Return of Or anization Exem t From Income Tax g p - Foundation ...

Return of Or anization Exem t From Income Tax g p - Foundation ...

Return of Or anization Exem t From Income Tax g p - Foundation ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Form 990 (2010)<br />

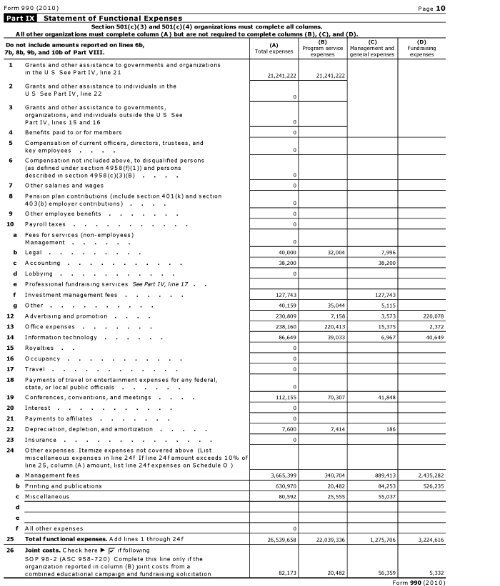

Form 990 (2010) Page 10<br />

Statement <strong>of</strong> Functional Expenses<br />

Section 501 ( c)(3) and 501(c)(4) org<strong>anization</strong>s must complete all columns.<br />

All other org<strong>anization</strong>s must complete column (A) but are not required to complete columns ( B), (C), and ( D).<br />

Do not include amounts reported on lines 6b,<br />

7b , 8b , 9b , and 10b <strong>of</strong> Part VIII .<br />

(A)<br />

Total expenses<br />

(B)<br />

Program service<br />

expenses<br />

(C)<br />

Management and<br />

general expenses<br />

(D)<br />

Fundraising<br />

expenses<br />

1 Grants and other assistance to governments and org<strong>anization</strong>s<br />

in the U S See Part IV, line 21<br />

21,241,222 21,241,222<br />

2 Grants and other assistance to individuals in the<br />

U S See Part IV, line 22 0<br />

3 Grants and other assistance to governments,<br />

org<strong>anization</strong>s , and individuals outside the U S See<br />

Part IV, lines 15 and 16 0<br />

4 Benefits paid to or for members 0<br />

5 Compensation <strong>of</strong> current <strong>of</strong>ficers, directors, trustees, and<br />

key employees 0<br />

6 Compensation not included above, to disqualified persons<br />

(as defined under section 4958 ( f)(1)) and persons<br />

described in section 4958 ( c)(3)(B) 0<br />

7 Other salaries and wages 0<br />

8 Pension plan contributions (include section 401(k) and section<br />

40 3(b) employer contributions) 0<br />

9 Other employee benefits 0<br />

10 Payroll taxes 0<br />

a<br />

Fees for services ( non-employees)<br />

Management . 0<br />

b Legal 40,000 32,004 7,996<br />

c Accounting 38,200 38,200<br />

d Lobbying 0<br />

e Pr<strong>of</strong>essional fundraising services See Part IV, line 17<br />

f Investment management fees 127,743 127,743<br />

g Other 40 ,159 35,044 5,115<br />

12 Advertising and promotion 230,809 7,158 3,573 220,078<br />

13 Office expenses 238,160 220,413 15,375 2,372<br />

14 Information technology 86,649 39,033 6,967 40,649<br />

15 Royalties 0<br />

16 Occupancy 0<br />

17 Travel 0<br />

18 Payments <strong>of</strong> travel or entertainment expenses for any federal,<br />

state, or local public <strong>of</strong>ficials 0<br />

19 Conferences , conventions , and meetings 112,155 70,307 41,848<br />

20 Interest 0<br />

21 Payments to affiliates 0<br />

22 Depreciation , depletion, and amortization 7,600 7,414 186<br />

23 Insurance 0<br />

24 Other expenses Itemize expenses not covered above (List<br />

miscellaneous expenses in line 24f If line 24f amount exceeds 10% <strong>of</strong><br />

line 25, column ( A) amount, list line 24f expenses on Schedule 0<br />

a Management fees 3,665 ,399 340,704 889,413 2,435,282<br />

b Printing and publications 630,970 20,482 84,253 526,235<br />

c Miscellaneous 80,592 25,555 55,037<br />

d<br />

e<br />

f All other expenses 0<br />

25 Total functional expenses . Add lines 1 through 24f 26,539,658 22,039,336 1,275,706 3,224,616<br />

26 Joint costs. Check here - F iffollowing<br />

SOP 98-2 (ASC 958-720) Complete this line only if the<br />

org<strong>anization</strong> reported in column (B) joint costs from a<br />

combined educational campaign and fundraising solicitation 2,173 0,482 6,359 ,332