Connect for the Month of March 2007 - Birla Sun Life Mutual Fund

Connect for the Month of March 2007 - Birla Sun Life Mutual Fund

Connect for the Month of March 2007 - Birla Sun Life Mutual Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

M a r c h 2 0 0 7<br />

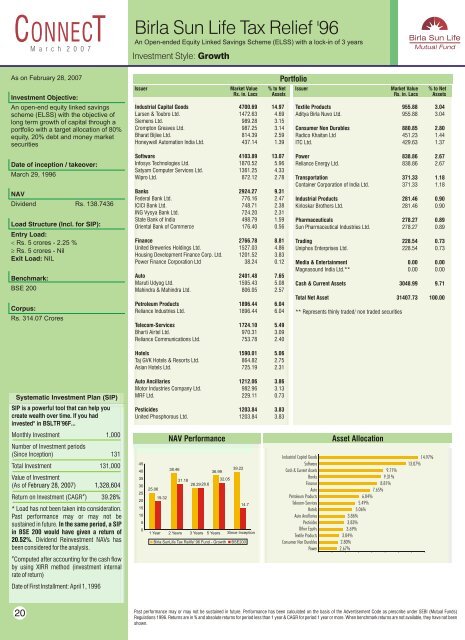

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Tax Relief '96<br />

An Open-ended Equity Linked Savings Scheme (ELSS) with a lock-in <strong>of</strong> 3 years<br />

Investment Style: Growth<br />

As on February 28, <strong>2007</strong><br />

Investment Objective:<br />

An open-end equity linked savings<br />

scheme (ELSS) with <strong>the</strong> objective <strong>of</strong><br />

long term growth <strong>of</strong> capital through a<br />

portfolio with a target allocation <strong>of</strong> 80%<br />

equity, 20% debt and money market<br />

securities<br />

Date <strong>of</strong> inception / takeover:<br />

<strong>March</strong> 29, 1996<br />

NAV<br />

Dividend Rs. 138.7436<br />

Load Structure (Incl. <strong>for</strong> SIP):<br />

Entry Load:<br />

< Rs. 5 crores - 2.25 %<br />

³ Rs. 5 crores - Nil<br />

Exit Load: NIL<br />

Benchmark:<br />

BSE 200<br />

Corpus:<br />

Rs. 314.07 Crores<br />

Issuer Market Value % to Net<br />

Rs. in. Lacs Assets<br />

Industrial Capital Goods 4700.69 14.97<br />

Larsen & Toubro Ltd. 1472.63 4.69<br />

Siemens Ltd. 989.28 3.15<br />

Crompton Greaves Ltd. 987.25 3.14<br />

Bharat Bijlee Ltd. 814.39 2.59<br />

Honeywell Automation India Ltd. 437.14 1.39<br />

S<strong>of</strong>tware 4103.89 13.07<br />

Infosys Technologies Ltd. 1870.52 5.96<br />

Satyam Computer Services Ltd. 1361.25 4.33<br />

Wipro Ltd. 872.12 2.78<br />

Banks 2924.27 9.31<br />

Federal Bank Ltd. 776.16 2.47<br />

ICICI Bank Ltd. 748.71 2.38<br />

ING Vysya Bank Ltd. 724.20 2.31<br />

State Bank <strong>of</strong> India 498.79 1.59<br />

Oriental Bank <strong>of</strong> Commerce 176.40 0.56<br />

Finance 2766.78 8.81<br />

United Breweries Holdings Ltd. 1527.03 4.86<br />

Housing Development Finance Corp. Ltd. 1201.52 3.83<br />

Power Finance Corporation Ltd 38.24 0.12<br />

Auto 2401.48 7.65<br />

Maruti Udyog Ltd. 1595.43 5.08<br />

Mahindra & Mahindra Ltd. 806.05 2.57<br />

Petroleum Products 1896.44 6.04<br />

Reliance Industries Ltd. 1896.44 6.04<br />

Telecom-Services 1724.10 5.49<br />

Bharti Airtel Ltd. 970.31 3.09<br />

Reliance Communications Ltd. 753.78 2.40<br />

Portfolio<br />

Issuer Market Value % to Net<br />

Rs. in. Lacs Assets<br />

Textile Products 955.88 3.04<br />

Aditya <strong>Birla</strong> Nuvo Ltd. 955.88 3.04<br />

Consumer Non Durables 880.85 2.80<br />

Radico Khaitan Ltd 451.23 1.44<br />

ITC Ltd. 429.63 1.37<br />

Power 838.86 2.67<br />

Reliance Energy Ltd. 838.86 2.67<br />

Transportation 371.33 1.18<br />

Container Corporation <strong>of</strong> India Ltd. 371.33 1.18<br />

Industrial Products 281.46 0.90<br />

Kirloskar Bro<strong>the</strong>rs Ltd. 281.46 0.90<br />

Pharmaceuticals 278.27 0.89<br />

<strong>Sun</strong> Pharmaceutical Industries Ltd. 278.27 0.89<br />

Trading 228.54 0.73<br />

Uniphos Enterprises Ltd. 228.54 0.73<br />

Media & Entertainment 0.00 0.00<br />

Magnasound India Ltd.** 0.00 0.00<br />

Cash & Current Assets 3048.99 9.71<br />

Total Net Asset 31407.73 100.00<br />

** Represents thinly traded/ non traded securities<br />

Hotels 1590.01 5.06<br />

Taj GVK Hotels & Resorts Ltd. 864.82 2.75<br />

Asian Hotels Ltd. 725.19 2.31<br />

Systematic Investment Plan (SIP)<br />

SIP is a powerful tool that can help you<br />

create wealth over time. If you had<br />

invested* in BSLTR’96F...<br />

Auto Ancillaries 1212.06 3.86<br />

Motor Industries Company Ltd. 982.96 3.13<br />

MRF Ltd. 229.11 0.73<br />

Pesticides 1203.84 3.83<br />

United Phosphorous Ltd. 1203.84 3.83<br />

<strong>Month</strong>ly Investment 1,000<br />

Number <strong>of</strong> Investment periods<br />

(Since Inception) 131<br />

Total Investment 131,000<br />

Value <strong>of</strong> Investment<br />

(As <strong>of</strong> February 28, <strong>2007</strong>)<br />

1,328,604<br />

.28<br />

#<br />

Return on Investment (CAGR ) 39 %<br />

* Load has not been taken into consideration.<br />

Past per<strong>for</strong>mance may or may not be<br />

sustained in future. In <strong>the</strong> same period, a SIP<br />

in BSE 200 would have given a return <strong>of</strong><br />

20.52%. Dividend Reinvestment NAVs has<br />

been considered <strong>for</strong> <strong>the</strong> analysis.<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

25.06<br />

19.32<br />

NAV Per<strong>for</strong>mance<br />

38.46<br />

31.18<br />

28.29 28.6<br />

36.99<br />

32.05<br />

39.22<br />

14.7<br />

1 Year 2 Years 3 Years 5 Years Since Inception<br />

<strong>Birla</strong> <strong>Sun</strong><strong>Life</strong> Tax Relife' 96 <strong>Fund</strong> - Growth<br />

BSE200<br />

Industrial Capital Goods<br />

S<strong>of</strong>tware<br />

Cash & Current Assets<br />

Banks<br />

Finance<br />

Auto<br />

Petroleum Products<br />

Telecom-Services<br />

Hotels<br />

Auto Ancillaries<br />

Pesticides<br />

O<strong>the</strong>r Equity<br />

Textile Products<br />

Consumer Non Durables<br />

Power<br />

Asset Allocation<br />

9.71%<br />

9.31%<br />

8.81%<br />

7.65%<br />

6.04%<br />

5.49%<br />

5.06%<br />

3.86%<br />

3.83%<br />

3.69%<br />

3.04%<br />

2.80%<br />

2.67%<br />

14.97%<br />

13.07%<br />

#<br />

Computed after accounting <strong>for</strong> <strong>the</strong> cash flow<br />

by using XIRR method (investment internal<br />

rate <strong>of</strong> return)<br />

Date <strong>of</strong> First Installment: April 1, 1996<br />

20<br />

Past per<strong>for</strong>mance may or may not be sustained in future. Per<strong>for</strong>mance has been calculated on <strong>the</strong> basis <strong>of</strong> <strong>the</strong> Advertisement Code as prescribe under SEBI (<strong>Mutual</strong> <strong>Fund</strong>s)<br />

Regulations 1996. Returns are in % and absolute returns <strong>for</strong> period less than 1 year & CAGR <strong>for</strong> period 1 year or more. When benchmark returns are not available, <strong>the</strong>y have not been<br />

shown.