growth, is better than stated in<br />

the above table.<br />

The growth in indirect staff was particularly<br />

evident in the Commercial Vehicle Systems<br />

business unit, with an increase of 18 FTE,<br />

largely due to the Indian start-up.<br />

Other operating expenses for 2011 were<br />

affected by the provision made for the<br />

EC fine and acquisition expenses. Adjusted<br />

for these items, other operating expenses<br />

increased by EUR 2.2 million (11%) from<br />

EUR 19.5 million to EUR 21.7 million. The<br />

increase was partly due to higher revenue,<br />

with variable costs like packaging,<br />

transport, energy and repair and<br />

maintenance all rising. Furthermore,<br />

IT expenses relating to the ERP roll-out had<br />

an increasing effect, as did the ‘100 years of<br />

electromagnetism’ celebrations in 2011.<br />

Adjusted other operating expenses<br />

expressed in terms of added value<br />

decreased from 17.0% to 16.1% in 2011.<br />

Net financing costs<br />

Net financing costs amounted to<br />

EUR 2.o million, including unfavourable<br />

exchange rate differences of<br />

EUR 0.2 million. EUR 1.8 million interest<br />

expenses also included the bank guarantee<br />

fee relating to the EC fine, commitment fees<br />

on unused facilities, amortised bank and<br />

legal fees (transaction costs), interest on<br />

pension obligations and a number of<br />

smaller items. Average (gross) bank debt<br />

levels in 2011 amounted to EUR 13 million,<br />

excluding (unpooled) cash positions.<br />

Average interest charged was 3.3%.<br />

Income tax<br />

The effective income tax rate for 2011,<br />

– 48.9%, is detrimentally influenced by the<br />

EC fine including interest, which is not tax<br />

deductable. The normalised tax situation<br />

is as follows:<br />

Tax paid in 2011 amounted to<br />

EUR 4.1 million, lower than the total tax<br />

charge of EUR 6.7 million, due to offsetting<br />

the tax loss carried forward in Germany and<br />

the Netherlands against the profit before<br />

tax recorded in 2011. Tax paid in 2011 was<br />

negatively influenced by a delayed payment<br />

from 2010 in Germany of EUR 0.8 million.<br />

Average staff costs per FTE increased in<br />

2011 to EUR 48,000 (2.2%), partly due to<br />

the severance payments and the 100 th<br />

anniversary bonus referred to above.<br />

The number of employees (in FTE)<br />

increased by 11% in 2011 as compared to<br />

2010. The increase can be shown as follows:<br />

<strong>Kendrion</strong> is heavily focused on increasing<br />

the company’s flexibility, monitored on the<br />

basis of quarterly measurements of<br />

changes in staff expenses and operating<br />

expenses, classified as fixed, variable and<br />

semi-variable costs.<br />

2011 2010 % growth<br />

Direct staff 680 610 11.5%<br />

Indirect staff 651 608 7.1%<br />

Temporary employees 152 158 (3.8)%<br />

Normalised profit before tax 27.2<br />

Income tax 6.7 (24.6%)<br />

Normalised net profit 20.5<br />

The normalised effective tax rate in 2010<br />

was 25%.<br />

For further information on the effective tax<br />

rate, refer to page 122 of the financial<br />

statements.<br />

42<br />

<strong>annual</strong> <strong>report</strong> 2011