1. Interest Rate Swap (IRS ... - Finance Trainer

1. Interest Rate Swap (IRS ... - Finance Trainer

1. Interest Rate Swap (IRS ... - Finance Trainer

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

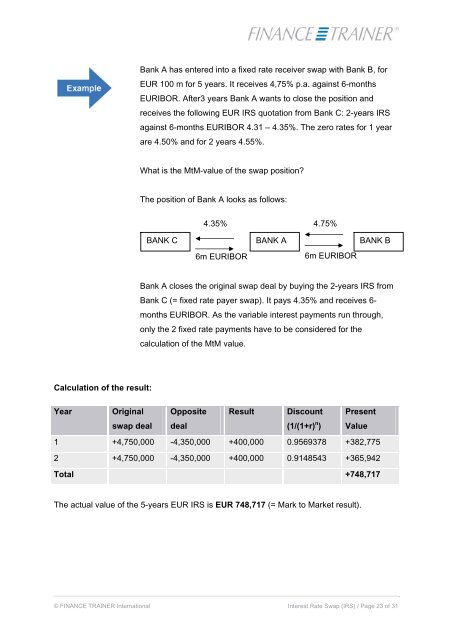

Bank A has entered into a fixed rate receiver swap with Bank B, for<br />

EUR 100 m for 5 years. It receives 4,75% p.a. against 6-months<br />

EURIBOR. After3 years Bank A wants to close the position and<br />

receives the following EUR <strong>IRS</strong> quotation from Bank C: 2-years <strong>IRS</strong><br />

against 6-months EURIBOR 4.31 – 4.35%. The zero rates for 1 year<br />

are 4.50% and for 2 years 4.55%.<br />

What is the MtM-value of the swap position<br />

The position of Bank A looks as follows:<br />

4.35%<br />

4.75%<br />

BANK C BANK A BANK B<br />

6m EURIBOR<br />

6m EURIBOR<br />

Bank A closes the original swap deal by buying the 2-years <strong>IRS</strong> from<br />

Bank C (= fixed rate payer swap). It pays 4.35% and receives 6-<br />

months EURIBOR. As the variable interest payments run through,<br />

only the 2 fixed rate payments have to be considered for the<br />

calculation of the MtM value.<br />

Calculation of the result:<br />

Year<br />

Original<br />

Opposite<br />

Result<br />

Discount<br />

Present<br />

swap deal<br />

deal<br />

(1/(1+r) n )<br />

Value<br />

1 +4,750,000 -4,350,000 +400,000 0.9569378 +382,775<br />

2 +4,750,000 -4,350,000 +400,000 0.9148543 +365,942<br />

Total +748,717<br />

The actual value of the 5-years EUR <strong>IRS</strong> is EUR 748,717 (= Mark to Market result).<br />

© FINANCE TRAINER International <strong>Interest</strong> <strong>Rate</strong> <strong>Swap</strong> (<strong>IRS</strong>) / Page 23 of 31