Return of Or anization Exem t From Income Tax g p - Foundation ...

Return of Or anization Exem t From Income Tax g p - Foundation ...

Return of Or anization Exem t From Income Tax g p - Foundation ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

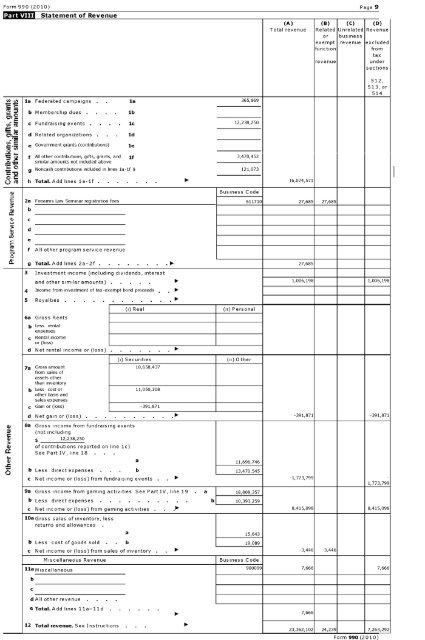

Form 990 (2010) Page 9<br />

1:M.&TJO04<br />

Statement <strong>of</strong> Revenue<br />

(A) (B) (C) (D)<br />

Total revenue Related Unrelated Revenue<br />

or business<br />

exempt revenue excluded<br />

function<br />

from<br />

tax<br />

revenue<br />

under<br />

sections<br />

la Federated campaigns . la 365,869<br />

512,<br />

513, or<br />

514<br />

E<br />

b Membership dues . . . . lb<br />

c Fundraising events . 1c 12,238,250<br />

d Related org<strong>anization</strong>s . ld<br />

e Government grants (contributions) le<br />

f All other contributions, gifts, grants, and if 3,470,452<br />

similar amounts not included above<br />

g Noncash contributions included in lines la-If $ 121,073<br />

h Total. Add lines la-1f . 16,074,571<br />

a, Business Code<br />

2a Firearms Law Seminar registration fees 611710 27,685 27,685<br />

b<br />

c<br />

U7<br />

O<br />

d<br />

e<br />

f All other program service revenue<br />

g Total. Add lines 2a-2f . 27,685<br />

3 Investment income (including dividends, interest<br />

and other similar amounts) 10- 1,006,198 1,006,198<br />

4 <strong>Income</strong> from investment <strong>of</strong> tax-exempt bond proceeds<br />

5 Royalties<br />

6a<br />

Gross Rents<br />

b Less rental<br />

expenses<br />

c Rental income<br />

or (loss)<br />

d Net rental income or (loss) . .<br />

7a Gross amount 10,658,437<br />

from sales <strong>of</strong><br />

assets other<br />

than inventory<br />

b Less cost or 11,050,308<br />

other basis and<br />

sales expenses<br />

c Gain or (loss) -391,871<br />

(i) Real (ii) Personal<br />

(i) Securities (ii) Other<br />

d Net gain or (loss) -391,871 -391,871<br />

q^ 8a Gross income from fundraising events<br />

(not including<br />

$ 12,238,250<br />

Qo <strong>of</strong> contributions reported on line 1c)<br />

See Part IV, line 18 .<br />

s<br />

a 11,696,746<br />

b Less direct expenses b 13,470,545<br />

c Net income or (loss) from fundraising events . -1,773,799 -<br />

1,773,799<br />

9a Gross income from gaming activities See Part IV, line 19 . a 18,808,357<br />

b Less direct expenses b 10,393,259<br />

c Net income or (loss) from gaming activities 8,415,098 8,415,098<br />

10aGross sales <strong>of</strong> inventory, less<br />

returns and allowances .<br />

a 15,643<br />

b Less cost <strong>of</strong> goods sold . b 19,089<br />

c Net income or (loss) from sales <strong>of</strong> inventory -3,446 -3,446<br />

Miscellaneous Revenue<br />

11a M i s c e l l a n e o u s<br />

Business Code<br />

900099 7,666 7,666<br />

b<br />

c<br />

dAll other revenue . .<br />

e Total . A dd l i n e s h a-11 d<br />

7,666<br />

12 Total revenue . See Instructions<br />

23,362,102 24,239 1 1 7,263,292<br />

Form 990 (2010)