Elpitiya Plantations Plc Annual Report 2010/11 - Colombo Stock ...

Elpitiya Plantations Plc Annual Report 2010/11 - Colombo Stock ...

Elpitiya Plantations Plc Annual Report 2010/11 - Colombo Stock ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements<br />

Year Ended 31 st March 20<strong>11</strong><br />

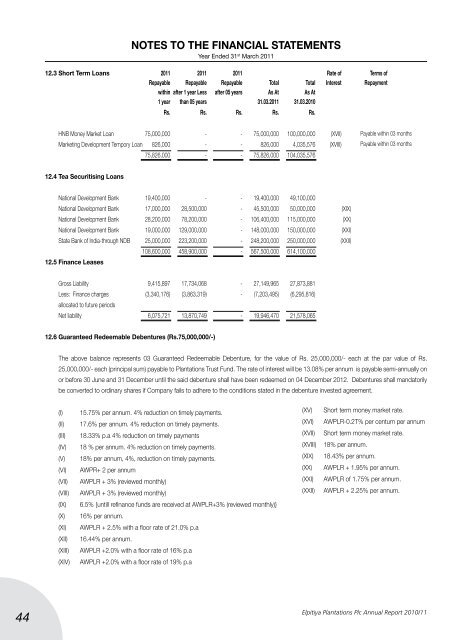

12.3 Short Term Loans 20<strong>11</strong> 20<strong>11</strong> 20<strong>11</strong> Rate of terms of<br />

Repayable Repayable Repayable total total Interest Repayment<br />

within after 1 year Less after 05 years as At as At<br />

1 year than 05 years 31.03.20<strong>11</strong> 31.03.<strong>2010</strong><br />

Rs. Rs. Rs. Rs. Rs.<br />

HNB Money Market Loan 75,000,000 - - 75,000,000 100,000,000 (XVII)<br />

Marketing Development Tempory Loan 826,000 - - 826,000 4,035,576 (XVIII)<br />

75,826,000 - - 75,826,000 104,035,576<br />

Payable within 03 months<br />

Payable within 03 months<br />

12.4 Tea Securitising Loans<br />

National Development Bank 19,400,000 - - 19,400,000 49,100,000<br />

National Development Bank 17,000,000 28,500,000 - 45,500,000 50,000,000 (XIX)<br />

National Development Bank 28,200,000 78,200,000 - 106,400,000 <strong>11</strong>5,000,000 (XX)<br />

National Development Bank 19,000,000 129,000,000 - 148,000,000 150,000,000 (XXI)<br />

State Bank of India-through NDB 25,000,000 223,200,000 - 248,200,000 250,000,000 (XXII)<br />

108,600,000 458,900,000 - 567,500,000 614,100,000<br />

12.5 Finance Leases<br />

Gross Liability 9,415,897 17,734,068 - 27,149,965 27,873,881<br />

Less: Finance charges (3,340,176) (3,863,319) - (7,203,495) (6,295,816)<br />

allocated to future periods<br />

Net liability 6,075,721 13,870,749 - 19,946,470 21,578,065<br />

12.6 Guaranteed Redeemable Debentures (Rs.75,000,000/-)<br />

The above balance represents 03 Guaranteed Redeemable Debenture, for the value of Rs. 25,000,000/- each at the par value of Rs.<br />

25,000,000/- each (principal sum) payable to <strong>Plantations</strong> Trust Fund. The rate of interest will be 13.08% per annum is payable semi-annually on<br />

or before 30 June and 31 December until the said debenture shall have been redeemed on 04 December 2012. Debentures shall mandatorily<br />

be converted to ordinary shares if Company fails to adhere to the conditions stated in the debenture invested agreement.<br />

(I)<br />

(II)<br />

(III)<br />

(IV)<br />

(V)<br />

(VI)<br />

(VII)<br />

(VIII)<br />

15.75% per annum. 4% reduction on timely payments.<br />

17.6% per annum. 4% reduction on timely payments.<br />

18.33% p.a 4% reduction on timely payments<br />

18 % per annum. 4% reduction on timely payments.<br />

18% per annum, 4%, reduction on timely payments.<br />

AWPR+ 2 per annum<br />

AWPLR + 3% (reviewed monthly)<br />

AWPLR + 3% (reviewed monthly)<br />

(XV)<br />

(XVI)<br />

(XVII)<br />

(XVIII)<br />

(XIX)<br />

(XX)<br />

(XXI)<br />

(XXII)<br />

Short term money market rate.<br />

AWPLR-0.2T% per centum per annum<br />

Short term money market rate.<br />

18% per annum.<br />

18.43% per annum.<br />

AWPLR + 1.95% per annum.<br />

AWPLR of 1.75% per annum.<br />

AWPLR + 2.25% per annum.<br />

(IX)<br />

6.5% {untill refinance funds are received at AWPLR+3% (reviewed monthly)}<br />

(X)<br />

16% per annum.<br />

(XI)<br />

AWPLR + 2.5% with a floor rate of 21.0% p.a<br />

(XII)<br />

16.44% per annum.<br />

(XIII)<br />

AWPLR +2.0% with a floor rate of 16% p.a<br />

(XIV)<br />

AWPLR +2.0% with a floor rate of 19% p.a<br />

44<br />

<strong>Elpitiya</strong> <strong>Plantations</strong> <strong>Plc</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>/<strong>11</strong>