2012 Annual Report (2 April 2013) - Grange Resources

2012 Annual Report (2 April 2013) - Grange Resources

2012 Annual Report (2 April 2013) - Grange Resources

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

80<br />

PAGE<br />

<strong>2012</strong> ANNUAL REPORT<br />

Notes to the Financial Statements (cont.)<br />

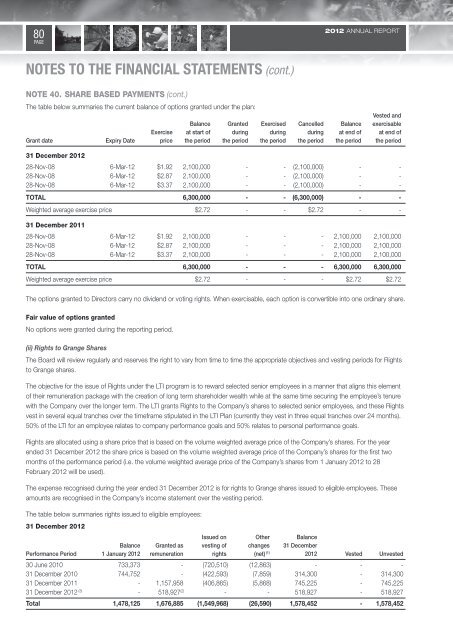

NOTE 40. SHARE BASED PAYMENTS (cont.)<br />

The table below summaries the current balance of options granted under the plan:<br />

Vested and<br />

Balance Granted Exercised Cancelled Balance exercisable<br />

Exercise at start of during during during at end of at end of<br />

Grant date Expiry Date price the period the period the period the period the period the period<br />

31 December <strong>2012</strong><br />

28-Nov-08 6-Mar-12 $1.92 2,100,000 - - (2,100,000) - -<br />

28-Nov-08 6-Mar-12 $2.87 2,100,000 - - (2,100,000) - -<br />

28-Nov-08 6-Mar-12 $3.37 2,100,000 - - (2,100,000) - -<br />

TOTAL 6,300,000 - - (6,300,000) - -<br />

Weighted average exercise price $2.72 - - $2.72 - -<br />

31 December 2011<br />

28-Nov-08 6-Mar-12 $1.92 2,100,000 - - - 2,100,000 2,100,000<br />

28-Nov-08 6-Mar-12 $2.87 2,100,000 - - - 2,100,000 2,100,000<br />

28-Nov-08 6-Mar-12 $3.37 2,100,000 - - - 2,100,000 2,100,000<br />

TOTAL 6,300,000 - - - 6,300,000 6,300,000<br />

Weighted average exercise price $2.72 - - - $2.72 $2.72<br />

The options granted to Directors carry no dividend or voting rights. When exercisable, each option is convertible into one ordinary share.<br />

Fair value of options granted<br />

No options were granted during the reporting period.<br />

(ii) Rights to <strong>Grange</strong> Shares<br />

The Board will review regularly and reserves the right to vary from time to time the appropriate objectives and vesting periods for Rights<br />

to <strong>Grange</strong> shares.<br />

The objective for the issue of Rights under the LTI program is to reward selected senior employees in a manner that aligns this element<br />

of their remuneration package with the creation of long term shareholder wealth while at the same time securing the employee’s tenure<br />

with the Company over the longer term. The LTI grants Rights to the Company’s shares to selected senior employees, and these Rights<br />

vest in several equal tranches over the timeframe stipulated in the LTI Plan (currently they vest in three equal tranches over 24 months).<br />

50% of the LTI for an employee relates to company performance goals and 50% relates to personal performance goals.<br />

Rights are allocated using a share price that is based on the volume weighted average price of the Company’s shares. For the year<br />

ended 31 December <strong>2012</strong> the share price is based on the volume weighted average price of the Company’s shares for the first two<br />

months of the performance period (i.e. the volume weighted average price of the Company’s shares from 1 January <strong>2012</strong> to 28<br />

February <strong>2012</strong> will be used).<br />

The expense recognised during the year ended 31 December <strong>2012</strong> is for rights to <strong>Grange</strong> shares issued to eligible employees. These<br />

amounts are recognised in the Company’s income statement over the vesting period.<br />

The table below summaries rights issued to eligible employees:<br />

31 December <strong>2012</strong><br />

Issued on Other Balance<br />

Balance Granted as vesting of changes 31 December<br />

Performance Period 1 January <strong>2012</strong> remuneration rights (net) (1) <strong>2012</strong> Vested Unvested<br />

30 June 2010 733,373 - (720,510) (12,863) - - -<br />

31 December 2010 744,752 - (422,593) (7,859) 314,300 - 314,300<br />

31 December 2011 - 1,157,958 (406,865) (5,868) 745,225 - 745,225<br />

31 December <strong>2012</strong> (3) - 518,927 (2) - - 518,927 - 518,927<br />

Total 1,478,125 1,676,885 (1,549,968) (26,590) 1,578,452 - 1,578,452