Guidance Paper - The Institute of Risk Management

Guidance Paper - The Institute of Risk Management

Guidance Paper - The Institute of Risk Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

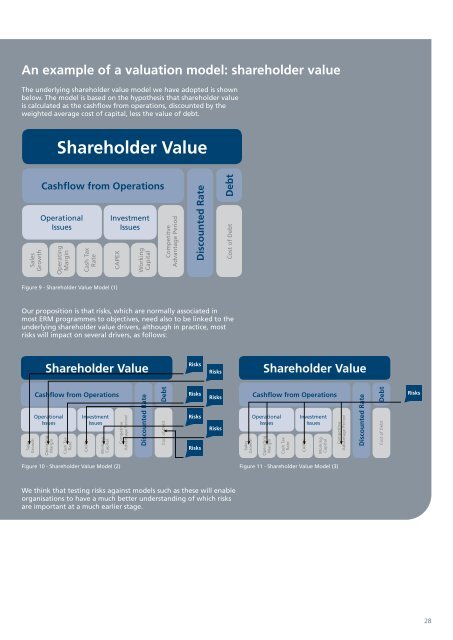

An example <strong>of</strong> a valuation model: shareholder value<br />

<strong>The</strong> underlying shareholder value model we have adopted is shown<br />

below. <strong>The</strong> model is based on the hypothesis that shareholder value<br />

is calculated as the cashflow from operations, discounted by the<br />

weighted average cost <strong>of</strong> capital, less the value <strong>of</strong> debt.<br />

Shareholder Value<br />

Sales<br />

Growth<br />

Cashflow from Operations<br />

Operational<br />

Issues<br />

Operating<br />

Margin<br />

Cash Tax<br />

Rate<br />

Investment<br />

Issues<br />

CAPEX<br />

Working<br />

Capital<br />

Competitve<br />

Advantage Period<br />

Discounted Rate<br />

Cost <strong>of</strong> Debt Debt<br />

Figure 9 - Shareholder Value Model (1)<br />

Our proposition is that risks, which are normally associated in<br />

most ERM programmes to objectives, need also to be linked to the<br />

underlying shareholder value drivers, although in practice, most<br />

risks will impact on several drivers, as follows:<br />

Shareholder Value<br />

<strong>Risk</strong>s<br />

<strong>Risk</strong>s<br />

Shareholder Value<br />

Sales<br />

Growth<br />

Cashflow from Operations<br />

Operational<br />

Issues<br />

Operating<br />

Margin<br />

Cash Tax<br />

Rate<br />

Investment<br />

Issues<br />

CAPEX<br />

Working<br />

Capital<br />

Competitve<br />

Advantage Period<br />

Discounted Rate<br />

Cost <strong>of</strong> Debt Debt<br />

<strong>Risk</strong>s<br />

<strong>Risk</strong>s<br />

<strong>Risk</strong>s<br />

<strong>Risk</strong>s<br />

<strong>Risk</strong>s<br />

Sales<br />

Growth<br />

Cashflow from Operations<br />

Operational<br />

Issues<br />

Operating<br />

Margin<br />

Cash Tax<br />

Rate<br />

Investment<br />

Issues<br />

CAPEX<br />

Working<br />

Capital<br />

Competitve<br />

Advantage Period<br />

Discounted Rate<br />

Cost <strong>of</strong> Debt Debt<br />

<strong>Risk</strong>s<br />

Figure 10 - Shareholder Value Model (2) Figure 11 - Shareholder Value Model (3)<br />

We think that testing risks against models such as these will enable<br />

organisations to have a much better understanding <strong>of</strong> which risks<br />

are important at a much earlier stage.<br />

28