Ohio Tax - Manufacturers' Education Council

Ohio Tax - Manufacturers' Education Council

Ohio Tax - Manufacturers' Education Council

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

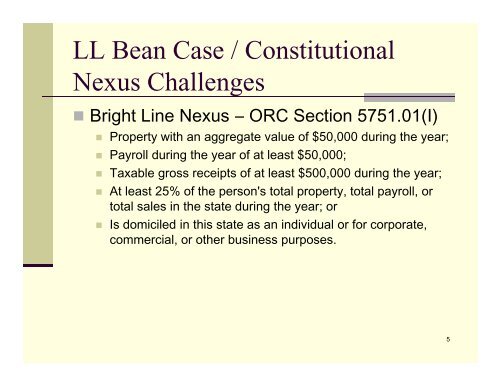

LL Bean Case / Constitutional<br />

Nexus Challenges<br />

• Bright Line Nexus – ORC Section 5751.01(I)<br />

• Property with an aggregate value of $50,000 during the year;<br />

• Payroll during the year of at least $50,000;<br />

• <strong>Tax</strong>able gross receipts of at least $500,000 000 during the year;<br />

• At least 25% of the person's total property, total payroll, or<br />

total sales in the state during the year; or<br />

• Is domiciled in this state as an individual or for corporate,<br />

commercial, or other business purposes.<br />

5