annual report - Kendrion

annual report - Kendrion

annual report - Kendrion

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The balance sheet total increased by<br />

EUR 52 million from end 2010 to end 2011,<br />

as a result of:<br />

z Acquisition of FAS Controls, Inc.:<br />

EUR 41 million;<br />

z Increased inventories (23%) and trade<br />

and other receivables (18.5%):<br />

total EUR 12 million;<br />

z Reduced deferred income tax:<br />

EUR 4 million.<br />

Goodwill payments were made for the<br />

Linnig Group in 2007, Tri-Tech in 2008,<br />

Magneta in 2010 and FAS Controls, at the<br />

end of 2011.<br />

Acquisition-related intangible assets for the<br />

four acquisitions mainly consist of the value<br />

of customer relations and technology.<br />

The <strong>annual</strong> amortisation (without taking<br />

foreign currency translation differences into<br />

account) will amount to EUR 2.4 million in<br />

2012 and EUR 2.0 million in 2013, and will<br />

decrease incrementally to EUR 1.3 million<br />

in 2017 and EUR 0.5 million in 2018 (up to<br />

2026). Further information is included in<br />

the notes 2 and 20 on pages 91 and<br />

following and 117 and following.<br />

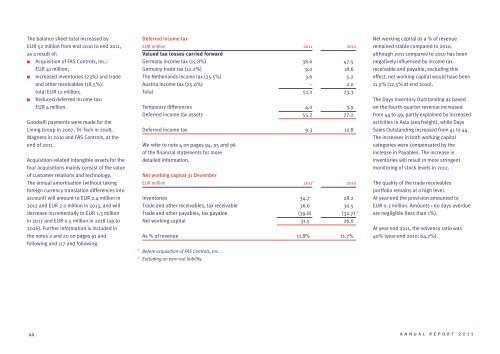

Deferred income tax<br />

EUR million<br />

Valued tax losses carried forward<br />

Germany income tax (15.8%)<br />

Germany trade tax (12.2%)<br />

The Netherlands income tax (25.5%)<br />

Austria income tax (25.0%)<br />

Total<br />

Temporary differences<br />

Deferred income tax assets<br />

Deferred income tax<br />

We refer to note 4 on pages 94, 95 and 96<br />

of the financial statements for more<br />

detailed information.<br />

Net working capital 31 December<br />

EUR million<br />

Inventories<br />

Trade and other receivables, tax receivable<br />

Trade and other payables, tax payable<br />

2011<br />

38.6<br />

9.0<br />

3.6<br />

–<br />

51.2<br />

4.0<br />

55.2<br />

9.3<br />

1<br />

2011<br />

34.7<br />

36.6<br />

(39.8)<br />

2010<br />

47.5<br />

18.6<br />

5.2<br />

2.0<br />

73.3<br />

3.9<br />

77.2<br />

12.8<br />

2010<br />

28.2<br />

30.5<br />

(32.7) Net working capital as a % of revenue<br />

remained stable compared to 2010,<br />

although 2011 compared to 2010 has been<br />

negatively influenced by income tax<br />

receivable and payable; excluding this<br />

effect, net working capital would have been<br />

11.9% (12.5% at end 2010).<br />

The Days Inventory Outstanding as based<br />

on the fourth-quarter revenue increased<br />

from 44 to 49, partly explained by increased<br />

activities in Asia (sea freight), while Days<br />

Sales Outstanding increased from 41 to 44.<br />

The increases in both working capital<br />

categories were compensated by the<br />

increase in Payables. The increase in<br />

inventories will result in more stringent<br />

monitoring of stock levels in 2012.<br />

The quality of the trade receivables<br />

portfolio remains at a high level.<br />

At year-end the provision amounted to<br />

EUR 0.3 million. Amounts › 60 days overdue<br />

are negligible (less than 1%).<br />

Net working capital 31.5 26.0<br />

At year-end 2011, the solvency ratio was<br />

As % of revenue 11.8% 11.7% 40% (year-end 2010: 64.7%).<br />

1 Before acquisition of FAS Controls, Inc.<br />

2 Excluding an earn-out liability.<br />

44<br />

<strong>annual</strong> <strong>report</strong> 2011