Return of Or anization Exem t From Income Tax g p - Foundation ...

Return of Or anization Exem t From Income Tax g p - Foundation ...

Return of Or anization Exem t From Income Tax g p - Foundation ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

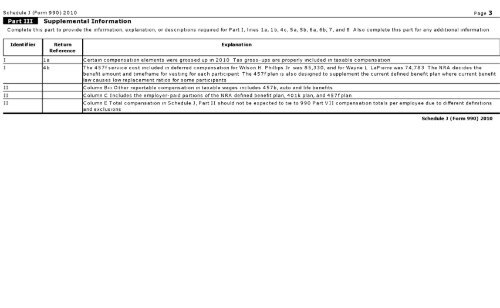

Schedule J (Form 990) 2010 Page 3<br />

Supplemental Information<br />

Complete this part to provide the information, explanation, or descriptions required for Part I, lines la, 1b, 4c, 5a, 5b, 6a, 6b, 7, and 8 Also complete this part for any additional information<br />

Identifier <strong>Return</strong> Explanation<br />

Reference<br />

I la Certain compensation elements were grossed up in 2010 <strong>Tax</strong> gross-ups are properly included in taxable compensation<br />

I 4b The 457f service cost included in deferred compensation for Wilson H Phillips Jr was 85,330, and for Wayne L LaPierre was 74,783 The NRA decides the<br />

benefit amount and timeframe for vesting for each participant The 457f plan is also designed to supplement the current defined benefit plan where current benefit<br />

law causes low replacement ratios for some participants<br />

II Column Biii Other reportable compensation in taxable wages includes 457b, auto and life benefits<br />

II<br />

Column C Includes the employer-paid portions <strong>of</strong> the NRA defined benefit plan, 401k plan, and 457f plan<br />

II Column E Total compensation in Schedule J, Part II should not be expected to tie to 990 Part VII compensation totals per employee due to different definitions<br />

and exclusions<br />

Schedule 3 (Form 990) 2010