Ohio Tax - Manufacturers' Education Council

Ohio Tax - Manufacturers' Education Council

Ohio Tax - Manufacturers' Education Council

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2011 <strong>Ohio</strong> <strong>Tax</strong> Conference<br />

<strong>Ohio</strong> Commercial Activity <strong>Tax</strong> (CAT) Audit Experiences<br />

Appendix A<br />

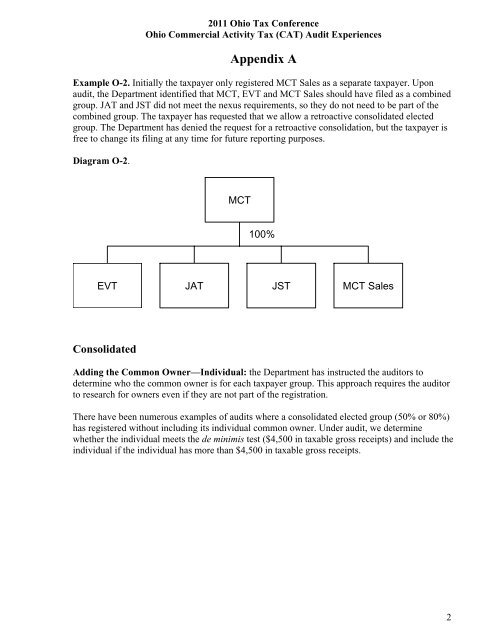

Example O-2. Initially the taxpayer only registered MCT Sales as a separate taxpayer. Upon<br />

audit, the Department identified that MCT, EVT and MCT Sales should have filed as a combined<br />

group. JAT and JST did not meet the nexus requirements, so they do not need to be part of the<br />

combined group. The taxpayer has requested that we allow a retroactive consolidated elected<br />

group. The Department has denied the request for a retroactive consolidation, but the taxpayer is<br />

free to change its filing at any time for future reporting purposes.<br />

Diagram O-2.<br />

MCT<br />

100%<br />

EVT JAT JST MCT Sales<br />

Consolidated<br />

Adding the Common Owner—Individual: the Department has instructed the auditors to<br />

determine who the common owner is for each taxpayer group. This approach requires the auditor<br />

to research for owners even if they are not part of the registration.<br />

There have been numerous examples of audits where a consolidated elected group (50% or 80%)<br />

has registered without including its individual common owner. Under audit, we determine<br />

whether the individual meets the de minimis test ($4,500 in taxable gross receipts) and include the<br />

individual if the individual has more than $4,500 in taxable gross receipts.<br />

2