2011 Annual Report (3 April 2012) - Grange Resources

2011 Annual Report (3 April 2012) - Grange Resources

2011 Annual Report (3 April 2012) - Grange Resources

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2011</strong> ANNUAL REPORT<br />

15<br />

Pellet production<br />

and sales<br />

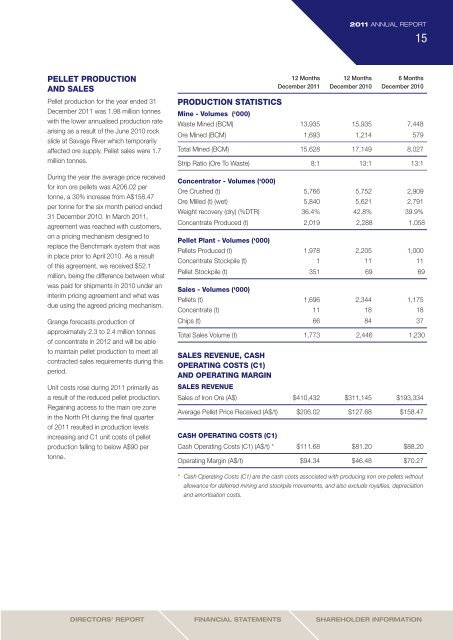

Pellet production for the year ended 31<br />

December <strong>2011</strong> was 1.98 million tonnes<br />

with the lower annualised production rate<br />

arising as a result of the June 2010 rock<br />

slide at Savage River which temporarily<br />

affected ore supply. Pellet sales were 1.7<br />

million tonnes.<br />

During the year the average price received<br />

for iron ore pellets was A206.02 per<br />

tonne, a 30% increase from A$158.47<br />

per tonne for the six month period ended<br />

31 December 2010. In March <strong>2011</strong>,<br />

agreement was reached with customers,<br />

on a pricing mechanism designed to<br />

replace the Benchmark system that was<br />

in place prior to <strong>April</strong> 2010. As a result<br />

of this agreement, we received $52.1<br />

million, being the difference between what<br />

was paid for shipments in 2010 under an<br />

interim pricing agreement and what was<br />

due using the agreed pricing mechanism.<br />

<strong>Grange</strong> forecasts production of<br />

approximately 2.3 to 2.4 million tonnes<br />

of concentrate in <strong>2012</strong> and will be able<br />

to maintain pellet production to meet all<br />

contracted sales requirements during this<br />

period.<br />

Unit costs rose during <strong>2011</strong> primarily as<br />

a result of the reduced pellet production.<br />

Regaining access to the main ore zone<br />

in the North Pit during the final quarter<br />

of <strong>2011</strong> resulted in production levels<br />

increasing and C1 unit costs of pellet<br />

production falling to below A$90 per<br />

tonne.<br />

12 Months 12 Months 6 Months<br />

December <strong>2011</strong> December 2010 December 2010<br />

PRODUCTION STATISTICS<br />

Mine - Volumes (‘000)<br />

Waste Mined (BCM) 13,935 15,935 7,448<br />

Ore Mined (BCM) 1,693 1,214 579<br />

Total Mined (BCM) 15,628 17,149 8,027<br />

Strip Ratio (Ore To Waste) 8:1 13:1 13:1<br />

Concentrator - Volumes (‘000)<br />

Ore Crushed (t) 5,766 5,752 2,909<br />

Ore Milled (t) (wet) 5,840 5,621 2,791<br />

Weight recovery (dry) (%DTR) 36.4% 42.8% 39.9%<br />

Concentrate Produced (t) 2,019 2,288 1,058<br />

Pellet Plant - Volumes (‘000)<br />

Pellets Produced (t) 1,978 2,205 1,000<br />

Concentrate Stockpile (t) 1 11 11<br />

Pellet Stockpile (t) 351 69 69<br />

Sales - Volumes (‘000)<br />

Pellets (t) 1,696 2,344 1,175<br />

Concentrate (t) 11 18 18<br />

Chips (t) 66 84 37<br />

Total Sales Volume (t) 1,773 2,446 1,230<br />

SALES REVENUE, CASH<br />

OPERATING COSTS (C1)<br />

AND OPERATING MARGIN<br />

SALES REVENUE<br />

Sales of Iron Ore (A$) $410,432 $311,145 $193,334<br />

Average Pellet Price Received (A$/t) $206.02 $127.68 $158.47<br />

CASH OPERATING COSTS (C1)<br />

Cash Operating Costs (C1) (A$/t) * $111.68 $81.20 $88.20<br />

Operating Margin (A$/t) $94.34 $46.48 $70.27<br />

* Cash Operating Costs (C1) are the cash costs associated with producing iron ore pellets without<br />

allowance for deferred mining and stockpile movements, and also exclude royalties, depreciation<br />

and amortisation costs.<br />

Directors’ <strong>Report</strong><br />

Financial Statements<br />

Shareholder information