Connect for the Month of March 2007 - Birla Sun Life Mutual Fund

Connect for the Month of March 2007 - Birla Sun Life Mutual Fund

Connect for the Month of March 2007 - Birla Sun Life Mutual Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

M a r c h 2 0 0 7<br />

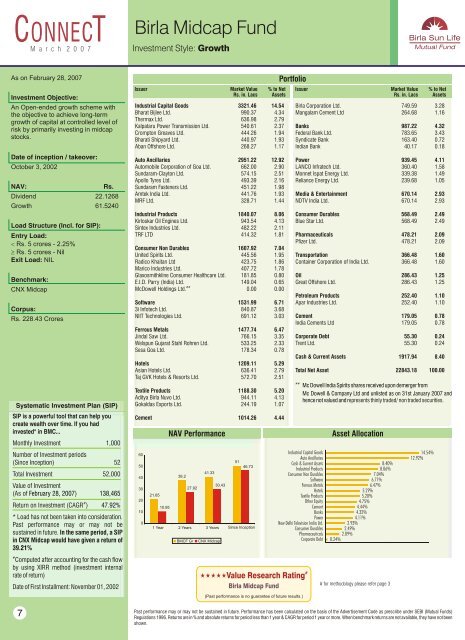

<strong>Birla</strong> Midcap <strong>Fund</strong><br />

Investment Style: Growth<br />

As on February 28, <strong>2007</strong><br />

Investment Objective:<br />

An Open-ended growth scheme with<br />

<strong>the</strong> objective to achieve long-term<br />

growth <strong>of</strong> capital at controlled level <strong>of</strong><br />

risk by primarily investing in midcap<br />

stocks.<br />

Date <strong>of</strong> inception / takeover:<br />

October 3, 2002<br />

NAV:<br />

Rs.<br />

Dividend 22.1268<br />

Growth 61.5240<br />

Load Structure (Incl. <strong>for</strong> SIP):<br />

Entry Load:<br />

< Rs. 5 crores - 2.25%<br />

³ Rs. 5 crores - Nil<br />

Exit Load: NIL<br />

Benchmark:<br />

CNX Midcap<br />

Corpus:<br />

Rs. 228.43 Crores<br />

Systematic Investment Plan (SIP)<br />

SIP is a powerful tool that can help you<br />

create wealth over time. If you had<br />

invested* in BMC...<br />

<strong>Month</strong>ly Investment 1,000<br />

Number <strong>of</strong> Investment periods<br />

(Since Inception) 52<br />

Total Investment 52,000<br />

Value <strong>of</strong> Investment<br />

(As <strong>of</strong> February 28, <strong>2007</strong> ) 138,465<br />

7<br />

47.92<br />

#<br />

Return on Investment (CAGR ) %<br />

* Load has not been taken into consideration.<br />

Past per<strong>for</strong>mance may or may not be<br />

sustained in future. In <strong>the</strong> same period, a SIP<br />

in CNX Midcap would have given a return <strong>of</strong><br />

39 .21%<br />

#<br />

Computed after accounting <strong>for</strong> <strong>the</strong> cash flow<br />

by using XIRR method (investment internal<br />

rate <strong>of</strong> return)<br />

Date <strong>of</strong> First Installment: November 01, 2002<br />

Issuer Market Value % to Net<br />

Rs. in. Lacs Assets<br />

Industrial Capital Goods 3321.46 14.54<br />

Bharat Bijlee Ltd. 990.37 4.34<br />

Thermax Ltd. 636.98 2.79<br />

Kalpataru Power Transmission Ltd. 540.61 2.37<br />

Crompton Greaves Ltd. 444.26 1.94<br />

Bharati Shipyard Ltd. 440.97 1.93<br />

Aban Offshore Ltd. 268.27 1.17<br />

Auto Ancillaries 2951.22 12.92<br />

Automobile Corporation <strong>of</strong> Goa Ltd. 662.00 2.90<br />

<strong>Sun</strong>daram-Clayton Ltd. 574.15 2.51<br />

Apollo Tyres Ltd. 493.39 2.16<br />

<strong>Sun</strong>daram Fasteners Ltd. 451.22 1.98<br />

Amtek India Ltd. 441.76 1.93<br />

MRF Ltd. 328.71 1.44<br />

Industrial Products 1840.07 8.06<br />

Kirloskar Oil Engines Ltd. 943.54 4.13<br />

Sintex Industries Ltd. 482.22 2.11<br />

TRF LTD 414.32 1.81<br />

Consumer Non Durables 1607.92 7.04<br />

United Spirits Ltd. 445.56 1.95<br />

Radico Khaitan Ltd 423.75 1.86<br />

Marico Industries Ltd. 407.72 1.78<br />

Glaxosmithkline Consumer Healthcare Ltd. 181.85 0.80<br />

E.I.D. Parry (India) Ltd. 149.04 0.65<br />

##<br />

McDowell Holdings Ltd. 0.00 0.00<br />

S<strong>of</strong>tware 1531.99 6.71<br />

3i Infotech Ltd. 840.87 3.68<br />

NIIT Technologies Ltd. 691.12 3.03<br />

Ferrous Metals 1477.74 6.47<br />

Jindal Saw Ltd. 766.15 3.35<br />

Welspun Gujarat Stahl Rohren Ltd. 533.25 2.33<br />

Sesa Goa Ltd. 178.34 0.78<br />

Hotels 1209.11 5.29<br />

Asian Hotels Ltd. 636.41 2.79<br />

Taj GVK Hotels & Resorts Ltd. 572.70 2.51<br />

Textile Products 1188.30 5.20<br />

Aditya <strong>Birla</strong> Nuvo Ltd. 944.11 4.13<br />

Gokaldas Exports Ltd. 244.19 1.07<br />

Cement 1014.26 4.44<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

21.65<br />

10.95<br />

NAV Per<strong>for</strong>mance<br />

38.2<br />

27.92<br />

BMCF Gr<br />

41.33<br />

CNX Midcap<br />

30.43<br />

51<br />

46.73<br />

1 Year 2 Years 3 Years Since Inception<br />

Portfolio<br />

#<br />

Value Research Rating<br />

<strong>Birla</strong> Midcap <strong>Fund</strong><br />

(Past per<strong>for</strong>mance is no guarantee <strong>of</strong> future results.)<br />

Issuer Market Value % to Net<br />

Rs. in. Lacs Assets<br />

<strong>Birla</strong> Corporation Ltd. 749.59 3.28<br />

Mangalam Cement Ltd 264.68 1.16<br />

Banks 987.22 4.32<br />

Federal Bank Ltd. 783.65 3.43<br />

Syndicate Bank 163.40 0.72<br />

Indian Bank 40.17 0.18<br />

Power 939.45 4.11<br />

LANCO Infratech Ltd. 360.40 1.58<br />

Monnet Ispat Energy Ltd. 339.38 1.49<br />

Reliance Energy Ltd. 239.68 1.05<br />

Media & Entertainment 670.14 2.93<br />

NDTV India Ltd. 670.14 2.93<br />

Consumer Durables 568.49 2.49<br />

Blue Star Ltd. 568.49 2.49<br />

Pharmaceuticals 478.21 2.09<br />

Pfizer Ltd. 478.21 2.09<br />

Transportation 366.48 1.60<br />

Container Corporation <strong>of</strong> India Ltd. 366.48 1.60<br />

Oil 286.43 1.25<br />

Great Offshore Ltd. 286.43 1.25<br />

Petroleum Products 252.40 1.10<br />

Apar Industries Ltd. 252.40 1.10<br />

Cement 179.05 0.78<br />

India Cements Ltd 179.05 0.78<br />

Corporate Debt 55.30 0.24<br />

Trent Ltd. 55.30 0.24<br />

Cash & Current Assets 1917.94 8.40<br />

Total Net Asset 22843.18 100.00<br />

##<br />

Industrial Capital Goods<br />

Auto Ancillaries<br />

Cash & Current Assets<br />

Industrial Products<br />

Consumer Non Durables<br />

S<strong>of</strong>tware<br />

Ferrous Metals<br />

Hotels<br />

Textile Products<br />

O<strong>the</strong>r Equity<br />

Cement<br />

Banks<br />

Power<br />

New Delhi Television India Ltd.<br />

Consumer Durables<br />

Pharmaceuticals<br />

Corporate Debt<br />

Mc Dowell India Spirits shares received upon demerger from<br />

Mc Dowell & Company Ltd and unlisted as on 31st January <strong>2007</strong> and<br />

hence not valued and represents thinly traded/ non traded securities.<br />

Asset Allocation<br />

8.40%<br />

8.06%<br />

7.04%<br />

6.71%<br />

6.47%<br />

5.29%<br />

5.20%<br />

4.75%<br />

4.44%<br />

4.32%<br />

4.11%<br />

2.93%<br />

2.49%<br />

2.09%<br />

0.24%<br />

# <strong>for</strong> methodology please refer page 3<br />

14.54%<br />

12.92%<br />

Past per<strong>for</strong>mance may or may not be sustained in future. Per<strong>for</strong>mance has been calculated on <strong>the</strong> basis <strong>of</strong> <strong>the</strong> Advertisement Code as prescribe under SEBI (<strong>Mutual</strong> <strong>Fund</strong>s)<br />

Regulations 1996. Returns are in % and absolute returns <strong>for</strong> period less than 1 year & CAGR <strong>for</strong> period 1 year or more. When benchmark returns are not available, <strong>the</strong>y have not been<br />

shown.