Connect for the Month of March 2007 - Birla Sun Life Mutual Fund

Connect for the Month of March 2007 - Birla Sun Life Mutual Fund

Connect for the Month of March 2007 - Birla Sun Life Mutual Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

As on February 28, <strong>2007</strong><br />

Investment Objective:<br />

An open-end income scheme with <strong>the</strong><br />

primary objective to generate regular<br />

income so as to make monthly and<br />

quarterly distributions to Unitholders<br />

and <strong>the</strong> secondary objective as growth<br />

<strong>of</strong> capital. <strong>Month</strong>ly income is not<br />

assured and is subject to availability <strong>of</strong><br />

distributable surplus.<br />

Date <strong>of</strong> inception / takeover:<br />

July 14, 1999<br />

NAV:<br />

Rs.<br />

Dividend 10.6311<br />

Growth 25.0732<br />

Quarterly Dividend 11.1508<br />

Load Structure (Incl. <strong>for</strong> SIP):<br />

Entry Load: NIL<br />

Exit Load: For redemption / switch<br />

out <strong>of</strong> units within 12 months from <strong>the</strong><br />

date <strong>of</strong> allotment: 1%<br />

Benchmark:<br />

M a r c h 2 0 0 7<br />

CRISIL MIP Blended Index<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> <strong>Month</strong>ly Income<br />

An open- ended fund. <strong>Month</strong>ly income is not assured and is subject to availability <strong>of</strong> distributable surplus<br />

Investment Style: (Equity) Value + Growth<br />

Interest Rate Sensitivity: (Debt) Medium<br />

Issuer Market Value % to Net Rating<br />

Rs. in. Lacs Assets<br />

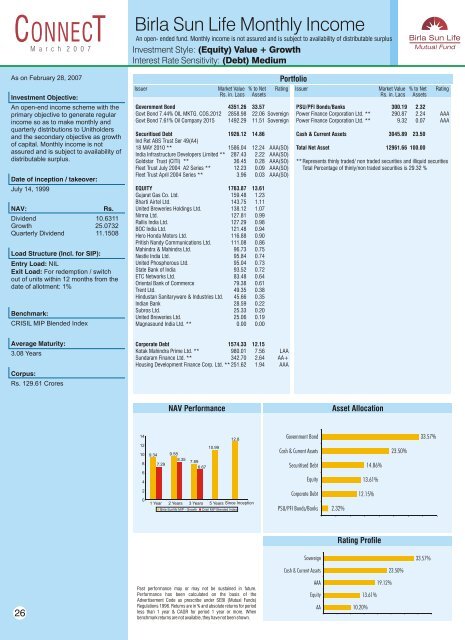

Government Bond 4351.26 33.57<br />

Govt Bond 7.44% OIL MKTG. COS.2012 2858.98 22.06 Sovereign<br />

Govt Bond 7.61% Oil Company 2015 1492.29 11.51 Sovereign<br />

Securitised Debt 1926.12 14.86<br />

Ind Ret ABS Trust Ser 49(A4)<br />

18 MAY 2010 ** 1586.04 12.24 AAA(SO)<br />

India Infrastructure Developers Limited ** 287.43 2.22 AAA(SO)<br />

Goldstar Trust (CITI) ** 36.45 0.28 AAA(SO)<br />

Fleet Trust July 2004 A2 Series ** 12.23 0.09 AAA(SO)<br />

Fleet Trust April 2004 Series ** 3.96 0.03 AAA(SO)<br />

EQUITY 1763.87 13.61<br />

Gujarat Gas Co. Ltd. 159.48 1.23<br />

Bharti Airtel Ltd. 143.75 1.11<br />

United Breweries Holdings Ltd. 138.12 1.07<br />

Nirma Ltd. 127.81 0.99<br />

Rallis India Ltd. 127.29 0.98<br />

BOC India Ltd. 121.48 0.94<br />

Hero Honda Motors Ltd. 116.88 0.90<br />

Pritish Nandy Communications Ltd. 111.08 0.86<br />

Mahindra & Mahindra Ltd. 96.73 0.75<br />

Nestle India Ltd. 95.84 0.74<br />

United Phosphorous Ltd. 95.04 0.73<br />

State Bank <strong>of</strong> India 93.52 0.72<br />

ETC Networks Ltd. 83.48 0.64<br />

Oriental Bank <strong>of</strong> Commerce 79.38 0.61<br />

Trent Ltd. 49.35 0.38<br />

Hindustan Sanitaryware & Industries Ltd. 45.66 0.35<br />

Indian Bank 28.59 0.22<br />

Subros Ltd. 25.33 0.20<br />

United Breweries Ltd. 25.06 0.19<br />

Magnasound India Ltd. ** 0.00 0.00<br />

Portfolio<br />

Issuer Market Value % to Net Rating<br />

Rs. in. Lacs Assets<br />

PSU/PFI Bonds/Banks 300.19 2.32<br />

Power Finance Corporation Ltd. ** 290.87 2.24 AAA<br />

Power Finance Corporation Ltd. ** 9.32 0.07 AAA<br />

Cash & Current Assets 3045.89 23.50<br />

Total Net Asset 12961.66 100.00<br />

**Represents thinly traded/ non traded securities and illiquid securities<br />

Total Percentage <strong>of</strong> thinly/non traded securities is 29.32 %<br />

Average Maturity:<br />

3.08 Years<br />

Corpus:<br />

Rs. 129.61 Crores<br />

Corporate Debt 1574.33 12.15<br />

Kotak Mahindra Prime Ltd. ** 980.01 7.56 LAA<br />

<strong>Sun</strong>daram Finance Ltd. ** 342.70 2.64 AA+<br />

Housing Development Finance Corp. Ltd. ** 251.62 1.94 AAA<br />

NAV Per<strong>for</strong>mance<br />

Asset Allocation<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

9.34 9.58<br />

8.35<br />

7.29<br />

7.89<br />

6.67<br />

10.99<br />

12.8<br />

Government Bond<br />

Cash & Current Assets<br />

Securitised Debt<br />

Equity<br />

14.86%<br />

13.61%<br />

23.50%<br />

33.57%<br />

2<br />

0<br />

1 Year 2 Years 3 Years 5 Years Since Inception<br />

<strong>Birla</strong> <strong>Sun</strong>life MIP - Growth<br />

Crisil MIP Blended Index<br />

Corporate Debt<br />

PSU/PFI Bonds/Banks<br />

2.32%<br />

12.15%<br />

Rating Pr<strong>of</strong>ile<br />

Sovereign<br />

33.57%<br />

Cash & Current Assets<br />

23.50%<br />

26<br />

Past per<strong>for</strong>mance may or may not be sustained in future.<br />

Per<strong>for</strong>mance has been calculated on <strong>the</strong> basis <strong>of</strong> <strong>the</strong><br />

Advertisement Code as prescribe under SEBI (<strong>Mutual</strong> <strong>Fund</strong>s)<br />

Regulations 1996. Returns are in % and absolute returns <strong>for</strong> period<br />

less than 1 year & CAGR <strong>for</strong> period 1 year or more. When<br />

benchmark returns are not available, <strong>the</strong>y have not been shown.<br />

AAA<br />

Equity<br />

AA<br />

19.12%<br />

13.61%<br />

10.20%