MLK PARADE - Deputy Sheriffs' Association of San Diego County

MLK PARADE - Deputy Sheriffs' Association of San Diego County

MLK PARADE - Deputy Sheriffs' Association of San Diego County

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

negotiations<br />

Negotiations Update<br />

The county made an <strong>of</strong>fer to the DSA to extend our contract to<br />

June 30, 2013. You might be asking yourself what would this mean<br />

to me Over a five-year period, our gross salary would stay about<br />

the same; however, by the end <strong>of</strong> the contract a top-step deputy<br />

sheriff would actually take home less money.<br />

After looking over the numbers, the board <strong>of</strong> directors and<br />

entire negotiations committee on behalf <strong>of</strong> our members<br />

rejected the latest contract <strong>of</strong>fer.<br />

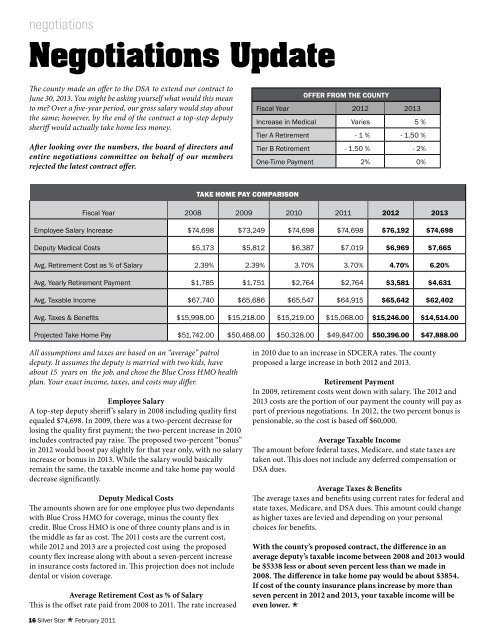

OFFER FROM THE COUNTY<br />

Fiscal Year 2012 2013<br />

Increase in Medical Varies 5 %<br />

Tier A Retirement - 1 % - 1.50 %<br />

Tier B Retirement - 1.50 % - 2%<br />

One-Time Payment 2% 0%<br />

TAKE HOME PAY COMPARISON<br />

Fiscal Year 2008 2009 2010 2011 2012 2013<br />

Employee Salary Increase $74,698 $73,249 $74,698 $74,698 $76,192 $74,698<br />

<strong>Deputy</strong> Medical Costs $5,173 $5,812 $6,387 $7,019 $6,969 $7,665<br />

Avg. Retirement Cost as % <strong>of</strong> Salary 2.39% 2.39% 3.70% 3.70% 4.70% 6.20%<br />

Avg. Yearly Retirement Payment $1,785 $1,751 $2,764 $2,764 $3,581 $4,631<br />

Avg. Taxable Income $67,740 $65,686 $65,547 $64,915 $65,642 $62,402<br />

Avg. Taxes & Benefits $15,998.00 $15,218.00 $15,219.00 $15,068.00 $15,246.00 $14,514.00<br />

Projected Take Home Pay $51,742.00 $50,468.00 $50,328.00 $49,847.00 $50,396.00 $47,888.00<br />

All assumptions and taxes are based on an “average” patrol<br />

deputy. It assumes the deputy is married with two kids, have<br />

about 15 years on the job, and chose the Blue Cross HMO health<br />

plan. Your exact income, taxes, and costs may differ.<br />

Employee Salary<br />

A top-step deputy sheriff’s salary in 2008 including quality first<br />

equaled $74,698. In 2009, there was a two-percent decrease for<br />

losing the quality first payment; the two-percent increase in 2010<br />

includes contracted pay raise. The proposed two-percent “bonus”<br />

in 2012 would boost pay slightly for that year only, with no salary<br />

increase or bonus in 2013. While the salary would basically<br />

remain the same, the taxable income and take home pay would<br />

decrease significantly.<br />

<strong>Deputy</strong> Medical Costs<br />

The amounts shown are for one employee plus two dependants<br />

with Blue Cross HMO for coverage, minus the county flex<br />

credit. Blue Cross HMO is one <strong>of</strong> three county plans and is in<br />

the middle as far as cost. The 2011 costs are the current cost,<br />

while 2012 and 2013 are a projected cost using the proposed<br />

county flex increase along with about a seven-percent increase<br />

in insurance costs factored in. This projection does not include<br />

dental or vision coverage.<br />

Average Retirement Cost as % <strong>of</strong> Salary<br />

This is the <strong>of</strong>fset rate paid from 2008 to 2011. The rate increased<br />

in 2010 due to an increase in SDCERA rates. The county<br />

proposed a large increase in both 2012 and 2013.<br />

Retirement Payment<br />

In 2009, retirement costs went down with salary. The 2012 and<br />

2013 costs are the portion <strong>of</strong> our payment the county will pay as<br />

part <strong>of</strong> previous negotiations. In 2012, the two percent bonus is<br />

pensionable, so the cost is based <strong>of</strong>f $60,000.<br />

Average Taxable Income<br />

The amount before federal taxes, Medicare, and state taxes are<br />

taken out. This does not include any deferred compensation or<br />

DSA dues.<br />

Average Taxes & Benefits<br />

The average taxes and benefits using current rates for federal and<br />

state taxes, Medicare, and DSA dues. This amount could change<br />

as higher taxes are levied and depending on your personal<br />

choices for benefits.<br />

With the county’s proposed contract, the difference in an<br />

average deputy’s taxable income between 2008 and 2013 would<br />

be $5338 less or about seven percent less than we made in<br />

2008. The difference in take home pay would be about $3854.<br />

If cost <strong>of</strong> the county insurance plans increase by more than<br />

seven percent in 2012 and 2013, your taxable income will be<br />

even lower. <br />

16 Silver Star February 2011