Return of Or anization Exem t From Income Tax g p - Foundation ...

Return of Or anization Exem t From Income Tax g p - Foundation ...

Return of Or anization Exem t From Income Tax g p - Foundation ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

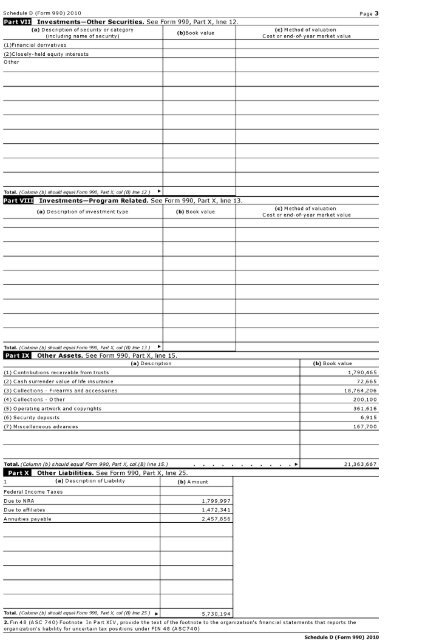

Schedule D (Form 990) 2010<br />

Schedule D (Form 990) 2010 Page 3<br />

UUM-Investments-0ther Securities . See Form 990 , Part X , line 12.<br />

(a) Description <strong>of</strong> security or category<br />

(c) Method <strong>of</strong> valuation<br />

(b)Book value<br />

(including name <strong>of</strong> security) Cost or end-<strong>of</strong>-year market value<br />

(1)Financial derivatives<br />

(2)Closely-held equity interests<br />

Other<br />

Total . (Column (b) should equal Form 990, Part X, col (B) line 12 ) 011<br />

Investments - Program Related . See Form 990, Part X, line 13.<br />

(a) Description <strong>of</strong> investment type I (b) Book value<br />

(c) Method <strong>of</strong> valuation<br />

Cost or end-<strong>of</strong>-vear market value<br />

Total . (Column (b) should equal Form 990, Part X, col (B) line 13) 01<br />

Other Assets . See Form 990. Part X. line 15.<br />

(a) Description<br />

(b) Book value<br />

(1) Contributions receivable from trusts 1,790,465<br />

(2) Cash surrender value <strong>of</strong> life insurance 72,665<br />

(3) Collections - Firearms and accessories 18,764,206<br />

(4) Collections - Other 200,100<br />

(5) Operating artwork and copyrights 361,616<br />

(6) Security deposits 6,915<br />

(7) Miscellaneous advances 167,700<br />

Total . (Column (b) should equal Form 990, Part X, col.(B) line 15.) 21,363,667<br />

Other Liabilities . See Form 990 , Part X , line 25.<br />

1 (a) Description <strong>of</strong> Liability ( b) Amount<br />

Federal <strong>Income</strong> <strong>Tax</strong>es<br />

Due to NRA 1,799,997<br />

Due to affiliates 1,472,341<br />

Annuities payable 2,457,856<br />

Total . (Column (b) should equal Form 990, Part X, col (B) line 25) P. I 5,730,194<br />

2. Fin 48 (ASC 740) Footnote In Part XIV, provide the text <strong>of</strong> the footnote to the org<strong>anization</strong>'s financial statements that reports the<br />

org<strong>anization</strong>'s liability for uncertain tax positions under FIN 48 (ASC740)