2011 Annual Report (3 April 2012) - Grange Resources

2011 Annual Report (3 April 2012) - Grange Resources

2011 Annual Report (3 April 2012) - Grange Resources

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GRANGE RESOURCES LIMITED<br />

86<br />

Notes to the Financial Statements (cont.)<br />

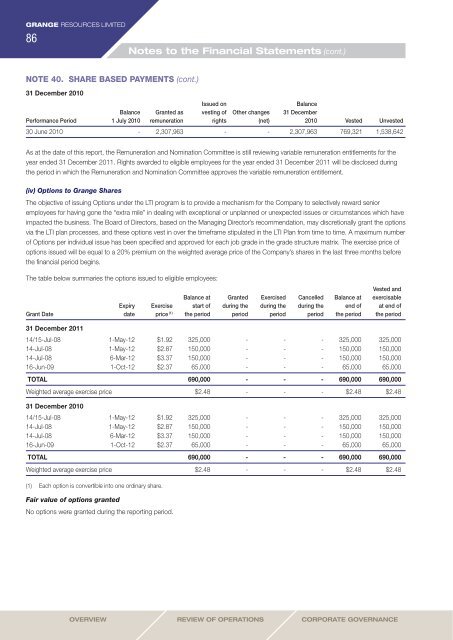

NOTE 40. SHARE BASED PAYMENTS (cont.)<br />

31 December 2010<br />

Issued on<br />

Balance<br />

Balance Granted as vesting of Other changes 31 December<br />

Performance Period 1 July 2010 remuneration rights (net) 2010 Vested Unvested<br />

30 June 2010 - 2,307,963 - - 2,307,963 769,321 1,538,642<br />

As at the date of this report, the Remuneration and Nomination Committee is still reviewing variable remuneration entitlements for the<br />

year ended 31 December <strong>2011</strong>. Rights awarded to eligible employees for the year ended 31 December <strong>2011</strong> will be disclosed during<br />

the period in which the Remuneration and Nomination Committee approves the variable remuneration entitlement.<br />

(iv) Options to <strong>Grange</strong> Shares<br />

The objective of issuing Options under the LTI program is to provide a mechanism for the Company to selectively reward senior<br />

employees for having gone the “extra mile” in dealing with exceptional or unplanned or unexpected issues or circumstances which have<br />

impacted the business. The Board of Directors, based on the Managing Director’s recommendation, may discretionally grant the options<br />

via the LTI plan processes, and these options vest in over the timeframe stipulated in the LTI Plan from time to time. A maximum number<br />

of Options per individual issue has been specified and approved for each job grade in the grade structure matrix. The exercise price of<br />

options issued will be equal to a 20% premium on the weighted average price of the Company’s shares in the last three months before<br />

the financial period begins.<br />

The table below summaries the options issued to eligible employees:<br />

Vested and<br />

Balance at Granted Exercised Cancelled Balance at exercisable<br />

Expiry Exercise start of during the during the during the end of at end of<br />

Grant Date date price (1) the period period period period the period the period<br />

31 December <strong>2011</strong><br />

14/15-Jul-08 1-May-12 $1.92 325,000 - - - 325,000 325,000<br />

14-Jul-08 1-May-12 $2.87 150,000 - - - 150,000 150,000<br />

14-Jul-08 6-Mar-12 $3.37 150,000 - - - 150,000 150,000<br />

16-Jun-09 1-Oct-12 $2.37 65,000 - - - 65,000 65,000<br />

TOTAL 690,000 - - - 690,000 690,000<br />

Weighted average exercise price $2.48 - - - $2.48 $2.48<br />

31 December 2010<br />

14/15-Jul-08 1-May-12 $1.92 325,000 - - - 325,000 325,000<br />

14-Jul-08 1-May-12 $2.87 150,000 - - - 150,000 150,000<br />

14-Jul-08 6-Mar-12 $3.37 150,000 - - - 150,000 150,000<br />

16-Jun-09 1-Oct-12 $2.37 65,000 - - - 65,000 65,000<br />

TOTAL 690,000 - - - 690,000 690,000<br />

Weighted average exercise price $2.48 - - - $2.48 $2.48<br />

(1) Each option is convertible into one ordinary share.<br />

Fair value of options granted<br />

No options were granted during the reporting period.<br />

Overview Review Of Operations Corporate Governance