2012 Annual Report (2 April 2013) - Grange Resources

2012 Annual Report (2 April 2013) - Grange Resources

2012 Annual Report (2 April 2013) - Grange Resources

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2012</strong> ANNUAL REPORT<br />

73<br />

PAGE<br />

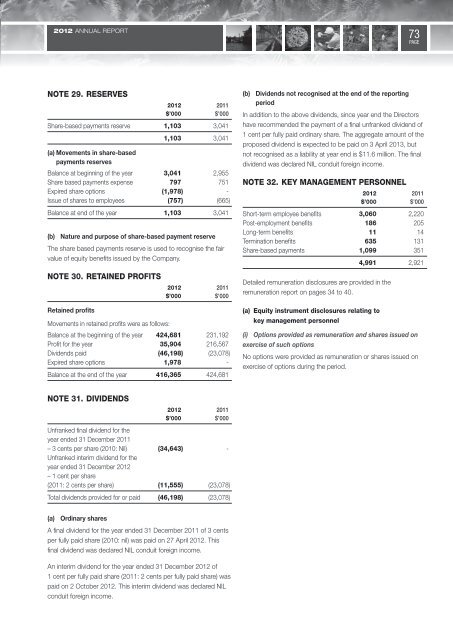

NOTE 29. RESERVES<br />

<strong>2012</strong> 2011<br />

$’000 $’000<br />

Share-based payments reserve 1,103 3,041<br />

(a) Movements in share-based<br />

payments reserves<br />

1,103 3,041<br />

Balance at beginning of the year 3,041 2,955<br />

Share based payments expense 797 751<br />

Expired share options (1,978) -<br />

Issue of shares to employees (757) (665)<br />

Balance at end of the year 1,103 3,041<br />

(b) Nature and purpose of share-based payment reserve<br />

The share based payments reserve is used to recognise the fair<br />

value of equity benefits issued by the Company.<br />

NOTE 30. RETAINED PROFITS<br />

Retained profits<br />

<strong>2012</strong> 2011<br />

$’000 $’000<br />

Movements in retained profits were as follows:<br />

Balance at the beginning of the year 424,681 231,192<br />

Profit for the year 35,904 216,567<br />

Dividends paid (46,198) (23,078)<br />

Expired share options 1,978 -<br />

Balance at the end of the year 416,365 424,681<br />

(b) Dividends not recognised at the end of the reporting<br />

period<br />

In addition to the above dividends, since year end the Directors<br />

have recommended the payment of a final unfranked dividend of<br />

1 cent per fully paid ordinary share. The aggregate amount of the<br />

proposed dividend is expected to be paid on 3 <strong>April</strong> <strong>2013</strong>, but<br />

not recognised as a liability at year end is $11.6 million. The final<br />

dividend was declared NIL conduit foreign income.<br />

NOTE 32. KEY MANAGEMENT PERSONNEL<br />

<strong>2012</strong> 2011<br />

$’000 $’000<br />

Short-term employee benefits 3,060 2,220<br />

Post-employment benefits 186 205<br />

Long-term benefits 11 14<br />

Termination benefits 635 131<br />

Share-based payments 1,099 351<br />

Detailed remuneration disclosures are provided in the<br />

remuneration report on pages 34 to 40.<br />

(a) Equity instrument disclosures relating to<br />

key management personnel<br />

4,991 2,921<br />

(i) Options provided as remuneration and shares issued on<br />

exercise of such options<br />

No options were provided as remuneration or shares issued on<br />

exercise of options during the period.<br />

NOTE 31. DIVIDENDS<br />

<strong>2012</strong> 2011<br />

$’000 $’000<br />

Unfranked final dividend for the<br />

year ended 31 December 2011<br />

– 3 cents per share (2010: Nil) (34,643) -<br />

Unfranked interim dividend for the<br />

year ended 31 December <strong>2012</strong><br />

– 1 cent per share<br />

(2011: 2 cents per share) (11,555) (23,078)<br />

Total dividends provided for or paid (46,198) (23,078)<br />

(a) Ordinary shares<br />

A final dividend for the year ended 31 December 2011 of 3 cents<br />

per fully paid share (2010: nil) was paid on 27 <strong>April</strong> <strong>2012</strong>. This<br />

final dividend was declared NIL conduit foreign income.<br />

An interim dividend for the year ended 31 December <strong>2012</strong> of<br />

1 cent per fully paid share (2011: 2 cents per fully paid share) was<br />

paid on 2 October <strong>2012</strong>. This interim dividend was declared NIL<br />

conduit foreign income.