Elpitiya Plantations Plc Annual Report 2010/11 - Colombo Stock ...

Elpitiya Plantations Plc Annual Report 2010/11 - Colombo Stock ...

Elpitiya Plantations Plc Annual Report 2010/11 - Colombo Stock ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

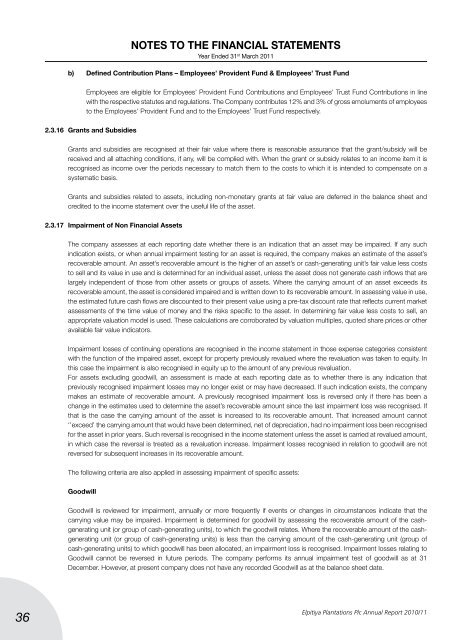

Notes to the Financial Statements<br />

Year Ended 31 st March 20<strong>11</strong><br />

b) Defined Contribution Plans – Employees’ Provident Fund & Employees’ Trust Fund<br />

Employees are eligible for Employees’ Provident Fund Contributions and Employees’ Trust Fund Contributions in line<br />

with the respective statutes and regulations. The Company contributes 12% and 3% of gross emoluments of employees<br />

to the Employees’ Provident Fund and to the Employees’ Trust Fund respectively.<br />

2.3.16 Grants and Subsidies<br />

Grants and subsidies are recognised at their fair value where there is reasonable assurance that the grant/subsidy will be<br />

received and all attaching conditions, if any, will be complied with. When the grant or subsidy relates to an income item it is<br />

recognised as income over the periods necessary to match them to the costs to which it is intended to compensate on a<br />

systematic basis.<br />

Grants and subsidies related to assets, including non-monetary grants at fair value are deferred in the balance sheet and<br />

credited to the income statement over the useful life of the asset.<br />

2.3.17 Impairment of Non Financial Assets<br />

The company assesses at each reporting date whether there is an indication that an asset may be impaired. If any such<br />

indication exists, or when annual impairment testing for an asset is required, the company makes an estimate of the asset’s<br />

recoverable amount. An asset’s recoverable amount is the higher of an asset’s or cash-generating unit’s fair value less costs<br />

to sell and its value in use and is determined for an individual asset, unless the asset does not generate cash inflows that are<br />

largely independent of those from other assets or groups of assets. Where the carrying amount of an asset exceeds its<br />

recoverable amount, the asset is considered impaired and is written down to its recoverable amount. In assessing value in use,<br />

the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market<br />

assessments of the time value of money and the risks specific to the asset. In determining fair value less costs to sell, an<br />

appropriate valuation model is used. These calculations are corroborated by valuation multiples, quoted share prices or other<br />

available fair value indicators.<br />

Impairment losses of continuing operations are recognised in the income statement in those expense categories consistent<br />

with the function of the impaired asset, except for property previously revalued where the revaluation was taken to equity. In<br />

this case the impairment is also recognised in equity up to the amount of any previous revaluation.<br />

For assets excluding goodwill, an assessment is made at each reporting date as to whether there is any indication that<br />

previously recognised impairment losses may no longer exist or may have decreased. If such indication exists, the company<br />

makes an estimate of recoverable amount. A previously recognised impairment loss is reversed only if there has been a<br />

change in the estimates used to determine the asset’s recoverable amount since the last impairment loss was recognised. If<br />

that is the case the carrying amount of the asset is increased to its recoverable amount. That increased amount cannot<br />

‘’exceed’ the carrying amount that would have been determined, net of depreciation, had no impairment loss been recognised<br />

for the asset in prior years. Such reversal is recognised in the income statement unless the asset is carried at revalued amount,<br />

in which case the reversal is treated as a revaluation increase. Impairment losses recognised in relation to goodwill are not<br />

reversed for subsequent increases in its recoverable amount.<br />

The following criteria are also applied in assessing impairment of specific assets:<br />

Goodwill<br />

Goodwill is reviewed for impairment, annually or more frequently if events or changes in circumstances indicate that the<br />

carrying value may be impaired. Impairment is determined for goodwill by assessing the recoverable amount of the cashgenerating<br />

unit (or group of cash-generating units), to which the goodwill relates. Where the recoverable amount of the cashgenerating<br />

unit (or group of cash-generating units) is less than the carrying amount of the cash-generating unit (group of<br />

cash-generating units) to which goodwill has been allocated, an impairment loss is recognised. Impairment losses relating to<br />

Goodwill cannot be reversed in future periods. The company performs its annual impairment test of goodwill as at 31<br />

December. However, at present company does not have any recorded Goodwill as at the balance sheet date.<br />

36<br />

<strong>Elpitiya</strong> <strong>Plantations</strong> <strong>Plc</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>/<strong>11</strong>