Untitled - Cerebral Palsy League

Untitled - Cerebral Palsy League

Untitled - Cerebral Palsy League

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

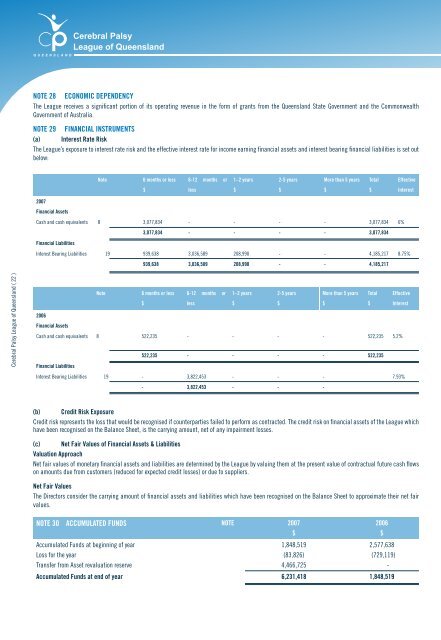

NOTE 28 ECONOMIC DEPENDENCY<br />

The <strong>League</strong> receives a significant portion of its operating revenue in the form of grants from the Queensland State Government and the Commonwealth<br />

Government of Australia.<br />

NOTE 29 FINANCIAL INSTRUMENTS<br />

(a) Interest Rate Risk<br />

The <strong>League</strong>’s exposure to interest rate risk and the effective interest rate for income earning financial assets and interest bearing financial liabilities is set out<br />

below:<br />

Note<br />

6 months or less<br />

6-12 months or<br />

1–2 years<br />

2-5 years<br />

More than 5 years<br />

Total<br />

Effective<br />

$<br />

less<br />

$<br />

$<br />

$<br />

$<br />

Interest<br />

2007<br />

Financial Assets<br />

Cash and cash equivalents 8 3,077,834 - - - - 3,077,834 6%<br />

3,077,834 - - - - 3,077,834<br />

Financial Liabilities<br />

Interest Bearing Liabilities 19 939,638 3,036,589 208,990 - - 4,185,217 8.75%<br />

939,638 3,036,589 208,990 - - 4,185,217<br />

<strong>Cerebral</strong> <strong>Palsy</strong> <strong>League</strong> of Queensland ( 22 )<br />

Note<br />

6 months or less 6-12 months or 1–2 years<br />

2-5 years<br />

More than 5 years Total Effective<br />

$<br />

less<br />

$<br />

$<br />

$<br />

$ Interest<br />

2006<br />

Financial Assets<br />

Cash and cash equivalents 8 522,235 - - - - 522,235 5.2%<br />

522,235 - - - - 522,235<br />

Financial Liabilities<br />

Interest Bearing Liabilities 19 - 3,822,453 - - - 7.93%<br />

- 3,822,453 - - -<br />

(b) Credit Risk Exposure<br />

Credit risk represents the loss that would be recognised if counterparties failed to perform as contracted. The credit risk on financial assets of the <strong>League</strong> which<br />

have been recognised on the Balance Sheet, is the carrying amount, net of any impairment losses.<br />

(c) Net Fair Values of Financial Assets & Liabilities<br />

Valuation Approach<br />

Net fair values of monetary financial assets and liabilities are determined by the <strong>League</strong> by valuing them at the present value of contractual future cash flows<br />

on amounts due from customers (reduced for expected credit losses) or due to suppliers.<br />

Net Fair Values<br />

The Directors consider the carrying amount of financial assets and liabilities which have been recognised on the Balance Sheet to approximate their net fair<br />

values.<br />

NOTE 30 ACCUMULATED FUNDS NOTE 2007<br />

$<br />

2006<br />

$<br />

Accumulated Funds at beginning of year<br />

Loss for the year<br />

Transfer from Asset revaluation reserve<br />

1,848,519<br />

(83,826)<br />

4,466,725<br />

2,577,638<br />

(729,119)<br />

-<br />

Accumulated Funds at end of year 6,231,418 1,848,519