Return of Or anization Exem t From Income Tax g p - Foundation ...

Return of Or anization Exem t From Income Tax g p - Foundation ...

Return of Or anization Exem t From Income Tax g p - Foundation ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

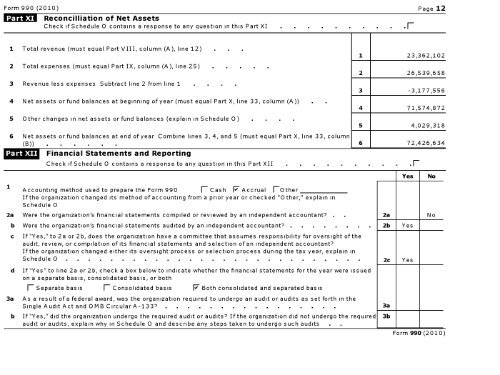

Form 990 (2010) Page 12<br />

1 :M. WO Reconcilliation <strong>of</strong> Net Assets<br />

Check if Schedule 0 contains a response to any question in this Part XI F<br />

1 Total revenue (must equal Part VIII, column (A), line 12)<br />

2 Total expenses (must equal Part IX, column (A), line 25)<br />

3 Revenue less expenses Subtract line 2 from line 1 .<br />

1 23,362,102<br />

2 26,539,658<br />

3 -3,177,556<br />

4 Net assets or fund balances at beginning <strong>of</strong> year (must equal Part X, line 33, column (A))<br />

5 Other changes in net assets or fund balances (explain in Schedule 0) .<br />

4 71,574,872<br />

5 4,029,318<br />

6 Net assets or fund balances at end <strong>of</strong> year Combine lines 3, 4, and 5 (must equal Part X, line 33, column<br />

(B))<br />

6 72,426,634<br />

Financial Statements and Reporting<br />

Eff-<br />

Check if Schedule 0 contains a response to any question in this Part XII .F<br />

GM<br />

Yes<br />

No<br />

1 Accounting method used to prepare the Form 990 p Cash F Accrual F-Other<br />

If the org<strong>anization</strong> changed its method <strong>of</strong> accounting from a prior year or checked "Other," explain in<br />

Schedule 0<br />

2a Were the org<strong>anization</strong>'s financial statements compiled or reviewed by an independent accountant's 2a No<br />

b Were the org<strong>anization</strong>'s financial statements audited by an independent accountant . 2b Yes<br />

c If "Yes,"to 2a or 2b, does the org<strong>anization</strong> have a committee that assumes responsibility for oversight <strong>of</strong> the<br />

audit, review, or compilation <strong>of</strong> its financial statements and selection <strong>of</strong> an independent accountant<br />

If the org<strong>anization</strong> changed either its oversight process or selection process during the tax year, explain in<br />

Schedule 0 2c Yes<br />

d If "Yes" to line 2a or 2b, check a box below to indicate whether the financial statements for the year were issued<br />

on a separate basis, consolidated basis, or both<br />

fl Separate basis fl Consolidated basis F Both consolidated and separated basis<br />

3a As a result <strong>of</strong> a federal award, was the org<strong>anization</strong> required to undergo an audit or audits as set forth in the<br />

Single Audit Act and 0MB Circular A-133 . . . . . . . . . . . . . . . 3a<br />

b If "Yes," did the org<strong>anization</strong> undergo the required audit or audits If the org<strong>anization</strong> did not undergo the required 3b<br />

audit or audits, explain why in Schedule 0 and describe any steps taken to undergo such audits .<br />

Form 990 (2010)