Connect for the Month of March 2007 - Birla Sun Life Mutual Fund

Connect for the Month of March 2007 - Birla Sun Life Mutual Fund

Connect for the Month of March 2007 - Birla Sun Life Mutual Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

M a r c h 2 0 0 7<br />

India Advantage <strong>Fund</strong> Ltd.<br />

(For Non-Resident Indians and Eligible Foreign Nationals)<br />

As on February 28, <strong>2007</strong><br />

Investment Objective:<br />

An Open-ended growth scheme with<br />

<strong>the</strong> objective <strong>of</strong> long-term appreciation<br />

through investment primarily in equity<br />

related securities <strong>of</strong> companies in India<br />

that are run by efficient management,<br />

have a sustainable and robust business<br />

model and are available at reasonable<br />

valuations.<br />

Date <strong>of</strong> inception / takeover:<br />

August 8, 1996<br />

NAV:<br />

$ per Class C Share : 163.56<br />

Conversion Rate:<br />

1USD = INR 44.31<br />

Benchmark:<br />

BSE Sensex and MSCI (India)<br />

AUM:<br />

USD 151.17 Million<br />

Bloomberg Ticker Code:<br />

INDADVC MP<br />

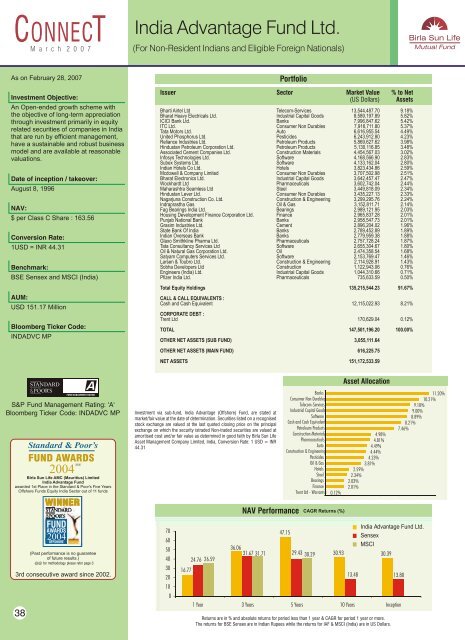

Portfolio<br />

Issuer Sector Market Value % to Net<br />

(US Dollars) Assets<br />

Bharti Airtel Ltd Telecom-Services 13,544,487.70 9.18%<br />

Bharat Heavy Electricals Ltd. Industrial Capital Goods 8,589,197.89 5.82%<br />

ICICI Bank Ltd. Banks 7,996,847.62 5.42%<br />

ITC Ltd. Consumer Non Durables 7,916,711.80 5.37%<br />

Tata Motors Ltd. Auto 6,616,955.54 4.49%<br />

United Phosphorus Ltd. Pesticides 6,243,912.80 4.23%<br />

Reliance Industries Ltd. Petroleum Products 5,869,627.62 3.98%<br />

Hindustan Petroleum Corporation Ltd. Petroleum Products 5,130,116.85 3.48%<br />

Associated Cement Companies Ltd. Construction Materials 4,454,567.03 3.02%<br />

Infosys Technologies Ltd. S<strong>of</strong>tware 4,168,566.90 2.83%<br />

Subex Systems Ltd. S<strong>of</strong>tware 4,133,162.04 2.80%<br />

Indian Hotels Co Ltd. Hotels 3,823,434.86 2.59%<br />

Mcdowell & Company Limited Consumer Non Durables 3,707,502.98 2.51%<br />

Bharat Electronics Ltd. Industrial Capital Goods 3,642,457.47 2.47%<br />

Wockhardt Ltd Pharmaceuticals 3,602,742.04 2.44%<br />

Maharashtra Seamless Ltd Steel 3,449,818.09 2.34%<br />

Hindustan Lever Ltd. Consumer Non Durables 3,435,227.13 2.33%<br />

Nagarjuna Construction Co. Ltd. Construction & Engineering 3,299,295.76 2.24%<br />

Indraprastha Gas Oil & Gas 3,152,811.71 2.14%<br />

Fag Bearings India Ltd. Bearings 2,989,121.95 2.03%<br />

Housing Development Finance Corporation Ltd. Finance 2,965,837.28 2.01%<br />

Punjab National Bank Banks 2,958,547.73 2.01%<br />

Grasim Industries Ltd. Cement 2,896,204.02 1.96%<br />

State Bank Of India Banks 2,789,452.89 1.89%<br />

Indian Overseas Bank Banks 2,779,959.38 1.88%<br />

Glaxo Smithkline Pharma Ltd. Pharmaceuticals 2,757,728.24 1.87%<br />

Tata Consultancy Services Ltd S<strong>of</strong>tware 2,655,304.67 1.80%<br />

Oil & Natural Gas Corporation Ltd. Oil 2,474,358.54 1.68%<br />

Satyam Computers Services Ltd. S<strong>of</strong>tware 2,153,769.47 1.46%<br />

Larsen & Toubro Ltd. Construction & Engineering 2,114,928.91 1.43%<br />

Sobha Developers Ltd Construction 1,122,943.06 0.76%<br />

Engineers (India) Ltd. Industrial Capital Goods 1,044,310.66 0.71%<br />

Pfizer India Ltd. Pharmaceuticals 735,633.59 0.50%<br />

Total Equity Holdings 135,215,544.23 91.67%<br />

CALL & CALL EQUIVALENTS :<br />

Cash and Cash Equivalent 12,115,022.93 8.21%<br />

CORPORATE DEBT :<br />

Trent Ltd 170,629.04 0.12%<br />

TOTAL 147,501,196.20 100.00%<br />

OTHER NET ASSETS (SUB FUND) 3,055,111.64<br />

OTHER NET ASSETS (MAIN FUND) 616,225.75<br />

NET ASSETS 151,172,533.59<br />

Asset Allocation<br />

@@<br />

2004<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> AMC (Mauritius) Limited<br />

India Advantage <strong>Fund</strong><br />

awarded 1st Place in <strong>the</strong> Standard & Poor's Five Years<br />

Offshore <strong>Fund</strong>s Equity India Sector out <strong>of</strong> 11 funds<br />

Investment via sub-fund, India Advantage (Offshore) <strong>Fund</strong>, are stated at<br />

market/fair value at <strong>the</strong> date <strong>of</strong> determination. Securities listed on a recognised<br />

stock exchange are valued at <strong>the</strong> last quoted closing price on <strong>the</strong> principal<br />

exchange on which <strong>the</strong> security istraded Non-traded securities are valued at<br />

amortised cost and/or fair value as determined in good faith by <strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong><br />

Asset Management Company Limited, India, Conversion Rate: 1 USD = INR<br />

44.31<br />

Banks<br />

Consumer Non Durables<br />

Telecom-Services<br />

Industrial Capital Goods<br />

S<strong>of</strong>tware<br />

Cash and Cash Equivalent<br />

Petroleum Products<br />

Construction Materials<br />

Pharmaceuticals<br />

Auto<br />

Construction & Engineering<br />

Pesticides<br />

Oil & Gas<br />

Hotels<br />

Steel<br />

Bearings<br />

Finance<br />

Trent Ltd - Warrants<br />

0.12%<br />

4.98%<br />

4.81%<br />

4.49%<br />

4.44%<br />

4.23%<br />

3.81%<br />

2.59%<br />

2.34%<br />

2.03%<br />

2.01%<br />

11.20%<br />

10.21%<br />

9.18%<br />

9.00%<br />

8.89%<br />

8.21%<br />

7.46%<br />

38<br />

2004<br />

(Past per<strong>for</strong>mance is no guarantee<br />

<strong>of</strong> future results.)<br />

@@ <strong>for</strong> methodology please refer page 3<br />

3rd consecutive award since 2002.<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

16.77<br />

24.76 26.59<br />

NAV Per<strong>for</strong>mance CAGR Returns (%)<br />

47.15<br />

36.06<br />

31.67 31.71 29.43 30.29<br />

India Advantage <strong>Fund</strong> Ltd.<br />

Sensex<br />

MSCI<br />

30.93 30.39<br />

13.48 13.80<br />

1 Year 3 Years 5 Years 10 Years Inception<br />

Returns are in % and absolute returns <strong>for</strong> period less than 1 year & CAGR <strong>for</strong> period 1 year or more.<br />

The returns <strong>for</strong> BSE Sensex are in Indian Rupees while <strong>the</strong> returns <strong>for</strong> IAF & MSCI (India) are in US Dollars.