Connect for the Month of March 2007 - Birla Sun Life Mutual Fund

Connect for the Month of March 2007 - Birla Sun Life Mutual Fund

Connect for the Month of March 2007 - Birla Sun Life Mutual Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

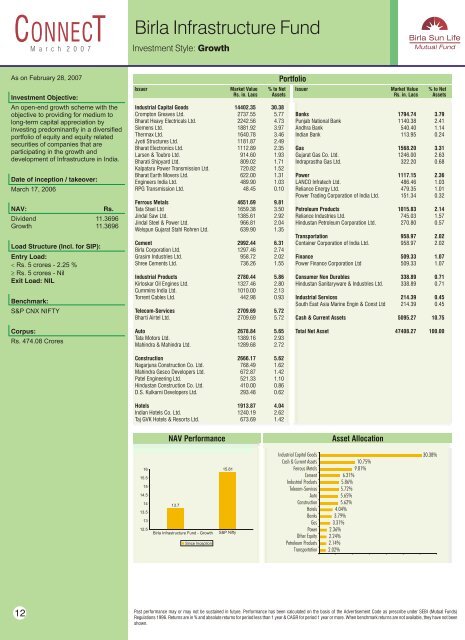

<strong>Birla</strong> Infrastructure <strong>Fund</strong><br />

M a r c h 2 0 0 7<br />

Investment Style: Growth<br />

As on February 28, <strong>2007</strong><br />

Investment Objective:<br />

An open-end growth scheme with <strong>the</strong><br />

objective to providing <strong>for</strong> medium to<br />

long-term capital appreciation by<br />

investing predominantly in a diversified<br />

portfolio <strong>of</strong> equity and equity related<br />

securities <strong>of</strong> companies that are<br />

participating in <strong>the</strong> growth and<br />

development <strong>of</strong> Infrastructure in India.<br />

Date <strong>of</strong> inception / takeover:<br />

<strong>March</strong> 17, 2006<br />

NAV:<br />

Rs.<br />

Dividend 11.3696<br />

Growth 11.3696<br />

Load Structure (Incl. <strong>for</strong> SIP):<br />

Entry Load:<br />

< Rs. 5 crores - 2.25 %<br />

³ Rs. 5 crores - Nil<br />

Exit Load: NIL<br />

Benchmark:<br />

S&P CNX NIFTY<br />

Issuer Market Value % to Net<br />

Rs. in. Lacs Assets<br />

Industrial Capital Goods 14402.35 30.38<br />

Crompton Greaves Ltd. 2737.55 5.77<br />

Bharat Heavy Electricals Ltd. 2242.56 4.73<br />

Siemens Ltd. 1881.92 3.97<br />

Thermax Ltd. 1640.78 3.46<br />

Jyoti Structures Ltd. 1181.87 2.49<br />

Bharat Electronics Ltd. 1112.89 2.35<br />

Larsen & Toubro Ltd. 914.60 1.93<br />

Bharati Shipyard Ltd. 809.02 1.71<br />

Kalpataru Power Transmission Ltd. 720.82 1.52<br />

Bharat Earth Movers Ltd. 622.00 1.31<br />

Engineers India Ltd. 489.90 1.03<br />

RPG Transmission Ltd. 48.45 0.10<br />

Ferrous Metals 4651.69 9.81<br />

Tata Steel Ltd 1659.38 3.50<br />

Jindal Saw Ltd. 1385.61 2.92<br />

Jindal Steel & Power Ltd. 966.81 2.04<br />

Welspun Gujarat Stahl Rohren Ltd. 639.90 1.35<br />

Cement 2992.44 6.31<br />

<strong>Birla</strong> Corporation Ltd. 1297.46 2.74<br />

Grasim Industries Ltd. 958.72 2.02<br />

Shree Cements Ltd. 736.26 1.55<br />

Industrial Products 2780.44 5.86<br />

Kirloskar Oil Engines Ltd. 1327.46 2.80<br />

Cummins India Ltd. 1010.00 2.13<br />

Torrent Cables Ltd. 442.98 0.93<br />

Telecom-Services 2709.69 5.72<br />

Bharti Airtel Ltd. 2709.69 5.72<br />

Portfolio<br />

Issuer Market Value % to Net<br />

Rs. in. Lacs Assets<br />

Banks 1794.74 3.79<br />

Punjab National Bank 1140.38 2.41<br />

Andhra Bank 540.40 1.14<br />

Indian Bank 113.95 0.24<br />

Gas 1568.20 3.31<br />

Gujarat Gas Co. Ltd. 1246.00 2.63<br />

Indraprastha Gas Ltd. 322.20 0.68<br />

Power 1117.15 2.36<br />

LANCO Infratech Ltd. 486.46 1.03<br />

Reliance Energy Ltd. 479.35 1.01<br />

Power Trading Corporation <strong>of</strong> India Ltd. 151.34 0.32<br />

Petroleum Products 1015.83 2.14<br />

Reliance Industries Ltd. 745.03 1.57<br />

Hindustan Petroleum Corporation Ltd. 270.80 0.57<br />

Transportation 958.97 2.02<br />

Container Corporation <strong>of</strong> India Ltd. 958.97 2.02<br />

Finance 509.33 1.07<br />

Power Finance Corporation Ltd 509.33 1.07<br />

Consumer Non Durables 338.89 0.71<br />

Hindustan Sanitaryware & Industries Ltd. 338.89 0.71<br />

Industrial Services 214.39 0.45<br />

South East Asia Marine Engin & Const Ltd 214.39 0.45<br />

Cash & Current Assets 5095.27 10.75<br />

Corpus:<br />

Rs. 474.08 Crores<br />

Auto 2678.84 5.65<br />

Tata Motors Ltd. 1389.16 2.93<br />

Mahindra & Mahindra Ltd. 1289.68 2.72<br />

Construction 2666.17 5.62<br />

Nagarjuna Construction Co. Ltd. 768.49 1.62<br />

Mahindra Gesco Developers Ltd. 672.87 1.42<br />

Patel Engineering Ltd. 521.33 1.10<br />

Hindustan Construction Co. Ltd. 410.00 0.86<br />

D.S. Kulkarni Developers Ltd. 293.48 0.62<br />

Hotels 1913.87 4.04<br />

Indian Hotels Co. Ltd. 1240.19 2.62<br />

Taj GVK Hotels & Resorts Ltd. 673.69 1.42<br />

Total Net Asset 47408.27 100.00<br />

NAV Per<strong>for</strong>mance<br />

Asset Allocation<br />

16<br />

15.5<br />

15<br />

14.5<br />

14<br />

13.5<br />

13<br />

12.5<br />

13.7<br />

<strong>Birla</strong> Infrastructure <strong>Fund</strong> - Growth<br />

Since Inception<br />

15.81<br />

S&P Nifty<br />

Industrial Capital Goods<br />

Cash & Current Assets<br />

Ferrous Metals<br />

Cement<br />

Industrial Products<br />

Telecom-Services<br />

Auto<br />

Construction<br />

Hotels<br />

Banks<br />

Gas<br />

Power<br />

O<strong>the</strong>r Equity<br />

Petroleum Products<br />

Transportation<br />

10.75%<br />

9.81%<br />

6.31%<br />

5.86%<br />

5.72%<br />

5.65%<br />

5.62%<br />

4.04%<br />

3.79%<br />

3.31%<br />

2.36%<br />

2.24%<br />

2.14%<br />

2.02%<br />

30.38%<br />

12<br />

Past per<strong>for</strong>mance may or may not be sustained in future. Per<strong>for</strong>mance has been calculated on <strong>the</strong> basis <strong>of</strong> <strong>the</strong> Advertisement Code as prescribe under SEBI (<strong>Mutual</strong> <strong>Fund</strong>s)<br />

Regulations 1996. Returns are in % and absolute returns <strong>for</strong> period less than 1 year & CAGR <strong>for</strong> period 1 year or more. When benchmark returns are not available, <strong>the</strong>y have not been<br />

shown.