2011 Annual Report (3 April 2012) - Grange Resources

2011 Annual Report (3 April 2012) - Grange Resources

2011 Annual Report (3 April 2012) - Grange Resources

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GRANGE RESOURCES LIMITED<br />

74<br />

Notes to the Financial Statements (cont.)<br />

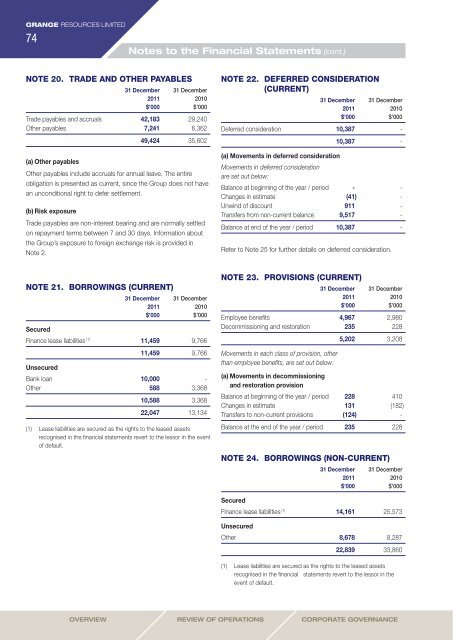

NOTE 20. TRADE AND OTHER PAYABLES<br />

31 December 31 December<br />

<strong>2011</strong> 2010<br />

$’000 $’000<br />

Trade payables and accruals 42,183 29,240<br />

Other payables 7,241 6,362<br />

(a) Other payables<br />

49,424 35,602<br />

Other payables include accruals for annual leave. The entire<br />

obligation is presented as current, since the Group does not have<br />

an unconditional right to defer settlement.<br />

(b) Risk exposure<br />

Trade payables are non-interest bearing and are normally settled<br />

on repayment terms between 7 and 30 days. Information about<br />

the Group’s exposure to foreign exchange risk is provided in<br />

Note 2.<br />

NOTE 22. DEFERRED CONSIDERATION<br />

(CURRENT)<br />

31 December 31 December<br />

<strong>2011</strong> 2010<br />

$’000 $’000<br />

Deferred consideration 10,387 -<br />

10,387 -<br />

(a) Movements in deferred consideration<br />

Movements in deferred consideration<br />

are set out below:<br />

Balance at beginning of the year / period - -<br />

Changes in estimate (41) -<br />

Unwind of discount 911 -<br />

Transfers from non-current balance 9,517 -<br />

Balance at end of the year / period 10,387 -<br />

Refer to Note 25 for further details on deferred consideration.<br />

NOTE 21. BORROWINGS (CURRENT)<br />

31 December 31 December<br />

<strong>2011</strong> 2010<br />

$’000 $’000<br />

Secured<br />

Finance lease liabilities (1) 11,459 9,766<br />

11,459 9,766<br />

Unsecured<br />

Bank loan 10,000 -<br />

Other 588 3,368<br />

10,588 3,368<br />

22,047 13,134<br />

(1) Lease liabilities are secured as the rights to the leased assets<br />

recognised in the financial statements revert to the lessor in the event<br />

of default.<br />

NOTE 23. PROVISIONS (CURRENT)<br />

31 December 31 December<br />

<strong>2011</strong> 2010<br />

$’000 $’000<br />

Employee benefits 4,967 2,980<br />

Decommissioning and restoration 235 228<br />

5,202 3,208<br />

Movements in each class of provision, other<br />

than employee benefits, are set out below:<br />

(a) Movements in decommissioning<br />

and restoration provision<br />

Balance at beginning of the year / period 228 410<br />

Changes in estimate 131 (182)<br />

Transfers to non-current provisions (124) -<br />

Balance at the end of the year / period 235 228<br />

NOTE 24. BORROWINGS (NON-CURRENT)<br />

31 December 31 December<br />

<strong>2011</strong> 2010<br />

$’000 $’000<br />

Secured<br />

Finance lease liabilities (1) 14,161 25,573<br />

Unsecured<br />

Other 8,678 8,287<br />

22,839 33,860<br />

(1) Lease liabilities are secured as the rights to the leased assets<br />

recognised in the financial statements revert to the lessor in the<br />

event of default.<br />

Overview Review Of Operations Corporate Governance