2011 Annual Report (3 April 2012) - Grange Resources

2011 Annual Report (3 April 2012) - Grange Resources

2011 Annual Report (3 April 2012) - Grange Resources

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2011</strong> ANNUAL REPORT<br />

75<br />

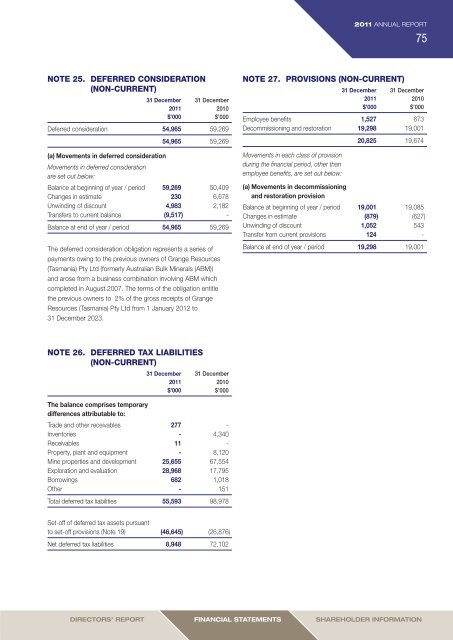

NOTE 25. DEFERRED CONSIDERATION<br />

(NON-CURRENT)<br />

31 December 31 December<br />

<strong>2011</strong> 2010<br />

$’000 $’000<br />

Deferred consideration 54,965 59,269<br />

(a) Movements in deferred consideration<br />

54,965 59,269<br />

Movements in deferred consideration<br />

are set out below:<br />

Balance at beginning of year / period 59,269 50,409<br />

Changes in estimate 230 6,678<br />

Unwinding of discount 4,983 2,182<br />

Transfers to current balance (9,517) -<br />

Balance at end of year / period 54,965 59,269<br />

The deferred consideration obligation represents a series of<br />

payments owing to the previous owners of <strong>Grange</strong> <strong>Resources</strong><br />

(Tasmania) Pty Ltd (formerly Australian Bulk Minerals (ABM))<br />

and arose from a business combination involving ABM which<br />

completed in August 2007. The terms of the obligation entitle<br />

the previous owners to 2% of the gross receipts of <strong>Grange</strong><br />

<strong>Resources</strong> (Tasmania) Pty Ltd from 1 January <strong>2012</strong> to<br />

31 December 2023.<br />

NOTE 27. PROVISIONS (NON-CURRENT)<br />

31 December 31 December<br />

<strong>2011</strong> 2010<br />

$’000 $’000<br />

Employee benefits 1,527 673<br />

Decommissioning and restoration 19,298 19,001<br />

Movements in each class of provision<br />

during the financial period, other than<br />

employee benefits, are set out below:<br />

20,825 19,674<br />

(a) Movements in decommissioning<br />

and restoration provision<br />

Balance at beginning of year / period 19,001 19,085<br />

Changes in estimate (879) (627)<br />

Unwinding of discount 1,052 543<br />

Transfer from current provisions 124 -<br />

Balance at end of year / period 19,298 19,001<br />

NOTE 26. DEFERRED TAX LIABILITIES<br />

(NON-CURRENT)<br />

31 December 31 December<br />

<strong>2011</strong> 2010<br />

$’000 $’000<br />

The balance comprises temporary<br />

differences attributable to:<br />

Trade and other receivables 277 -<br />

Inventories - 4,340<br />

Receivables 11 -<br />

Property, plant and equipment - 8,120<br />

Mine properties and development 25,655 67,554<br />

Exploration and evaluation 28,968 17,795<br />

Borrowings 682 1,018<br />

Other - 151<br />

Total deferred tax liabilities 55,593 98,978<br />

Set-off of deferred tax assets pursuant<br />

to set-off provisions (Note 19) (46,645) (26,876)<br />

Net deferred tax liabilities 8,948 72,102<br />

DirectorS’ <strong>Report</strong><br />

Financial Statements<br />

Shareholder information