Ohio Tax - Manufacturers' Education Council

Ohio Tax - Manufacturers' Education Council

Ohio Tax - Manufacturers' Education Council

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

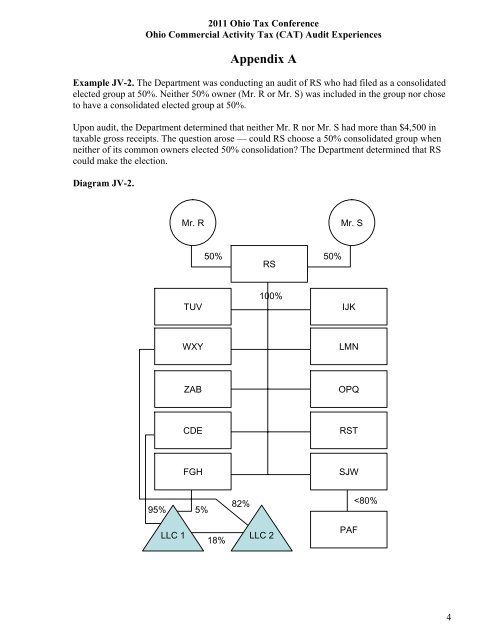

2011 <strong>Ohio</strong> <strong>Tax</strong> Conference<br />

<strong>Ohio</strong> Commercial Activity <strong>Tax</strong> (CAT) Audit Experiences<br />

Appendix A<br />

Example JV-2. The Department was conducting an audit of RS who had filed as a consolidated<br />

elected group at 50%. Neither 50% owner (Mr. R or Mr. S) was included in the group nor chose<br />

to have a consolidated elected group at 50%.<br />

Upon audit, the Department determined that neither Mr. R nor Mr. S had more than $4,500 in<br />

taxable gross receipts. The question arose — could RS choose a 50% consolidated group when<br />

neither of its common owners elected 50% consolidation The Department determined that RS<br />

could make the election.<br />

Diagram JV-2.<br />

Mr. R<br />

Mr. S<br />

50%<br />

RS<br />

50%<br />

TUV<br />

100%<br />

IJK<br />

WXY<br />

LMN<br />

ZAB<br />

OPQ<br />

CDE<br />

RST<br />

FGH<br />

SJW<br />

95%<br />

5%<br />

82%