1. Types of risk trading ... - Finance Trainer

1. Types of risk trading ... - Finance Trainer

1. Types of risk trading ... - Finance Trainer

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

RISK MANAGEMENT<br />

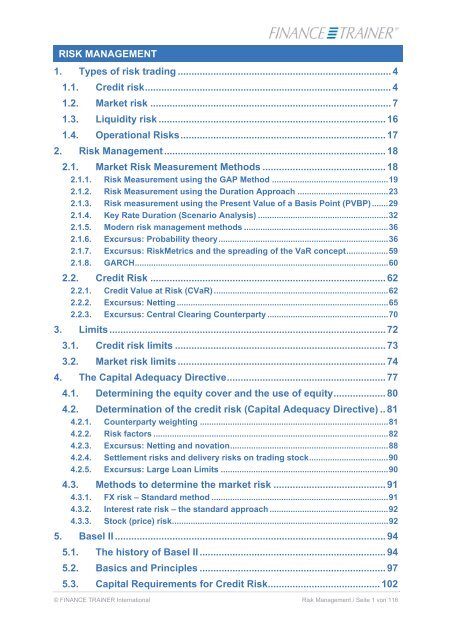

<strong>1.</strong> <strong>Types</strong> <strong>of</strong> <strong>risk</strong> <strong>trading</strong> .............................................................................. 4<br />

<strong>1.</strong><strong>1.</strong> Credit <strong>risk</strong>.......................................................................................... 4<br />

<strong>1.</strong>2. Market <strong>risk</strong> ........................................................................................ 7<br />

<strong>1.</strong>3. Liquidity <strong>risk</strong> ................................................................................... 16<br />

<strong>1.</strong>4. Operational Risks........................................................................... 17<br />

2. Risk Management................................................................................. 18<br />

2.<strong>1.</strong> Market Risk Measurement Methods ............................................. 18<br />

2.<strong>1.</strong><strong>1.</strong> Risk Measurement using the GAP Method ..................................................19<br />

2.<strong>1.</strong>2. Risk Measurement using the Duration Approach .......................................23<br />

2.<strong>1.</strong>3. Risk measurement using the Present Value <strong>of</strong> a Basis Point (PVBP) .......29<br />

2.<strong>1.</strong>4. Key Rate Duration (Scenario Analysis) ........................................................32<br />

2.<strong>1.</strong>5. Modern <strong>risk</strong> management methods ..............................................................36<br />

2.<strong>1.</strong>6. Excursus: Probability theory.........................................................................36<br />

2.<strong>1.</strong>7. Excursus: RiskMetrics and the spreading <strong>of</strong> the VaR concept..................59<br />

2.<strong>1.</strong>8. GARCH.............................................................................................................60<br />

2.2. Credit Risk ...................................................................................... 62<br />

2.2.<strong>1.</strong> Credit Value at Risk (CVaR) ...........................................................................62<br />

2.2.2. Excursus: Netting ...........................................................................................65<br />

2.2.3. Excursus: Central Clearing Counterparty ....................................................70<br />

3. Limits ..................................................................................................... 72<br />

3.<strong>1.</strong> Credit <strong>risk</strong> limits ............................................................................. 73<br />

3.2. Market <strong>risk</strong> limits ............................................................................ 74<br />

4. The Capital Adequacy Directive.......................................................... 77<br />

4.<strong>1.</strong> Determining the equity cover and the use <strong>of</strong> equity................... 80<br />

4.2. Determination <strong>of</strong> the credit <strong>risk</strong> (Capital Adequacy Directive) .. 81<br />

4.2.<strong>1.</strong> Counterparty weighting .................................................................................81<br />

4.2.2. Risk factors .....................................................................................................82<br />

4.2.3. Excursus: Netting and novation....................................................................88<br />

4.2.4. Settlement <strong>risk</strong>s and delivery <strong>risk</strong>s on <strong>trading</strong> stock..................................90<br />

4.2.5. Excursus: Large Loan Limits ........................................................................90<br />

4.3. Methods to determine the market <strong>risk</strong> ......................................... 91<br />

4.3.<strong>1.</strong> FX <strong>risk</strong> – Standard method ............................................................................91<br />

4.3.2. Interest rate <strong>risk</strong> – the standard approach ...................................................92<br />

4.3.3. Stock (price) <strong>risk</strong>.............................................................................................92<br />

5. Basel II ................................................................................................... 94<br />

5.<strong>1.</strong> The history <strong>of</strong> Basel II .................................................................... 94<br />

5.2. Basics and Principles .................................................................... 97<br />

5.3. Capital Requirements for Credit Risk......................................... 102<br />

© FINANCE TRAINER International Risk Management / Seite 1 von 116

RISK MANAGEMENT<br />

In recent years <strong>risk</strong> management thinking has undergone dramatic changes, driven by the<br />

tremendous growth in derivatives <strong>trading</strong>, the development <strong>of</strong> modern approaches within<br />

finance theory, and also by an understanding that classic accounting approaches cannot<br />

adequately describe the <strong>risk</strong>s involved in complex <strong>trading</strong> and hedging strategies. Today, the<br />

bank departments <strong>of</strong> strategic planning, system support, and controlling try to evaluate the<br />

impact <strong>of</strong> these new possibilities on the overall strategy <strong>of</strong> the banks, on the role <strong>of</strong> the<br />

management, and on the optimum allocation <strong>of</strong> the company’s capital. With the help <strong>of</strong> <strong>risk</strong><br />

measurement, <strong>risk</strong> assessment, and <strong>risk</strong> monitoring banks try to develop methods to<br />

estimate market, credit liquidity and operational <strong>risk</strong>s adequately. Furthermore a clear limit<br />

system was established that allows the bank’s overall <strong>risk</strong>s room to manoeuvre within given<br />

limits.<br />

At present, legislation strongly favours statistical methods such as the value at <strong>risk</strong> (VAR)<br />

approach to quantify the respective <strong>risk</strong>s <strong>of</strong> banks. These VAR approaches take several<br />

factors into account: Possible fluctuations <strong>of</strong> individual <strong>risk</strong> positions, potential correlations<br />

between different positions, liquidity <strong>risk</strong>s, and the probability <strong>of</strong> counterparty default. The<br />

role <strong>of</strong> the bank management is to guarantee that the methods in use match the <strong>risk</strong>s that<br />

are taken by the bank.<br />

A very important source <strong>of</strong> bank revenues stems from the presence <strong>of</strong> <strong>risk</strong>; most <strong>risk</strong>s should<br />

not to be seen in a negative way. Banks must control <strong>risk</strong>s so that on the one hand the <strong>risk</strong>s<br />

are limited, but on the other hand they still allow banks to earn money on them. In order to<br />

achieve these two aims, <strong>risk</strong>s must be measurable and thus estimable.<br />

The majority <strong>of</strong> bank <strong>risk</strong>s are controlled within <strong>trading</strong> and treasury. Since <strong>trading</strong> is one <strong>of</strong><br />

the core areas <strong>of</strong> banking, it is strongly affected by the question <strong>of</strong> limiting and measuring<br />

<strong>risk</strong>s.<br />

Risks are always linked to uncertainty. Modern approaches <strong>of</strong> <strong>risk</strong> measurement try to<br />

quantify these uncertainties in order to compare different <strong>risk</strong> positions, and consequently the<br />

returns on <strong>risk</strong>.<br />

Another important aspect <strong>of</strong> the modern <strong>risk</strong> measurement methods is the idea that the total<br />

<strong>risk</strong> is lower than the sum <strong>of</strong> the single <strong>risk</strong>s involved. This idea is based on the portfolio<br />

theory, whereby the total <strong>risk</strong> may be reduced by diversification. In the context <strong>of</strong> FX trades,<br />

this means that a single position (e.g. short USD position) bears a higher <strong>risk</strong> than a position<br />

© FINANCE TRAINER International Risk Management / Seite 2 von 116

that is composed <strong>of</strong> different individual positions (e.g. the same amount composed <strong>of</strong> short<br />

positions in USD, GBP, JPY, and CHF). The probability that each position turns negative is<br />

lower than the probability that a single position will lead to a loss.<br />

The same ideas apply also to the credit <strong>risk</strong>, where the <strong>risk</strong> <strong>of</strong> a single credit is higher than a<br />

comparable <strong>risk</strong> that is based on a variety <strong>of</strong> borrowers (with comparable creditworthiness).<br />

In the following, we will firstly define and classify the various banking <strong>risk</strong>s and then present<br />

different measurement methods using the example <strong>of</strong> interest rate <strong>risk</strong>. We will then illustrate<br />

how banks limit those <strong>risk</strong>s internally. The last chapter will deal with the legal requirements<br />

banks have to adhere to regarding the measurement <strong>of</strong> banking <strong>risk</strong>s and required minimum<br />

capital requirements.<br />

The tasks <strong>of</strong> the ALCO (Asset Liability Committee) and the frequency <strong>of</strong> their meetings<br />

normally depend on the structure <strong>of</strong> the bank. Normally the ALCO convenes monthly and the<br />

typical main task is controlling the bank’s overall balance structure and market <strong>risk</strong>.<br />

Beyond this, the ALCO normally carries out the following tasks which are <strong>of</strong> great importance<br />

to the overall control <strong>of</strong> the bank:<br />

• Controlling the liquidity <strong>risk</strong> <strong>of</strong> the entire bank<br />

• Equity Management planning (solvency)<br />

• Establishing the transfer prices for interest and liquidity<br />

• Monitoring the development <strong>of</strong> the bank’s lending and deposit business<br />

© FINANCE TRAINER International Risk Management / Seite 3 von 116

<strong>1.</strong> <strong>Types</strong> <strong>of</strong> <strong>risk</strong> <strong>trading</strong><br />

Risk is defined as the likelihood <strong>of</strong> a loss or a lower than expected return. Risk only applies<br />

to future and therefore uncertain events. Risks that have materialized are no longer classified<br />

as <strong>risk</strong>s; rather they have been entered in the pr<strong>of</strong>it and loss account (as a loss).<br />

Overview<br />

Total Bank Risk<br />

Credit Risk Market Risk Liquidity Risk Operational Risk<br />

<strong>1.</strong><strong>1.</strong> Credit <strong>risk</strong><br />

Credit <strong>risk</strong> is the <strong>risk</strong> <strong>of</strong> loss due to a debtor's non-payment <strong>of</strong> a loan or other line <strong>of</strong> credit or<br />

the reduction <strong>of</strong> the expected return due to a so-called credit event. A credit event may be<br />

the default <strong>of</strong> a debtor, a change in a debtor’s creditworthiness (rating migration) or the<br />

movement <strong>of</strong> market credit spreads. Average expected losses in the credit business are<br />

covered by charging an expected loss premium to the debtor. Credit <strong>risk</strong> means therefore<br />

losses that exceed the expected loss.<br />

Classic credit <strong>risk</strong> (counterparty <strong>risk</strong>)<br />

The classic credit <strong>risk</strong> refers to the loss <strong>of</strong> a transaction’s total capital amount (or parts <strong>of</strong> it)<br />

due to the partner’s inability to pay. This classic credit <strong>risk</strong> exists for banks with all asset<br />

deals, since all receivables are booked in the balance sheet with the capital amount. The<br />

same <strong>risk</strong> occurs with warranties that the bank has given.<br />

With derivatives (<strong>of</strong>f- balance sheet products), this classic credit <strong>risk</strong> is per se eliminated.<br />

Consider that the borrower defaults after the credit has been given but<br />

before it is paid back. This would mean that the bank loses the total<br />

amount <strong>of</strong> capital and the accrued interest.<br />

With an interest rate swap, the bank does not <strong>risk</strong> losing the<br />

underlying amount <strong>of</strong> capital in case <strong>of</strong> a default.<br />

© FINANCE TRAINER International Risk Management / Seite 4 von 116

Settlement <strong>risk</strong><br />

Settlement <strong>risk</strong> represents a type <strong>of</strong> credit <strong>risk</strong> that occurs with all exchange transactions:<br />

The bank has already completed its part <strong>of</strong> the transaction while the partner’s default<br />

prevents the completion <strong>of</strong> the transaction. Therefore, the extent <strong>of</strong> the settlement <strong>risk</strong> equals<br />

the total value <strong>of</strong> the transaction. The <strong>risk</strong> exists from the time the bank has done the<br />

transaction until the completion <strong>of</strong> the transaction by the counterparty.<br />

If the payment arrangements differ due to different time zones, then settlement <strong>risk</strong> becomes<br />

a particular concern. If, for example, a EUR/USD spot transaction is settled, the payer <strong>of</strong> the<br />

EUR may complete his payment several hours before he can receive the USD in return.<br />

The settlement <strong>risk</strong> should be particularly considered in the case <strong>of</strong> FX transactions. Here, on<br />

the one hand volumes are tending to increase, but on the other hand almost all transactions<br />

are settled over the counter. Settlement <strong>risk</strong> hit the headlines in 1974 with the bankruptcy <strong>of</strong><br />

the Herstatt Bank, since then settlement <strong>risk</strong> has also been known as "Herstatt <strong>risk</strong>".<br />

Replacement <strong>risk</strong><br />

Replacement <strong>risk</strong> refers to a bank’s <strong>risk</strong> that due to counterparty´s default the position must<br />

be replaced at an extra cost in the market. Replacement <strong>risk</strong> is therefore mainly an element<br />

<strong>of</strong> OTC derivatives. As for derivatives that are traded on the (stock) exchange there is<br />

assumed to be no credit <strong>risk</strong> (i.e. replacement <strong>risk</strong>), as the exchange provides for<br />

replacement <strong>risk</strong> by charging margins.<br />

If the bank enters an interest rate swap and the counterparty defaults during the term, the<br />

bank has to arrange a new interest rate swap at current market rates for the rest <strong>of</strong> the term,<br />

in order to create the same interest position as before the default. Due to this new deal,<br />

additional costs can occur.<br />

Today, banks make use <strong>of</strong> two common methods to estimate replacement <strong>risk</strong>:<br />

A simple and established method is the so-called maturity method whereby a specified<br />

percentage per year (<strong>of</strong> remaining maturity) is applied as a so-called credit equivalent.<br />

Usually different percentage rates are applied depending on whether the replacement <strong>risk</strong><br />

stems from an interest rate instrument or a FX instrument (or both).<br />

© FINANCE TRAINER International Risk Management / Seite 5 von 116

A bank uses the following percentage rates to charge OTC derivatives<br />

against their (credit) limits:<br />

Interest rate instruments: 1% per year <strong>of</strong> maturity<br />

FX instruments: 3% per year <strong>of</strong> maturity<br />

Thus, 10% <strong>of</strong> the principal <strong>of</strong> an interest rate swap with 10 years <strong>of</strong><br />

remaining maturity would be charged against the credit <strong>risk</strong> limit for<br />

the counterparty<br />

As for a 2-year FX outright, 6% <strong>of</strong> the principal would be charged<br />

against the limit.<br />

The second method, the mark-to-market approach, is more complex but also more<br />

accurate. In a first step, the current market values <strong>of</strong> all OTC derivatives are calculated. Only<br />

positive market values are used for the subsequent calculation <strong>of</strong> a <strong>risk</strong> figure, because the<br />

default <strong>of</strong> a counterparty would not result in a loss if the mark-to-market value was negative.<br />

The positive mark-to-market value represents the loss that would be caused by the default <strong>of</strong><br />

the respective counterparty today. Because MTM values are subject to volatility, the <strong>risk</strong><br />

figure (=credit equivalent) is calculated by charging an add-on (calculated as a % <strong>of</strong> the<br />

principal) to the sum <strong>of</strong> positive OTC market values.<br />

1) IRS, 10 years, (fixed rate) receiver, rate: 4.00%, principal: 50m<br />

2) FX outright, EUR/USD at <strong>1.</strong>1500, 2 years, principal: 50m<br />

Add-on: Interest rate transactions 1%<br />

FX transactions 5%<br />

Current MTM values<br />

MTM Positive MTM Add-on<br />

Credit<br />

Equivalent<br />

IRS +4,200,00 4,200,00 500,000 4,700,000<br />

Outright - 2,342,000 0 2,500,000 2,500,000<br />

Sum 7,200,000<br />

In total, EUR 7,200,000 would be charged against the credit limits <strong>of</strong> the counterparty.<br />

This methodology allows accounting for possible netting agreements.<br />

© FINANCE TRAINER International Risk Management / Seite 6 von 116

<strong>1.</strong>2. Market <strong>risk</strong><br />

Market <strong>risk</strong> (also called price <strong>risk</strong>) is the <strong>risk</strong> that the bank suffers losses on its open positions<br />

due to unfavourable market movements. Especially in the <strong>trading</strong> section, market <strong>risk</strong>s must<br />

be taken into account, since most open positions are found there.<br />

Overview: Market <strong>risk</strong>s<br />

Market Risk<br />

Currency Risk<br />

Interest Rate<br />

Risk<br />

Stock Price<br />

Risk<br />

Other Price<br />

Risks<br />

Basis Risk<br />

Interest Level Yield Curve Basis Risk<br />

Interest rate <strong>risk</strong><br />

Interest rate <strong>risk</strong> is the <strong>risk</strong> <strong>of</strong> loss due to interest rate movements. It is possible to<br />

differentiate between the following “classes” <strong>of</strong> interest rate movements:<br />

- change <strong>of</strong> the interest rate level (parallel shift <strong>of</strong> the yield curve)<br />

- yield curve twist<br />

- basis <strong>risk</strong>: The <strong>risk</strong> that the values <strong>of</strong> two similar, but not identical positions behave<br />

differently. For example different interest instruments (like deposits and FRAs) with<br />

the same term may still have an influence on the result in case <strong>of</strong> differing price<br />

movements <strong>of</strong> the 2 instruments envolved.<br />

FX <strong>risk</strong><br />

Foreign exchange <strong>risk</strong> is the <strong>risk</strong> <strong>of</strong> loss due to changes in exchange rates<br />

Stock price <strong>risk</strong><br />

Stock price <strong>risk</strong> is the <strong>risk</strong> <strong>of</strong> loss due to changes in stock prices<br />

© FINANCE TRAINER International Risk Management / Seite 7 von 116

Other price <strong>risk</strong>s<br />

Other price <strong>risk</strong>s are <strong>risk</strong>s <strong>of</strong> loss due to changes in gold and commodity prices or in prices <strong>of</strong><br />

other positions where market prices exist.<br />

© FINANCE TRAINER International Risk Management / Seite 8 von 116

FX position keeping<br />

Position keeping is a procedure where all transactions in a currency pair are recorded (e.g.<br />

GBP/USD) and the open balance is valued at the end <strong>of</strong> each time interval. This way, a bank<br />

has a comprehensive overview <strong>of</strong> its open positions and the <strong>risk</strong>s it is currently running.<br />

Three steps are necessary in order to calculate and evaluate an open FX – position:<br />

I. Calculation <strong>of</strong> the net position in the base currency<br />

The net position in a currency is the amount by which a dealer is short or long <strong>of</strong> that<br />

currency after balancing out all deals. Long positions bear positive signs, short positions<br />

negative signs. If long and short positions cancel each other out the position is said to<br />

be closed.<br />

II.<br />

Calculation <strong>of</strong> the net position in the quote currency<br />

The volume <strong>of</strong> the base currency is multiplied by the price in order to get the volume <strong>of</strong><br />

the quote currency. The volumes are then totalled.<br />

III. Valuation at the average rate<br />

The open net position is valued at the average rate. In order to calculate the average<br />

rate, the net position in the quote currency is divided by the net position in the base<br />

currency. The net position reflects the volume <strong>of</strong> the open position in the base currency.<br />

The average rate takes all transactions into account and can therefore be interpreted as<br />

the break-even rate. This means that if the position is closed at that rate there is neither<br />

a pr<strong>of</strong>it nor a loss. If the position is closed (or valued) at a better rate a dealing (or<br />

valuation) pr<strong>of</strong>it can be realised.<br />

© FINANCE TRAINER International Risk Management / Seite 9 von 116

You make the following USD / CHF transactions:<br />

Sell USD 10m at <strong>1.</strong>4020<br />

Sell USD 10m at <strong>1.</strong>4025<br />

Buy USD 15m at <strong>1.</strong>4023<br />

Buy USD 10m at <strong>1.</strong>4018<br />

Your position:<br />

Position base<br />

currency rate<br />

Rate<br />

Position quote<br />

currency<br />

Total position<br />

Average<br />

- 10.000.000 1,4020 + 14.020.000 - 10.000.000 1,40200<br />

- 10.000.000 1,4025 + 14.025.000 - 20.000.000 1,40225<br />

+ 15.000.000 1,4023 - 2<strong>1.</strong>034.500 - 5.000.000 1,40210<br />

+ 10.000.000 1,4018 - 14.018.000 + 5.000.000 1,40150<br />

+ 5.000.000 - 7.007.500 1,4015<br />

You have a long position <strong>of</strong> USD 5m at <strong>1.</strong>4015.<br />

By comparing your position with the current rate you can determine if the position is a pr<strong>of</strong>it<br />

or loss.<br />

The following principles apply:<br />

In the case <strong>of</strong> long positions the average rate is compared with the bid rate. The<br />

question is if the base currency was bought cheaper than it can be sold now.<br />

In the case <strong>of</strong> short positions the average rate is compared with the <strong>of</strong>fered rate. The<br />

question is if the amount sold can be repurchased cheaper.<br />

In practice, the valuation <strong>of</strong> the position is done at the mid rate, though a valuation at the<br />

bid/<strong>of</strong>fer rates is theoretically correct.<br />

© FINANCE TRAINER International Risk Management / Seite 10 von 116

Continued: Your net position is USD 5m long at an USD / CHF<br />

average rate <strong>of</strong> <strong>1.</strong>4015. The closing rate is <strong>1.</strong>4017 – 19. Did you<br />

make a pr<strong>of</strong>it or loss<br />

You are USD 5m long, which you can sell at <strong>1.</strong>4017. Since you have<br />

paid on average <strong>1.</strong>4015 CHF per USD you cash in a pr<strong>of</strong>it <strong>of</strong> 0.0002<br />

CHF per USD, i.e. CHF 1,000 (5,000,000 x 0.0002).<br />

If you revalue the position at the mid rate (<strong>1.</strong>4018) your result is CHF<br />

1,500 (5,000,000 x 0.0003).<br />

Position keeping<br />

If a closed position shall be valued again you can choose between two possibilities:<br />

a) You continue with the average rate <strong>of</strong> the net position<br />

b) The open net position is valued and the pr<strong>of</strong>it/loss booked. The starting point for next<br />

day’s valuation is then the net position at the valuation rate.<br />

© FINANCE TRAINER International Risk Management / Seite 11 von 116

We continue with the USD/CHF example calculated above. You are<br />

USD 5m long at <strong>1.</strong>4015, valuation against <strong>1.</strong>4017. Your next deal is<br />

the sale <strong>of</strong> USD 7m at <strong>1.</strong>4016. Value the position if the closing rate is<br />

<strong>1.</strong>4016.<br />

Option 1<br />

Position base<br />

currency<br />

Rate<br />

Position quote<br />

currency<br />

Total position<br />

Average rate<br />

+ 5.000.000 1,4015 - 7.007.500 + 5.000.000 1,40150<br />

- 7.000.000 1,4016 + 9.81<strong>1.</strong>200 - 2.000.000 1,40185<br />

- 2.000.000 + 2.803.700 1,40185<br />

Average rate: <strong>1.</strong>40185<br />

Valuation rate: <strong>1.</strong>4016<br />

Result: Pr<strong>of</strong>it CHF 500 (2m x (<strong>1.</strong>40185-<strong>1.</strong>4016)<br />

Option 2<br />

Position base<br />

currency<br />

Rate<br />

Position quote<br />

currency<br />

Total position<br />

Average rate<br />

+ 5.000.000 1,4017 - 7.008.500 + 5.000.000 1,40170<br />

- 7.000.000 1,4016 + 9.81<strong>1.</strong>200 - 2.000.000 1,40135<br />

- 2.000.000 + 2.802.700 1,40135<br />

Average rate: <strong>1.</strong>40135 for 2m<br />

Valuation rate: <strong>1.</strong>4016<br />

Result: Pr<strong>of</strong>it 1,000 (Valuation Day 1)<br />

Loss 500 (Valuation Day 2)<br />

Total: Pr<strong>of</strong>it 500<br />

In option 1 all pr<strong>of</strong>its/losses <strong>of</strong> the past are incorporated in the average rate.<br />

In the second possibility the result is locked in and the next average rate reflects the breakeven<br />

for the new deals.<br />

© FINANCE TRAINER International Risk Management / Seite 12 von 116

Position keeping if the base currency is the domestic currency<br />

In continental Europe, the switch to the Euro poses the problem that the positions are kept<br />

and valued in the domestic currency. Thus, the position in the base currency is no longer<br />

automatically the open FX position. The open FX position is now the position in the base<br />

currency or pr<strong>of</strong>its/losses, which incur if the valuation is done at the valuation rate in the<br />

domestic currency.<br />

You buy EUR/USD 10m at <strong>1.</strong>1835 and buy EUR/USD 12m at <strong>1.</strong>1837.<br />

You sell EUR/USD 22m at <strong>1.</strong>1838. Furthermore, you buy EUR/USD<br />

10m at <strong>1.</strong>1840 and sell EUR/USD 5m at <strong>1.</strong>1842.<br />

What is your position and result at the end <strong>of</strong> the day if you revalue<br />

your position against a EUR/USD closing rate <strong>of</strong> <strong>1.</strong>1837<br />

Position base<br />

currency<br />

Rate<br />

Position quote<br />

currency<br />

Total position<br />

Average Rate<br />

+ 10.000.000 1,1835 - 1<strong>1.</strong>835.000 + 10.000.000 1,18350<br />

+ 10.000.000 1,1837 - 14.204.400 + 22.000.000 1,18360<br />

+ 10.000.000 1,1840 - 1<strong>1.</strong>840.000 + 32.000.000 1,18370<br />

- 22.000.000 1,1838 + 26.043.600 + 10.000.000 1,18350<br />

- 5.000.000 1,1842 + 5.92<strong>1.</strong>000 + 5.000.000 1,18296<br />

+ 5.000.000 - 5.914.800 1,18296<br />

You are Euro 5m long at a EUR/USD rate <strong>of</strong> <strong>1.</strong>18296. You earn a<br />

pr<strong>of</strong>it <strong>of</strong> 0.00074 Euro per USD (<strong>1.</strong>1837 – <strong>1.</strong>18296). With 5m Euro,<br />

that is 3,700 USD or 3,125.79 Euro.<br />

Keeping a closed position<br />

Usually, positions are kept in the base currency. If the position in the base currency is closed<br />

you have two possibilities to continue your position keeping:<br />

a) You fix the result <strong>of</strong> the closed position and start with a new calculation <strong>of</strong> the<br />

average rate. In the final valuation the result <strong>of</strong> the closed position must be taken into<br />

account separately.<br />

© FINANCE TRAINER International Risk Management / Seite 13 von 116

) You skip the transaction that would close your position and re-insert it for valuation<br />

later. This way, you can calculate an average rate covering all transactions, against<br />

which you can make a valuation.<br />

In the morning you buy EUR/USD 10m at 1,1835 and EUR/USD 12m<br />

at 1,1837. You sell EUR/USD 22m at <strong>1.</strong>1838. In the afternoon, you<br />

buy EUR/USD 10m at <strong>1.</strong>1840 and sell EUR/USD 5m at <strong>1.</strong>1842.<br />

What is your position and result at the end <strong>of</strong> the day if you revalue<br />

your position at a EUR/USD closing rate <strong>of</strong> <strong>1.</strong>1837<br />

Option 1<br />

Step 1<br />

Position base<br />

currency<br />

Rate<br />

Position quoted<br />

currency<br />

Total position<br />

Average Rate<br />

+ 10.000.000 1,1835 - 1<strong>1.</strong>835.000 + 10.000.000 1,1835<br />

+ 12.000.000 1,1837 - 14.204.400 + 22.000.000 1,18360909<br />

- 22.000.000 1,1838 + 26.043.600 0<br />

0 + 4.200<br />

Step 2<br />

Position base<br />

currency<br />

Rate<br />

Position quoted<br />

currency<br />

Total position<br />

Average rate<br />

+ 10.000.000 1,1840 + 1<strong>1.</strong>840.000 + 10.000.000 1,1840<br />

- 5.000.000 1,1842 - 5.92<strong>1.</strong>000 + 5.000.000 1,1838<br />

+ 5.000.000 + 5.919.000 1,1838<br />

You have a loss <strong>of</strong> 500 USD (5,000,000 x (<strong>1.</strong>1837 – <strong>1.</strong>1838) on the<br />

5m Euro. If you add the pr<strong>of</strong>it <strong>of</strong> USD 4,200 from the first transaction,<br />

the total result is a pr<strong>of</strong>it <strong>of</strong> USD 3,700 or 3,700 / <strong>1.</strong>1837 = 3125.79<br />

Euro.<br />

© FINANCE TRAINER International Risk Management / Seite 14 von 116

Option 2<br />

Position base<br />

currency<br />

Rate<br />

Position quote<br />

currency<br />

Total position<br />

Average rate<br />

+ 10.000.000 1,1835 - 1<strong>1.</strong>835.000 + 10.000.000 1,18350<br />

+ 12.000.000 1,1837 - 14.204.400 + 22.000.000 1,18360<br />

+ 10.000.000 1,1840 - 1<strong>1.</strong>840.000 + 32.000.000 1,18370<br />

- 22.000.000 1,1838 + 26.043.600 + 10.000.000 1,18350<br />

- 5.000.000 1,1842 + 5.92<strong>1.</strong>000 + 5.000.000 1,18296<br />

+ 5.000.000 - 5.914.800 1,182960<br />

Your pr<strong>of</strong>it is 5m x 0.00074 = USD 3,700.<br />

Independently <strong>of</strong> the calculation you receive the same result.<br />

© FINANCE TRAINER International Risk Management / Seite 15 von 116

<strong>1.</strong>3. Liquidity <strong>risk</strong><br />

As a basic principle, one distinguishes between two basic types <strong>of</strong> liquidity <strong>risk</strong>:<br />

<br />

<br />

Refinancing or Funding Risk<br />

Refinancing <strong>risk</strong> represents the <strong>risk</strong> that liabilities cannot be met due to the lack <strong>of</strong><br />

(regular) refinancing or funding sources. This kind <strong>of</strong> <strong>risk</strong> might materialise in the form <strong>of</strong><br />

unexpectedly high costs for (short-term) funding in the simplest case or in the form <strong>of</strong><br />

illiquidity in the most extreme case. A shortage <strong>of</strong> funding need not be the result <strong>of</strong> a<br />

deteriorated credit quality <strong>of</strong> the bank but may also be caused by general market<br />

circumstances.<br />

Refinancing <strong>risk</strong> exists whenever the assets <strong>of</strong> a bank (e.g. loans) are committed for a<br />

longer maturity than liabilities (e.g. savings), which means that the refinancing <strong>of</strong> the<br />

assets is not guaranteed for their whole maturity.<br />

Asset Liquidity Risk<br />

Asset liquidity <strong>risk</strong> stands for the <strong>risk</strong> that certain assets <strong>of</strong> a bank cannot be sold or can<br />

only be sold at an extraordinarily high bid-ask spread. This kind <strong>of</strong> liquidity <strong>risk</strong> may also<br />

be seen as a subcategory <strong>of</strong> market <strong>risk</strong>.<br />

© FINANCE TRAINER International Risk Management / Seite 16 von 116

<strong>1.</strong>4. Operational Risks<br />

The Basel II Committee distinguishes between operational <strong>risk</strong>s that can be attributed to<br />

internal or external sources.<br />

The first class includes the <strong>risk</strong> <strong>of</strong> loss resulting from inadequate or failed<br />

internal processes,<br />

people and<br />

systems.<br />

Operational <strong>risk</strong>s represent all those <strong>risk</strong>s that are caused by malfunctioning systems in<br />

banks. These may be computer shutdowns as well as inadequate organisational foundations<br />

within the banks.<br />

Even if banks are determined to establish the best systems and processes possible, the <strong>risk</strong><br />

still exists that established procedures are bypassed with criminal intent by individuals.<br />

The following <strong>risk</strong>s fall within the class <strong>of</strong> external operational <strong>risk</strong>s:<br />

Political <strong>risk</strong>s<br />

Changes in the political landscape may have influences on the bank’s business opportunities<br />

as well as on the business conditions which the bank’s partners are facing.<br />

Image <strong>risk</strong>s<br />

Due to the fact that banks are operating in a highly sensitive area (managing someone else’s<br />

money), their business connections are very vulnerable to a possible loss <strong>of</strong> image. Rumours<br />

and/or scandals may lead to greater business losses, even though the economic effects<br />

themselves might be headed <strong>of</strong>f easily by the bank.<br />

Legal <strong>risk</strong>s and <strong>risk</strong>s <strong>of</strong> statutory regulations<br />

Some <strong>risk</strong>s cannot be influenced by banks, but could still play a role for the total <strong>risk</strong> <strong>of</strong> the<br />

bank. These <strong>risk</strong>s could be legal uncertainties during the treaty’s drafting as well as <strong>risk</strong>s that<br />

are a result <strong>of</strong> possible changes in statutory regulations.<br />

© FINANCE TRAINER International Risk Management / Seite 17 von 116

2. Risk Management<br />

2.<strong>1.</strong> Market Risk Measurement Methods<br />

In the following section we would like to present different methods <strong>of</strong> <strong>risk</strong> measurement,<br />

using the example <strong>of</strong> interest rate <strong>risk</strong> measurement. The methods will be briefly explained<br />

using a simple example and will then be applied to a standard example portfolio. Finally, the<br />

advantages and disadvantages <strong>of</strong> each method will be listed.<br />

ACCRUAL<br />

MTM APPROACHES<br />

Shows impact <strong>of</strong><br />

interest rate<br />

changes on net<br />

interest income<br />

Estimates the price<br />

change which is<br />

due to a change in<br />

the interest rate<br />

MODIFIED<br />

DURATION<br />

Calculates the<br />

impact <strong>of</strong><br />

discretionary yield<br />

curve changes on<br />

interest positions<br />

KEY RATE<br />

DURATION<br />

(Scenario<br />

analysis)<br />

Calculates the<br />

impact <strong>of</strong> historical<br />

rate changes with<br />

the regard to<br />

current interest<br />

VOLATILITY<br />

CONCEPT<br />

Calculates the<br />

impact <strong>of</strong> historical<br />

rate changes<br />

having regard to<br />

correlations on the<br />

current interest<br />

position<br />

VALUE AT<br />

RISK<br />

The only method to<br />

make all market<br />

and credit <strong>risk</strong>s<br />

comparable<br />

GAP<br />

METHOD<br />

© FINANCE TRAINER International Risk Management / Seite 18 von 116

Our <strong>trading</strong> book<br />

Position Product Volume Rate Term<br />

1 Bond - 50,000,000 5.00% 3 years<br />

2 Bond - 50,000,000 6.00% 7 years<br />

3 Buy IRS 1 + 100,000,000 5.50% 5 years<br />

4 Interbank + 100,000,000 3.50% 6 months<br />

We assume the following yield curve for our example calculations:<br />

Position<br />

Yield<br />

ON 2.25%<br />

6 months 3.50%<br />

1 year 4.00%<br />

2 year 4.50%<br />

3 year 5.00%<br />

4 year 5.25%<br />

5 year 5.50%<br />

6 year 5.75%<br />

7 year 6.00%<br />

2.<strong>1.</strong><strong>1.</strong> Risk Measurement using the GAP Method<br />

Basic Principle: The GAP method assesses the change in the annual pr<strong>of</strong>it and loss account<br />

that will be caused given a defined change in interest rates. The basic underlying assumption<br />

is that the bank’s interest rate positions are not sold before maturity. Therefore, possible<br />

market value changes <strong>of</strong> positions due to interest rate changes are neglected and only the<br />

impact on annual interest earnings and expenditures is taken into consideration.<br />

The supposed interest rate change may be a parallel shift <strong>of</strong> the yield curve or more complex<br />

interest changes regarding the level <strong>of</strong> interest rates and the shape <strong>of</strong> the yield curve.<br />

Depending on the time horizon, the projected interest earnings will only be influenced by the<br />

changes <strong>of</strong> money market rates. The GAP analysis is therefore mainly used in classic ALM<br />

<strong>of</strong> interest <strong>risk</strong> and is only used for positions <strong>of</strong> the banking book (i.e. interest rate positions<br />

1 5-year fixed rate against 6-month EURIBOR<br />

© FINANCE TRAINER International Risk Management / Seite 19 von 116

that are originated via the customer business and interest positions which the bank intends to<br />

hold unto maturity (“buy and hold")).<br />

Loan 12 months, 100m, 3.00%<br />

Deposit ON, 100m, 2.25%<br />

GAP report<br />

ON 12 months Sum<br />

Assets 100 100<br />

Rate 3.00% 3.00%<br />

Liabilities 100 100<br />

Rate 2.25% 2.25%<br />

Net interest income is projected to be 0.75%. In order to measure the <strong>risk</strong> <strong>of</strong> this projection,<br />

we suppose that short term rates change (here: increase).<br />

Given a supposed interest rate increase <strong>of</strong> 1% we receive the following picture:<br />

ON 12 months Sum<br />

Assets 100 100<br />

Rate 3.00% 3.00%<br />

+ 1%<br />

Liabilities 100 100<br />

Rate 3.25% 3.25%<br />

Net interest income has now been reduced to –0.25%. The <strong>risk</strong> <strong>of</strong> loss would therefore be<br />

EUR 0.25m (100m * 0.25%)<br />

© FINANCE TRAINER International Risk Management / Seite 20 von 116

Example: GAP report for example portfolio<br />

6 m 3 years 5 years 7 years Sum<br />

Assets 100 (2) 50 (3) 50 (4) 200<br />

Rate 3.50% 5.00% 6.00% 4.50%<br />

Liabilities 100 (1) 100 (2) 200<br />

Rate 3.50% 5.50% 4.50%<br />

Net interest<br />

income:<br />

0.00<br />

(1) Interbank Refinancing<br />

(2) Buy IRS<br />

(3) Bond 3 years<br />

(4) Bond 7 years<br />

Given the current situation, net interest income is projected to equal 0%. The reason is that<br />

the weighted average interest <strong>of</strong> the bank’s assets equals the weighted average interest <strong>of</strong><br />

their liabilities.<br />

Because an increase or decrease in money market rates impacts the asset side and the<br />

liabilities side by the same amount, the projected net interest income will be the same for any<br />

scenario.<br />

The GAP methodology therefore shows no interest rate <strong>risk</strong> for our example portfolio.<br />

© FINANCE TRAINER International Risk Management / Seite 21 von 116

Advantages and Drawbacks <strong>of</strong> the GAP Methodology<br />

Advantages<br />

Simple handling: If basis positions and their interest pr<strong>of</strong>iles are known, <strong>risk</strong> can be<br />

calculated in a relatively simple and straightforward way.<br />

The GAP methodology is the only kind <strong>of</strong> interest <strong>risk</strong> measurement that depicts<br />

changes in the bank’s net interest income.<br />

Drawbacks<br />

Assumptions have to be made on how expiring positions are renewed. The most basic<br />

assumption is to renew all expiring transactions on an ON basis.<br />

The GAP analysis implies an unchanging <strong>risk</strong> structure, so that effects <strong>of</strong> interest rate<br />

changes over the course <strong>of</strong> time cannot be illustrated (at least in a systematic way).<br />

MTM effects are ignored. The GAP analysis explains only the net interest margin or the<br />

part <strong>of</strong> the interest result that can be explained by interest rate <strong>risk</strong>s which the bank has<br />

taken. As soon as interest rate products have to be mark-to-market (e.g. bonds in the<br />

<strong>trading</strong> book, derivatives …), the GAP analysis will only explain a certain part <strong>of</strong> the<br />

bank’s interest result and thus its <strong>risk</strong>.<br />

The assumptions on how the yield curve will change are arbitrary. Comparisons with<br />

other <strong>risk</strong>s (e.g. FX, stocks, <strong>trading</strong> book) are not possible.<br />

Conclusion<br />

It is insufficient to quantify interest rate <strong>risk</strong> using the GAP analysis as the sole method. The<br />

information <strong>of</strong> the GAP report on changes <strong>of</strong> the net interest margin, however, is an<br />

important decision criterion when managing the bank’s banking book.<br />

© FINANCE TRAINER International Risk Management / Seite 22 von 116

2.<strong>1.</strong>2. Risk Measurement using the Duration Approach<br />

The duration approach is probably the best-known key figure for measuring interest rate <strong>risk</strong>.<br />

Originally, the duration was mainly used for fixed rate bonds. Now the duration is used for all<br />

interest rate positions. There are two types <strong>of</strong> duration: the Macaulay Duration (or: simple<br />

duration) and the so-called Modified Duration. The calculation <strong>of</strong> both durations is similar;<br />

their interpretation, however, differs significantly.<br />

The Macaulay duration is de facto irrelevant for bank’s internal <strong>risk</strong> measurement. However<br />

in order to explain the concept <strong>of</strong> duration in general, we will explain the basic principle and<br />

interpretation <strong>of</strong> the Macaulay duration and its application.<br />

Simple Duration (Macaulay Duration)<br />

Basic Principle<br />

The Macaulay Duration <strong>of</strong> a bond is the length <strong>of</strong> time over which the losses / pr<strong>of</strong>its due to a<br />

one-time change in interest rates are <strong>of</strong>fset by the higher / lower interest rate that the bond<br />

holder receives on reinvested coupon payments.<br />

Formula: Macaulay Duration<br />

D<br />

Macaulay<br />

=<br />

N<br />

∑<br />

n=<br />

1<br />

N<br />

∑<br />

n=<br />

1<br />

n x CF<br />

( 1+<br />

r)<br />

CF<br />

n<br />

n<br />

n<br />

( 1+<br />

r) n<br />

D Macaulay<br />

n<br />

N<br />

CF n<br />

r<br />

= Macaulay Duration<br />

= year index<br />

= total maturity in years<br />

= cash flow in year n<br />

= current yield for total maturity<br />

© FINANCE TRAINER International Risk Management / Seite 23 von 116

Simple example <strong>of</strong> application<br />

Bond 3 years; coupon 5%<br />

1 2 3 4 5<br />

(1⋅ 2)<br />

2<br />

Year cash flow (1+r) t<br />

3<br />

3<br />

1 5 <strong>1.</strong>05000 4.76190 4.76190<br />

2 5 <strong>1.</strong>10250 9.07029 4.53515<br />

3 105 <strong>1.</strong>15763 272.10767 90.70320<br />

Sum 285.93986 100.00000<br />

Macaulay duration:<br />

285.93986 =<br />

100<br />

2.86<br />

Information: A yield <strong>of</strong> 5% is guaranteed over an investment horizon <strong>of</strong> 2.86 years.<br />

fixed-rate bond at: 100<br />

maturity:<br />

3 years<br />

coupon: 5%<br />

duration:<br />

2.86 years<br />

maturity<br />

market yield 5% market yield 6%<br />

price +<br />

price interest interest price interest<br />

price +<br />

interest<br />

cash<br />

flow<br />

1 5 100 5 105 98.17 5 103.17<br />

2 5 100 5 + 0.25 110.25 99.06 5 + 0.30 109.36<br />

2.86 100 4 .3 + 0.44 114.99 99.86 4.3 + 0.53 114.99<br />

3 105 100 5 + 0.51 115.51 100 5 + 0.56 115.56<br />

coupon<br />

interest on reinvested<br />

coupon (50 x 5 %)<br />

© FINANCE TRAINER International Risk Management / Seite 24 von 116

Statement<br />

Investors buying a 3-year fixed-rate bond should have an investment horizon <strong>of</strong> 2.86 years if<br />

they want to ensure a certain yield on their investment. If the bond is sold earlier, the investor<br />

is exposed to the <strong>risk</strong> <strong>of</strong> rising interest rates (which means falling bond prices), and the yield<br />

is thus not ensured.<br />

Therefore, the Macaulay duration should be read as an investment horizon and cannot be<br />

used as a <strong>risk</strong> figure for pr<strong>of</strong>essional <strong>trading</strong>. What is more, the assumptions <strong>of</strong> a flat yield<br />

curve (i.e. coupons can be reinvested at the current bond yield) and only one change <strong>of</strong> the<br />

yield level are quite unrealistic. Therefore, the informative value <strong>of</strong> the Macaulay duration has<br />

to be questioned.<br />

In the worst case, interest rates fall at the beginning <strong>of</strong> the bond investment, so that the<br />

interest on the reinvested coupon is low, and rise at the end <strong>of</strong> the investment horizon, which<br />

causes the price <strong>of</strong> the bond to decline. Under this scenario, the bond investment would yield<br />

a lower return than ‘promised’ by the Macaulay duration.<br />

Modified Duration<br />

Basic principle: The modified duration is an estimation <strong>of</strong> the price change <strong>of</strong> an interest<br />

instrument due to changes in the price <strong>of</strong> the respective market interest rates. Thus, the<br />

modified duration shows the sensitivity <strong>of</strong> interest instruments to supposed interest rate<br />

changes. In contrast to the GAP analysis, <strong>risk</strong> is not calculated as a change in the annual net<br />

interest income, but as the change <strong>of</strong> mark-to-market prices under specified (interest rate)<br />

scenarios.<br />

MD<br />

MD<br />

n<br />

N<br />

CF n<br />

r<br />

=<br />

N<br />

∑<br />

n=<br />

1<br />

N<br />

∑<br />

n=<br />

1<br />

n x CF<br />

( 1+<br />

r)<br />

CF<br />

n<br />

n<br />

( 1+<br />

r)<br />

n<br />

n<br />

1<br />

x<br />

1+<br />

r<br />

= Modified Duration<br />

= year index<br />

= total maturity in years<br />

= cash flow in year n<br />

= current yield (for total maturity)<br />

© FINANCE TRAINER International Risk Management / Seite 25 von 116

Comparing the two duration formulas, one finds the following relationship:<br />

MD = D<br />

Macaulay<br />

1<br />

x<br />

1+<br />

r<br />

Looking at the formula for the Macaulay duration, one can see that the Macaulay duration<br />

could be also described as the maturity-weighted present value <strong>of</strong> the cash flows, or as the<br />

present value-weighted average capital tie-up.<br />

fixed rate coupon, price: 100<br />

maturity:<br />

3 years<br />

coupon: 5%<br />

1 2 3 4 5<br />

Year cash flow 1/(1+r) t 1*2*3 2*3<br />

285.94179<br />

MD = x<br />

100.00<br />

1 5 0.95238 4.76190 4.76190<br />

2 5 0.90703 9.07029 4.53515<br />

3 105 0.86384 272.10960 90.70320<br />

Sum 285.94179 100.00000<br />

1<br />

( 1+<br />

0.05)<br />

=<br />

2.72<br />

The modified duration <strong>of</strong> the 3-year coupon equals 2.72. Using this number, one is able to<br />

estimate the price change <strong>of</strong> the bond given a supposed change in market interest rates.<br />

Let’s assume that the current price <strong>of</strong> the bond stands at 10<strong>1.</strong>00. The modified duration <strong>of</strong><br />

2.72 means that a 1% change <strong>of</strong> the yield will change the price <strong>of</strong> the bond by 2.72%, i.e.<br />

2.75 (=10<strong>1.</strong>00 * 2.72%).<br />

By using the modified duration the price sensitivity for each single position is calculated. For<br />

the assumed interest changes the effects on the value <strong>of</strong> the portfolio are then calculated.<br />

Example portfolio<br />

Product volume interest rate Maturity MD<br />

bond - 50,000,000 5.00% 3 years 2.72<br />

Bond - 50,000,000 6.00% 7 years 5.58<br />

buy IRS + 100,000,000 5.50% 5 years 3.78 (*)<br />

Interbank + 100,000,000 3.50% 6 months 0.49<br />

(*) Modified Duration <strong>of</strong> the IRS position calculated by synthetic positions (5.50% issue 5 years (fixed leg) and 3.5% asset 6<br />

months (variable leg))<br />

© FINANCE TRAINER International Risk Management / Seite 26 von 116

Product volume MD pr<strong>of</strong>it / loss<br />

bond 3 years - 50,000,000 2.72 - 1,360,000<br />

bond 7 years - 50,000,000 5.58 - 2,790,000<br />

IRS + 100,000,000 3.78 + 3,780,000<br />

Interbank + 100,000,000 0.49 + 490,000<br />

TOTAL RISK + 120,000<br />

(50,000,000 * 1 % * 5,58)<br />

If interest rates increase by 1%, the MTM result will increase by 120,000. If interest rates<br />

decrease by 1%, the MTM result will be reduced by 120,000. Therefore, the <strong>risk</strong> assuming a<br />

1% change in interest rates is established as 120,000.<br />

Even though the modified duration was originally designed to measure the <strong>risk</strong> <strong>of</strong> fixed-rate<br />

bonds, the concept can nevertheless be applied to the total interest rate position <strong>of</strong> the bank.<br />

This applied to on-balance assets and liabilities positions as well as to derivative products.<br />

The main advantages <strong>of</strong> this method are<br />

Simple handling and calculation<br />

High acceptance level due to simple statements and interpretation<br />

Costs due to any need to sell a position before maturity are taken into account<br />

No assumptions necessary regarding the roll-over <strong>of</strong> expiring positions<br />

Drawbacks / points <strong>of</strong> criticism<br />

<br />

<br />

<br />

<br />

Flat yield curve is assumed<br />

Basic calculation does not include the effect <strong>of</strong> yield curve changes<br />

Assumed interest rate changes are arbitrary and the resulting <strong>risk</strong> figures cannot be<br />

compared to other <strong>risk</strong>s<br />

The calculated <strong>risk</strong> figure is a pure MTM <strong>risk</strong> containing no information on net interest<br />

income<br />

Consequences<br />

The duration approach is well-suited for the estimation <strong>of</strong> the <strong>risk</strong> <strong>of</strong> individual positions and<br />

thus for determining the necessary volume <strong>of</strong> hedge transactions (e.g. the hedge <strong>of</strong> a bond<br />

© FINANCE TRAINER International Risk Management / Seite 27 von 116

with futures). A simple duration approach, however, is not suited for the <strong>risk</strong> measurement <strong>of</strong><br />

a complex <strong>trading</strong> book.<br />

© FINANCE TRAINER International Risk Management / Seite 28 von 116

2.<strong>1.</strong>3. Risk measurement using the Present Value <strong>of</strong> a Basis Point<br />

(PVBP)<br />

Basic Principle<br />

As is the case with the duration approach, the Present Value <strong>of</strong> a Basis Point (PVBP)<br />

method does not estimate changes <strong>of</strong> the annual net interest income, but the change in the<br />

present value <strong>of</strong> a position. To do so, the exact times <strong>of</strong> the cash flows <strong>of</strong> the position<br />

(nominal and coupon payments) are identified and mapped to an available number <strong>of</strong> zero<br />

rates. Then, value changes are calculated for each mapped amount <strong>of</strong> cash flow assuming a<br />

change <strong>of</strong> 1 basis point (BP) <strong>of</strong> the underlying zero rate.<br />

The determined <strong>risk</strong> numbers <strong>of</strong> all positions are aggregated for each zero rate and used for<br />

the <strong>risk</strong> measurement. A final <strong>risk</strong> figure is attained by assuming interest rate changes (<strong>of</strong> the<br />

zero curve).<br />

Example PVBP<br />

position<br />

bond: 3 years<br />

coupon 5%<br />

volume<br />

50m<br />

(1) (2) (3) (4) (5)<br />

Year cash flow interest rate discount factor<br />

present value<br />

(2*3)<br />

1 2,500,000 4.00% 0.96153846 2,403,846<br />

2 2,500,000 4.50% 0.91553184 2,288,830<br />

3 52,500,000 5.00% 0.86299665 45,307,324<br />

Sum 50,000,000<br />

result for + 0.01% interest rate change<br />

(1) (2) (3) (4) (5)<br />

Year cash flow interest rate discount factor<br />

present value<br />

(2*3)<br />

1 2,500,000 4.01% 0.96144601 2,403,615<br />

2 2,500,000 4.51% 0.91535622 2,288,391<br />

3 52,500,000 5.01% 0.86274851 45,294,297<br />

sum: 49,986,302<br />

differential: -13,698<br />

Interpretation: Given a shift in the zero curve <strong>of</strong> 1bp (0.01%), there will be a MTM loss <strong>of</strong><br />

13,698 on the first bond position (50m, 3 years, 5% coupon).<br />

© FINANCE TRAINER International Risk Management / Seite 29 von 116

Our Trading Book<br />

Product volume rate maturity PVBP<br />

Bond - 50,000,000 5.00% 3 years - 13,697.75<br />

Bond - 50,000,000 6.00% 7 years - 28,419.30<br />

buy IRS + 100,000,000 5.50% 5 years + 38,235.51<br />

Interbank + 100,000,000 3.50% 6 months + 4,913.76<br />

<strong>risk</strong> with<br />

+ 100 bp<br />

interest rate change<br />

product volume PVBP pr<strong>of</strong>it / loss<br />

bond 3 years - 50,000,000 - 13,698 - 1,369,775<br />

bond 7 years - 50,000,000 - 28,419 - 2,841,930<br />

IRS + 100,000,000 + 38,236 + 3,823,551<br />

Interbank + 100,000,000 + 4,914 + 491,376<br />

TOTAL RISK + 103,222<br />

Interpretation<br />

(- 28,419.30 * 100)<br />

If interest rates increase by 100bp, the present value <strong>of</strong> the example portfolio will increase by<br />

103,222. The <strong>risk</strong> (which is here the decrease <strong>of</strong> interest rates) is therefore established as<br />

103,222.<br />

Advantages (as with the Duration Method)<br />

<br />

<br />

<br />

<br />

<br />

Simple handling and calculation<br />

High acceptance level due to simple statements and interpretation<br />

Costs due to any need to sell a position before maturity are taken into account<br />

No assumptions necessary regarding the roll-over <strong>of</strong> expiring positions<br />

The shape <strong>of</strong> the current zero curve is taken into account<br />

Drawbacks / points <strong>of</strong> criticism (as with the Duration Method)<br />

<br />

Basic calculation does not include the effect <strong>of</strong> yield curve changes<br />

© FINANCE TRAINER International Risk Management / Seite 30 von 116

Assumed interest rate changes are arbitrary and the resulting <strong>risk</strong> figures cannot be<br />

compared to other <strong>risk</strong>s<br />

The calculated <strong>risk</strong> figure is a pure MTM <strong>risk</strong> containing no information on net interest<br />

income<br />

Conclusion<br />

Basically, the PVBP approach is a refined duration approach that also takes the present yield<br />

curve into account. The basic drawbacks <strong>of</strong> the duration approach remain the same,<br />

however. Therefore, the PVBP approach may “only” be used as an alternative for the<br />

duration method that also allows the use <strong>of</strong> operative limits for maturity bands.<br />

© FINANCE TRAINER International Risk Management / Seite 31 von 116

2.<strong>1.</strong>4. Key Rate Duration (Scenario Analysis)<br />

Basic Principle<br />

As for the Key Rate Duration, the Present Values <strong>of</strong> a Basis Point (or the respective<br />

Duration) are calculated and shown for the cash flows that are mapped to the different<br />

maturity bands rather than on an aggregated basis for each individual position. Thus each<br />

position is divided up into its cash flows. The <strong>risk</strong> is then calculated by moving the interest<br />

rate curve and calculating the effect for the different maturity bands separately.<br />

Example Key Rate Duration<br />

bond: 3 years<br />

coupon: 5%<br />

volume: 50m<br />

In a first step, the PVBP <strong>of</strong> 13.698 (see previous calculation) is allocated to the different<br />

maturity bands<br />

year cash flow interest rate<br />

discount present<br />

factor value (1)<br />

1 2,500,000 4.00% 0.96153846 2,403,846<br />

2 2,500,000 4.50% 0.91553184 2,288,830<br />

3 52,500,000 5.00% 0.86299665 45,307,324<br />

Sum 50,000,000(1)<br />

result with + 0.01% interest rate change<br />

year cash flow interest rate<br />

discount present differential<br />

factor value (2)<br />

(2)-(1)<br />

1 2,500,000 4.01% 0.96144601 2,403,615 - 231<br />

2 2,500,000 4.51% 0.91535622 2,288,391 - 439<br />

3 52,500,000 5.01% 0.86274851 45,294,297 - 13,028<br />

Sum 49,986,302 - 13,698<br />

© FINANCE TRAINER International Risk Management / Seite 32 von 116

0<br />

-2000<br />

-4000<br />

-6000<br />

-8000<br />

-10000<br />

-12000<br />

-14000<br />

1 year 2 years 3 years<br />

-231<br />

-439<br />

-13,028<br />

PVBP<br />

Subsequently, present value results are calculated for different supposed interest rate<br />

curves. In our simple example we assume a steepening interest rate curve for scenario 1 and<br />

an inverted interest rate curve for scenario 2.<br />

SCENARIO ANALYSIS 1 year 2 years 3 years Key Rate Duration<br />

current rates 4.00% 4.50% 5.00%<br />

PVBP - 231 - 439 - 13,028<br />

scenario 1 4.00% 5.00% 6.00%<br />

Result 0 - 21,950 - 1,302,800 - 1,324,750<br />

scenario 2 6.00% 5.00% 4.00%<br />

Result - 46,200 - 21,950 + 1,302,800 + 1,234,650<br />

- 439 * 50<br />

Scenario 1 would therefore cause a loss on the current positions, scenario 2 a pr<strong>of</strong>it.<br />

Consequently, a <strong>risk</strong> <strong>of</strong> 1,324,750 would be reported.<br />

Our Trading Book<br />

product volume rate maturity<br />

bond - 50,000,000 5.00% 3 years<br />

bond - 50,000,000 6.00% 7 years<br />

buy IRS + 100,000,000 5.50% 5 years<br />

interbank + 100,000,000 3.50% 6 months<br />

© FINANCE TRAINER International Risk Management / Seite 33 von 116

We get the following picture by calculating the PVBPs for the individual cash flows in the<br />

different maturity bands.<br />

50,000<br />

40,000<br />

37,498<br />

30,000<br />

20,000<br />

10,000<br />

779<br />

1,231<br />

0<br />

1 Y<br />

-10,000<br />

2 Y 3 Y 4 Y 5 Y 6 Y 7 Y<br />

-20,000<br />

-12,407<br />

-30,000<br />

-23,607<br />

PVBP<br />

We assume again a steepening interest rate curve for scenario <strong>1.</strong> Scenario 2 represents a<br />

parallel interest rate increase by 100 basis points.<br />

Scenario Analysis<br />

PVBP<br />

current<br />

rates<br />

scenario 1 pr<strong>of</strong>it / loss scenario 2 pr<strong>of</strong>it / loss<br />

6 months 0 3.50% 3.50% 0 4.50% 0<br />

1 year 0 4.00% 4.00% 0 5.00% 0<br />

2 years 0 4.50% 4.25% 0 5.50% 0<br />

3 years - 12,407 5.00% 4.75% + 310,181 6.00% - 1,240,723<br />

4 years 779 5.25% 5.25% 0 6.25% + 77,949<br />

5 years 37,498 5.50% 5.75% + 937,444 6.50% 3,749,774<br />

6 years - 1,231 5.75% 6.38% - 76,933 6.75% - 123,092<br />

7 years - 23,607 6.00% 7.00% - 2,360,687 7.00% - 2,360,687<br />

Key Duration Rate - 1,189,995 + 103,222<br />

- 12.407 * - 25<br />

Therefore, we would calculate a <strong>risk</strong> <strong>of</strong> 1,189,995 for our <strong>trading</strong> portfolio. Under scenario 2<br />

(parallel shift), the result equals exactly the <strong>risk</strong> that we received using the PVBP approach<br />

(assuming a 100bp shift).<br />

© FINANCE TRAINER International Risk Management / Seite 34 von 116

Advantages<br />

<br />

<br />

<br />

<br />

Costs due to any need to sell a position before maturity are taken into account<br />

No assumptions necessary regarding the roll-over <strong>of</strong> expiring positions<br />

Changes in the shape <strong>of</strong> the interest rate curve can be simulated<br />

Relatively simple handling: if the timetable <strong>of</strong> cash flows is known, <strong>risk</strong> can be calculated<br />

for a variety <strong>of</strong> possible scenarios in a straightforward way<br />

Drawbacks / points <strong>of</strong> criticism<br />

<br />

<br />

<br />

<br />

The possible interest curves can only be built up by scenarios. As the number <strong>of</strong><br />

possible yield curves is endless, we cannot ensure that the computed scenarios<br />

correspond to real life scenarios. Additionally changing the scenarios may lead to a<br />

changed <strong>risk</strong> figure even if the positions are not changed.<br />

The assumptions on how the interest rate curve changes are arbitrary and don’t allow<br />

comparisons to other <strong>risk</strong> figures.<br />

The assumption by how much interest rates change is still arbitrary. This means that it<br />

remains difficult to compare the computed <strong>risk</strong> figures with other <strong>risk</strong> types.<br />

The calculated <strong>risk</strong> figure is a pure MTM <strong>risk</strong> containing no information on net interest<br />

income<br />

Conclusion<br />

The key rate duration is the first <strong>of</strong> the approaches presented that allows the quantifying <strong>of</strong><br />

the interest curve <strong>risk</strong>. Due to the arbitrary definition <strong>of</strong> scenarios, the use <strong>of</strong> the methodology<br />

as an objective and systematic <strong>risk</strong> measurement approach is very limited. The methodology<br />

is <strong>of</strong>ten used by banks for stress testing, where extreme yield curve movements are<br />

assumed and the reported <strong>risk</strong> figure is compared with the results <strong>of</strong> these scenarios.<br />

© FINANCE TRAINER International Risk Management / Seite 35 von 116

2.<strong>1.</strong>5. Modern <strong>risk</strong> management methods<br />

All <strong>of</strong> the above mentioned <strong>risk</strong> measurement methods focus only on individual types <strong>of</strong> <strong>risk</strong>.<br />

Therefore, the total <strong>risk</strong> can only be determined by adding these individual <strong>risk</strong>s. Possible<br />

effects <strong>of</strong> diversification are not taken into account by these <strong>risk</strong> measurement methods. In<br />

<strong>risk</strong> measurement, the value at <strong>risk</strong> approach (VAR) is currently the most widely used<br />

method. Large banks use this approach mainly to quantify the price <strong>risk</strong>s <strong>of</strong> their <strong>trading</strong><br />

positions. Another incentive to use this approach is that it can also be used to determine the<br />

capital requirements (Capital Adequacy Directive).<br />

The outstanding characteristic <strong>of</strong> all methods employed is to cover different types <strong>of</strong> <strong>risk</strong> -<br />

e.g. share <strong>risk</strong>s, FX <strong>risk</strong>s and interest rate <strong>risk</strong>s – by a standard measurement instruction in<br />

order to consider diversification effects on the aggregation <strong>of</strong> <strong>risk</strong>s.<br />

Generally, the value at <strong>risk</strong> approach refers to the negative change in value (measured in<br />

absolute terms) <strong>of</strong> an individual position or <strong>of</strong> a portfolio, which is not exceeded during a<br />

certain time with a certain probability.<br />

2.<strong>1.</strong>6. Excursus: Probability theory<br />

Modern <strong>risk</strong> management is based on statistical methods to a large degree. It is therefore<br />

important to have some knowledge <strong>of</strong> the relevant statistic basics.<br />

The most important statistical key figures are the mean or expected value and the<br />

variance. The mean measures the average size <strong>of</strong> a number <strong>of</strong> values, while the variance<br />

measures to which degree these values vary around the mean.<br />

A variable that randomly takes on different values is called random variable. The average<br />

value (result <strong>of</strong> a great number <strong>of</strong> observations) <strong>of</strong> such a random variable is called expected<br />

value or mean.<br />

© FINANCE TRAINER International Risk Management / Seite 36 von 116

In order to welcome their guests, a hotel in Las Vegas <strong>of</strong>fers the<br />

following gamble:<br />

Each guest is allowed to throw two dice. If the sum <strong>of</strong> pips exceeds<br />

seven, the guest receives the difference in USD. If the sum <strong>of</strong> pips<br />

falls short <strong>of</strong> seven, the guest has to pay the difference to the hotel. If<br />

the sum <strong>of</strong> pips equals seven, no payment is made.<br />

We will now determine if this gamble is “fair” in the sense that the<br />

pr<strong>of</strong>it potential corresponds to the loss potential<br />

Expected Value / Mean<br />

In a first step, we will calculate the expected value <strong>of</strong> the sum <strong>of</strong> pips. We come to this<br />

number by multiplying all possible outcomes by their probabilities and summing them up.<br />

EV<br />

EV<br />

p i<br />

x i<br />

i<br />

= ∑ p i x i<br />

i<br />

= expected value<br />

= probability <strong>of</strong> outcome i<br />

= value (sum <strong>of</strong> dips) <strong>of</strong> outcome i<br />

= index <strong>of</strong> outcomes<br />

The probability <strong>of</strong> each outcome corresponds here to the relative frequency <strong>of</strong> each value.<br />

For one die, the probability for each value equals one sixth (1/6). As there are more<br />

combinations possible that yield a certain value when using two dice, the probabilities for the<br />

individual values differ.<br />

6<br />

5<br />

Häufigkeit<br />

4<br />

3<br />

2<br />

1<br />

0<br />

2 3 4 5 6 7 8 9 10 11 12 Wert<br />

© FINANCE TRAINER International Risk Management / Seite 37 von 116

The expected value equals the sum <strong>of</strong> the probability weighted outcome values. Here, the<br />

expected value equals seven.<br />

Because the pr<strong>of</strong>it / loss threshold is also seven, the gamble can be defined as “fair”.<br />

For a gambler, however, it is also important to know to what degree an outcome might<br />

deviate from the expected value, because the pr<strong>of</strong>it or loss that a gambler makes is not<br />

determined by the expected value <strong>of</strong> a game but by the actual outcome.<br />

The two key figures from the field <strong>of</strong> statistics that are used to assess the variation <strong>of</strong><br />

outcomes around the mean are called variance (σ2) and standard deviation (σ).<br />

Variance<br />

The dispersion <strong>of</strong> a random variable around the mean is measured as the deviation <strong>of</strong><br />

outcomes from the expected value (xi – EV). The variance is calculated as the sum <strong>of</strong><br />

probability-weighted squared deviations <strong>of</strong> the possible outcomes from the mean. Squaring<br />

the deviations has the practical purpose that negative and positive deviations don’t cancel<br />

each other out (in which case the true dispersion would not be measured) and that larger<br />

deviations receive a higher weighting than smaller ones.<br />

Var<br />

Var<br />

EV<br />

p i<br />

x i<br />

i<br />

( x EV )<br />

= ∑ p −<br />

i<br />

i<br />

i<br />

= variance (σ2)<br />

= expected value<br />

= probability <strong>of</strong> outcome xi<br />

= value <strong>of</strong> outcome i<br />

= index <strong>of</strong> outcomes<br />

2<br />

Remark: Whenever a distribution is unknown, the variance has to be estimated by making<br />

observations <strong>of</strong> outcomes (e.g. as is the case for volatile assets). Because the distribution is<br />

unknown, the formula for the estimation <strong>of</strong> the variance looks slightly different. Even though<br />

the probability <strong>of</strong> one observation equals 1/n (where n is the number <strong>of</strong> observations), the<br />

observations are weighted using the term 1/(n-1).<br />

Var<br />

Var<br />

EV<br />

n<br />

x i<br />

i<br />

=<br />

( x − EV )<br />

n<br />

i<br />

∑<br />

i = 1<br />

n −<br />

1<br />

= variance (σ2)<br />

= expected value<br />

= number <strong>of</strong> observations<br />

= value <strong>of</strong> observation i<br />

= index <strong>of</strong> observations<br />

2<br />

© FINANCE TRAINER International Risk Management / Seite 38 von 116

Standard Deviation<br />

The standard deviation equals the square root <strong>of</strong> the variance. In the financial world, the term<br />

volatility is <strong>of</strong>ten used as a synonym for standard deviation. Compared with the variance, the<br />

standard deviation has the advantage that the dimension <strong>of</strong> the standard deviation is the<br />

same as the dimension <strong>of</strong> the observed random variable (e.g. cm, kg or a monetary unit) and<br />

that it can therefore be interpreted intuitively. The variance, on the other hand, represents a<br />

non-dimensional number.<br />

Stdev =<br />

Var<br />

=<br />

∑<br />

i<br />

p<br />

i<br />

*<br />

( x − EV )<br />

i<br />

2<br />

Var = variance (σ2)<br />

Stdev = standard deviation<br />

EV = expected value<br />

pi = probability <strong>of</strong> outcome xi<br />

xi = value <strong>of</strong> outcome i<br />

i = index <strong>of</strong> outcomes<br />

In the case <strong>of</strong> our gamble, the variance is calculated as 5.8. The standard deviation equals<br />

therefore 2.4.<br />

a value 2 3 4 5 6 7 8 9 10 11 12 Summe<br />

b frequency 1 2 3 4 5 6 5 4 3 2 1 36<br />

c prob. 1/36 2/36 3/36 4/36 5/36 6/36 5/36 4/36 3/36 2/36 1/36 1<br />

a * c<br />

a- EW<br />

(a- EW) 2<br />

c * (a- EW) 2<br />

prob. weigh.<br />

values<br />

deviation<br />

from EV<br />

squard<br />

deviation<br />

prob. weigh.<br />

squared dev.<br />

2/36 6/36 12/36 20/36 30/36 42/36 40/36 36/36 30/36 22/36 12/36 252/36 =7<br />

-5 -4 -3 -2 -1 0 1 2 3 4 5 0<br />

25 16 9 4 1 0 1 4 9 16 25 110<br />

25/36 32/36 27/36 16/36 5/36 0/36 5/36 16/36 27/36 32/36 25/36 210/36 =5.83<br />

(EV = 7, Variance = 5.83)<br />

Stdev =<br />

5 .8 =<br />

2.4<br />

© FINANCE TRAINER International Risk Management / Seite 39 von 116

In order to get a better understanding <strong>of</strong> the standard deviation we will have a look at the<br />

probability distribution <strong>of</strong> the gamble.<br />

The following illustration shows the probabilities for all possible outcomes <strong>of</strong> the gamble.<br />

Looking at the probability distribution <strong>of</strong> the gamble, one can calculate the probability that the<br />