Return of Or anization Exem t From Income Tax g p - Foundation ...

Return of Or anization Exem t From Income Tax g p - Foundation ...

Return of Or anization Exem t From Income Tax g p - Foundation ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

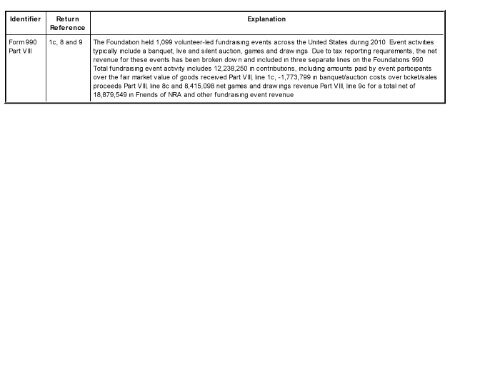

Identifier<br />

<strong>Return</strong><br />

Reference<br />

Explanation<br />

Form 990 1c, 8 and 9 The <strong>Foundation</strong> held 1,099 volunteer-led fundraising events across the United States during 2010 Event activities<br />

Part VIII typically include a banquet, live and silent auction, games and drawings Due to tax reporting requirements, the net<br />

revenue for these events has been broken down and included in three separate lines on the <strong>Foundation</strong>s 990<br />

Total fundraising event activity includes 12,238,250 in contributions, including amounts paid by event participants<br />

over the fair market value <strong>of</strong> goods received Part VIII, line 1 c, -1,773,799 in banquet/auction costs over ticket/sales<br />

proceeds Part VIII, line 8c and 8,415,098 net games and drawings revenue Part VIII, line 9c for a total net <strong>of</strong><br />

18,879,549 in Friends <strong>of</strong> NRA and other fundraising event revenue