glOBal Wind energy OuTlOOk 2010 - Global Wind Energy Council

glOBal Wind energy OuTlOOk 2010 - Global Wind Energy Council

glOBal Wind energy OuTlOOk 2010 - Global Wind Energy Council

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

R e g i o n a l s c e n a r i o r e s u l T S<br />

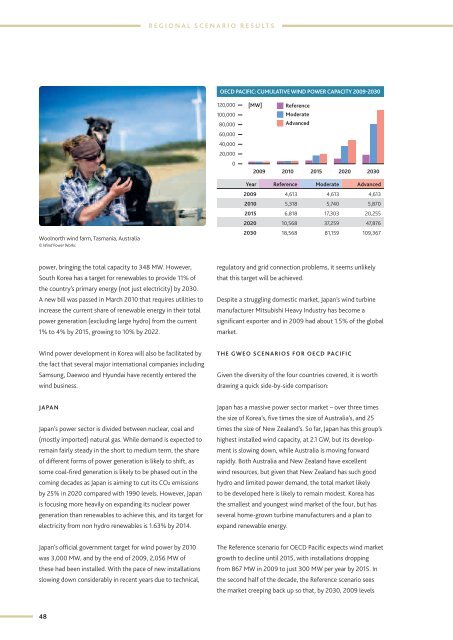

Oecd pacific: cuMulaTive <strong>Wind</strong> POWer capaciTY 2009-2030<br />

120,000<br />

100,000<br />

80,000<br />

60,000<br />

40,000<br />

20,000<br />

0<br />

[MW] Reference<br />

Moderate<br />

Advanced<br />

2009 <strong>2010</strong> 2015 2020 2030<br />

Woolnorth wind farm, Tasmania, Australia<br />

© <strong>Wind</strong> Power Works<br />

Year Reference Moderate Advanced<br />

2009 4,613 4,613 4,613<br />

<strong>2010</strong> 5,318 5,740 5,870<br />

2015 6,818 17,303 20,255<br />

2020 10,568 37,259 47,876<br />

2030 18,568 81,159 109,367<br />

power, bringing the total capacity to 348 MW. However,<br />

South Korea has a target for renewables to provide 11% of<br />

the country’s primary <strong>energy</strong> (not just electricity) by 2030.<br />

A new bill was passed in March <strong>2010</strong> that requires utilities to<br />

increase the current share of renewable <strong>energy</strong> in their total<br />

power generation (excluding large hydro) from the current<br />

1% to 4% by 2015, growing to 10% by 2022.<br />

regulatory and grid connection problems, it seems unlikely<br />

that this target will be achieved.<br />

Despite a struggling domestic market, Japan’s wind turbine<br />

manufacturer Mitsubishi Heavy Industry has become a<br />

significant exporter and in 2009 had about 1.5% of the global<br />

market.<br />

<strong>Wind</strong> power development in Korea will also be facilitated by<br />

the fact that several major international companies including<br />

Samsung, Daewoo and Hyundai have recently entered the<br />

wind business.<br />

The GWEO scenariOS For Oecd Pacific<br />

Given the diversity of the four countries covered, it is worth<br />

drawing a quick side-by-side comparison:<br />

Japan<br />

Japan’s power sector is divided between nuclear, coal and<br />

(mostly imported) natural gas. While demand is expected to<br />

remain fairly steady in the short to medium term, the share<br />

of different forms of power generation is likely to shift, as<br />

some coal-fired generation is likely to be phased out in the<br />

coming decades as Japan is aiming to cut its CO2 emissions<br />

by 25% in 2020 compared with 1990 levels. However, Japan<br />

is focusing more heavily on expanding its nuclear power<br />

generation than renewables to achieve this, and its target for<br />

electricity from non hydro renewables is 1.63% by 2014.<br />

Japan has a massive power sector market – over three times<br />

the size of Korea’s, five times the size of Australia’s, and 25<br />

times the size of New Zealand’s. So far, Japan has this group’s<br />

highest installed wind capacity, at 2.1 GW, but its development<br />

is slowing down, while Australia is moving forward<br />

rapidly. Both Australia and New Zealand have excellent<br />

wind resources, but given that New Zealand has such good<br />

hydro and limited power demand, the total market likely<br />

to be developed here is likely to remain modest. Korea has<br />

the smallest and youngest wind market of the four, but has<br />

several home-grown turbine manufacturers and a plan to<br />

expand renewable <strong>energy</strong>.<br />

Japan’s official government target for wind power by <strong>2010</strong><br />

was 3,000 MW, and by the end of 2009, 2,056 MW of<br />

these had been installed. With the pace of new installations<br />

slowing down considerably in recent years due to technical,<br />

The Reference scenario for OECD Pacific expects wind market<br />

growth to decline until 2015, with installations dropping<br />

from 867 MW in 2009 to just 300 MW per year by 2015. In<br />

the second half of the decade, the Reference scenario sees<br />

the market creeping back up so that, by 2030, 2009 levels<br />

48