Connect for the Month of March 2007 - Birla Sun Life Mutual Fund

Connect for the Month of March 2007 - Birla Sun Life Mutual Fund

Connect for the Month of March 2007 - Birla Sun Life Mutual Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

M a r c h 2 0 0 7<br />

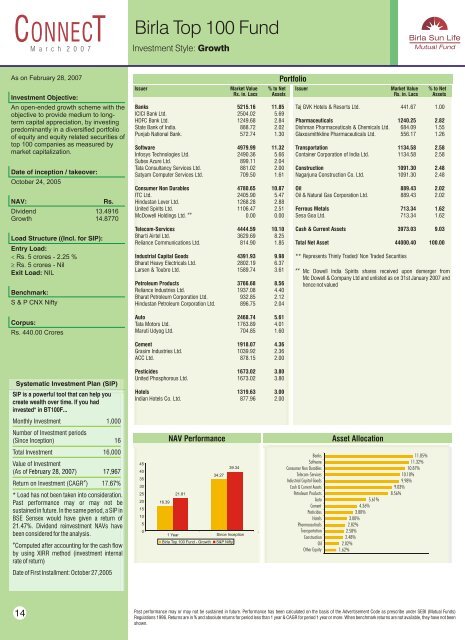

<strong>Birla</strong> Top 100 <strong>Fund</strong><br />

Investment Style: Growth<br />

As on February 28, <strong>2007</strong><br />

Investment Objective:<br />

An open-ended growth scheme with <strong>the</strong><br />

objective to provide medium to longterm<br />

capital appreciation, by investing<br />

predominantly in a diversified portfolio<br />

<strong>of</strong> equity and equity related securities <strong>of</strong><br />

top 100 companies as measured by<br />

market capitalization.<br />

Date <strong>of</strong> inception / takeover:<br />

October 24, 2005<br />

NAV:<br />

Rs.<br />

Dividend 13.4916<br />

Growth 14.8770<br />

Load Structure ((Incl. <strong>for</strong> SIP):<br />

Entry Load:<br />

< Rs. 5 crores - 2.25 %<br />

³ Rs. 5 crores - Nil<br />

Exit Load: NIL<br />

Benchmark:<br />

S & P CNX Nifty<br />

Corpus:<br />

Rs. 440.00 Crores<br />

Issuer Market Value % to Net<br />

Rs. in. Lacs Assets<br />

Banks 5215.16 11.85<br />

ICICI Bank Ltd. 2504.02 5.69<br />

HDFC Bank Ltd. 1249.68 2.84<br />

State Bank <strong>of</strong> India. 888.72 2.02<br />

Punjab National Bank. 572.74 1.30<br />

S<strong>of</strong>tware 4979.99 11.32<br />

Infosys Technologies Ltd. 2490.36 5.66<br />

Subex Azure Ltd. 899.11 2.04<br />

Tata Consultancy Services Ltd. 881.02 2.00<br />

Satyam Computer Services Ltd. 709.50 1.61<br />

Consumer Non Durables 4780.65 10.87<br />

ITC Ltd. 2405.90 5.47<br />

Hindustan Lever Ltd. 1268.28 2.88<br />

United Spirits Ltd. 1106.47 2.51<br />

##<br />

McDowell Holdings Ltd. 0.00 0.00<br />

Telecom-Services 4444.59 10.10<br />

Bharti Airtel Ltd. 3629.69 8.25<br />

Reliance Communications Ltd. 814.90 1.85<br />

Industrial Capital Goods 4391.93 9.98<br />

Bharat Heavy Electricals Ltd. 2802.19 6.37<br />

Larsen & Toubro Ltd. 1589.74 3.61<br />

Petroleum Products 3766.68 8.56<br />

Reliance Industries Ltd. 1937.08 4.40<br />

Bharat Petroleum Corporation Ltd. 932.85 2.12<br />

Hindustan Petroleum Corporation Ltd. 896.75 2.04<br />

Auto 2468.74 5.61<br />

Tata Motors Ltd. 1763.89 4.01<br />

Maruti Udyog Ltd. 704.85 1.60<br />

Portfolio<br />

Issuer Market Value % to Net<br />

Rs. in. Lacs Assets<br />

Taj GVK Hotels & Resorts Ltd. 441.67 1.00<br />

Pharmaceuticals 1240.25 2.82<br />

Dishman Pharmaceuticals & Chemicals Ltd. 684.09 1.55<br />

Glaxosmithkline Pharmaceuticals Ltd. 556.17 1.26<br />

Transportation 1134.58 2.58<br />

Container Corporation <strong>of</strong> India Ltd. 1134.58 2.58<br />

Construction 1091.30 2.48<br />

Nagarjuna Construction Co. Ltd. 1091.30 2.48<br />

Oil 889.43 2.02<br />

Oil & Natural Gas Corporation Ltd. 889.43 2.02<br />

Ferrous Metals 713.34 1.62<br />

Sesa Goa Ltd. 713.34 1.62<br />

Cash & Current Assets 3973.03 9.03<br />

Total Net Asset 44000.40 100.00<br />

** Represents Thinly Traded/ Non Traded Securities<br />

##<br />

Mc Dowell India Spirits shares received upon demerger from<br />

Mc Dowell & Company Ltd and unlisted as on 31st January <strong>2007</strong> and<br />

hence not valued<br />

Cement 1918.07 4.36<br />

Grasim Industries Ltd. 1039.92 2.36<br />

ACC Ltd. 878.15 2.00<br />

Systematic Investment Plan (SIP)<br />

SIP is a powerful tool that can help you<br />

create wealth over time. If you had<br />

invested* in BT100F...<br />

Pesticides 1673.02 3.80<br />

United Phosphorous Ltd. 1673.02 3.80<br />

Hotels 1319.63 3.00<br />

Indian Hotels Co. Ltd. 877.96 2.00<br />

<strong>Month</strong>ly Investment 1,000<br />

Number <strong>of</strong> Investment periods<br />

(Since Inception) 16<br />

NAV Per<strong>for</strong>mance<br />

Asset Allocation<br />

Total Investment 16,000<br />

Value <strong>of</strong> Investment<br />

(As <strong>of</strong> February 28, <strong>2007</strong> ) 17,967<br />

.67<br />

#<br />

Return on Investment (CAGR ) 17 %<br />

* Load has not been taken into consideration.<br />

Past per<strong>for</strong>mance may or may not be<br />

sustained in future. In <strong>the</strong> same period, a SIP in<br />

BSE Sensex would have given a return <strong>of</strong><br />

21.47%. Dividend reinvestment NAVs have<br />

been considered <strong>for</strong> <strong>the</strong> analysis.<br />

#<br />

Computed after accounting <strong>for</strong> <strong>the</strong> cash flow<br />

by using XIRR method (investment internal<br />

rate <strong>of</strong> return)<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

16.39<br />

21.81<br />

34.27<br />

39.34<br />

1 Year Since Inception<br />

<strong>Birla</strong> Top 100 <strong>Fund</strong> - Growth<br />

S&P Nifty<br />

Banks<br />

S<strong>of</strong>tware<br />

Consumer Non Durables<br />

Telecom-Services<br />

Industrial Capital Goods<br />

Cash & Current Assets<br />

Petroleum Products<br />

Auto<br />

Cement<br />

Pesticides<br />

Hotels<br />

Pharmaceuticals<br />

Transportation<br />

Construction<br />

Oil<br />

O<strong>the</strong>r Equity<br />

5.61%<br />

4.36%<br />

3.80%<br />

3.00%<br />

2.82%<br />

2.58%<br />

2.48%<br />

2.02%<br />

1.62%<br />

11.85%<br />

11.32%<br />

10.87%<br />

10.10%<br />

9.98%<br />

9.03%<br />

8.56%<br />

Date <strong>of</strong> First Installment: October 27,2005<br />

14<br />

Past per<strong>for</strong>mance may or may not be sustained in future. Per<strong>for</strong>mance has been calculated on <strong>the</strong> basis <strong>of</strong> <strong>the</strong> Advertisement Code as prescribe under SEBI (<strong>Mutual</strong> <strong>Fund</strong>s)<br />

Regulations 1996. Returns are in % and absolute returns <strong>for</strong> period less than 1 year & CAGR <strong>for</strong> period 1 year or more. When benchmark returns are not available, <strong>the</strong>y have not been<br />

shown.